Stock Analysis

Exploring High Growth Tech Stocks And 2 Other Promising Innovators With Potential

Reviewed by Simply Wall St

In recent weeks, global markets have experienced significant fluctuations, with U.S. stocks retracting some gains amid uncertainties surrounding the incoming administration's policies and interest rate expectations. As investors navigate this volatile landscape, identifying high-growth tech stocks and other promising innovators becomes crucial for those seeking potential opportunities in an evolving market environment.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Material Group | 20.45% | 24.01% | ★★★★★★ |

| Yggdrazil Group | 24.66% | 85.53% | ★★★★★★ |

| eWeLLLtd | 26.52% | 27.53% | ★★★★★★ |

| Ascelia Pharma | 76.15% | 47.16% | ★★★★★★ |

| Seojin SystemLtd | 33.54% | 52.43% | ★★★★★★ |

| Medley | 25.57% | 31.67% | ★★★★★★ |

| Pharma Mar | 26.94% | 56.39% | ★★★★★★ |

| Mental Health TechnologiesLtd | 27.88% | 79.61% | ★★★★★★ |

| Elliptic Laboratories | 65.73% | 103.55% | ★★★★★★ |

| UTI | 114.97% | 134.60% | ★★★★★★ |

Click here to see the full list of 1309 stocks from our High Growth Tech and AI Stocks screener.

Let's uncover some gems from our specialized screener.

Talkweb Information SystemLtd (SZSE:002261)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Talkweb Information System Co., Ltd. operates in China, offering education services and mobile games, with a market capitalization of CN¥28.03 billion.

Operations: Talkweb Information System Co., Ltd. generates revenue primarily through its education services and mobile games in China. The company has a market capitalization of approximately CN¥28.03 billion, reflecting its significant presence in these sectors.

Talkweb Information System Co., Ltd. has demonstrated a significant revenue jump to CNY 2.94 billion, up from CNY 1.87 billion year-over-year, showcasing robust growth potential despite a challenging fiscal period with net income dropping to CNY 11.01 million from CNY 72.71 million previously reported. This downturn coincides with their strategic move to repurchase and cancel restricted stocks, reflecting a proactive stance in capital management amid market volatility. With earnings forecasted to surge by an impressive 71.2% annually, the company is poised for a turnaround, especially as it aligns its operations towards profitability within three years, outpacing the average market growth expectations.

China Transinfo Technology (SZSE:002373)

Simply Wall St Growth Rating: ★★★★☆☆

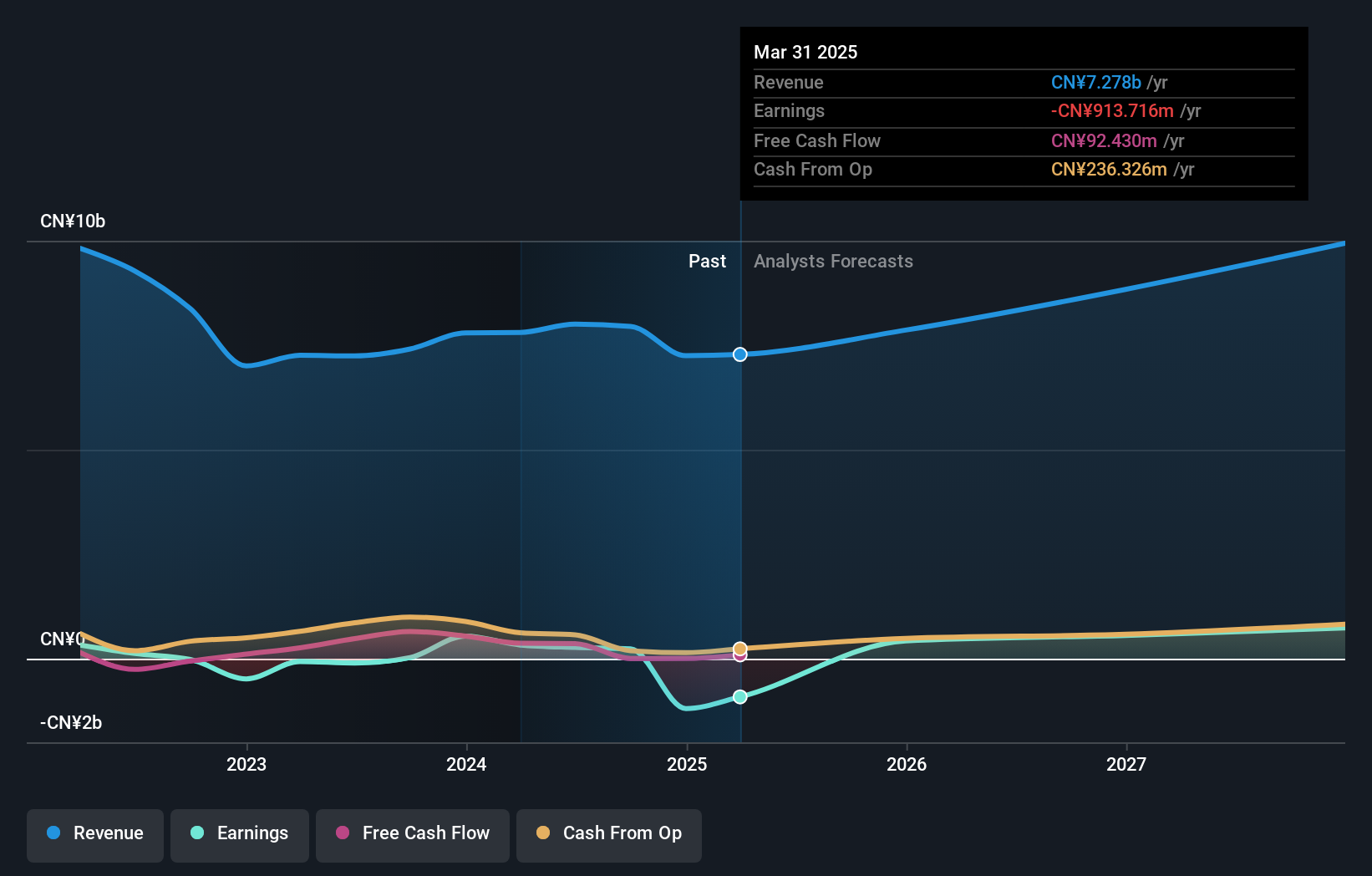

Overview: China Transinfo Technology Co., Ltd. operates in the transportation and IoT sectors with a market capitalization of CN¥16.06 billion.

Operations: The company focuses on developing and providing solutions in the transportation and Internet of Things (IoT) sectors.

China Transinfo Technology has been navigating a challenging fiscal landscape, with recent earnings revealing a revenue increase to CNY 5.41 billion from CNY 5.25 billion year-over-year, yet net income plummeted to CNY 15.76 million from a robust CNY 323.54 million previously. This stark contrast underscores the company's strategic pivot towards enhancing its R&D capabilities, as evidenced by an aggressive allocation of resources amounting to significant annual increases in R&D expenses aimed at fostering innovation and securing competitive advantages in rapidly evolving tech landscapes. Despite these hurdles, the firm's commitment is reflected in an anticipated earnings growth of 59.7% per annum, outstripping broader market trends and underscoring potential for recovery and expansion in its tech-driven offerings.

- Navigate through the intricacies of China Transinfo Technology with our comprehensive health report here.

Gain insights into China Transinfo Technology's past trends and performance with our Past report.

T&S CommunicationsLtd (SZSE:300570)

Simply Wall St Growth Rating: ★★★★★★

Overview: T&S Communications Co., Ltd. is a company based in the People’s Republic of China that focuses on developing, manufacturing, and selling fiber optics communication products, with a market capitalization of CN¥15.72 billion.

Operations: The company generates revenue primarily from its Optical Communication Components segment, which accounts for CN¥1.17 billion.

T&S CommunicationsLtd has demonstrated robust growth, with revenues surging to CNY 915.87 million, up from CNY 623.05 million year-over-year, a clear indicator of its expanding market presence. This growth is underpinned by a significant commitment to innovation, as reflected in its R&D spending which has been strategically increased to harness emerging technological opportunities. The company's earnings have similarly shown an impressive uptick, growing by 44.7% annually, outpacing many competitors within the tech sector and highlighting its potential for sustained expansion in the dynamic tech landscape.

- Click to explore a detailed breakdown of our findings in T&S CommunicationsLtd's health report.

Explore historical data to track T&S CommunicationsLtd's performance over time in our Past section.

Seize The Opportunity

- Explore the 1309 names from our High Growth Tech and AI Stocks screener here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002373

China Transinfo Technology

Engages in the transportation and IoT businesses.