- China

- /

- Communications

- /

- SZSE:300563

Optimistic Investors Push Shenyu Communication Technology Inc. (SZSE:300563) Shares Up 30% But Growth Is Lacking

Despite an already strong run, Shenyu Communication Technology Inc. (SZSE:300563) shares have been powering on, with a gain of 30% in the last thirty days. The last month tops off a massive increase of 130% in the last year.

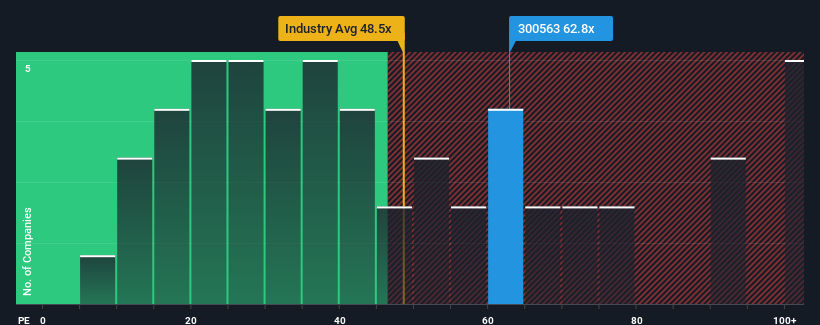

Following the firm bounce in price, given close to half the companies in China have price-to-earnings ratios (or "P/E's") below 28x, you may consider Shenyu Communication Technology as a stock to avoid entirely with its 62.8x P/E ratio. However, the P/E might be quite high for a reason and it requires further investigation to determine if it's justified.

Recent times have been quite advantageous for Shenyu Communication Technology as its earnings have been rising very briskly. It seems that many are expecting the strong earnings performance to beat most other companies over the coming period, which has increased investors’ willingness to pay up for the stock. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Check out our latest analysis for Shenyu Communication Technology

What Are Growth Metrics Telling Us About The High P/E?

The only time you'd be truly comfortable seeing a P/E as steep as Shenyu Communication Technology's is when the company's growth is on track to outshine the market decidedly.

Retrospectively, the last year delivered an exceptional 167% gain to the company's bottom line. The strong recent performance means it was also able to grow EPS by 43% in total over the last three years. Therefore, it's fair to say the earnings growth recently has been superb for the company.

Weighing that recent medium-term earnings trajectory against the broader market's one-year forecast for expansion of 36% shows it's noticeably less attractive on an annualised basis.

In light of this, it's alarming that Shenyu Communication Technology's P/E sits above the majority of other companies. Apparently many investors in the company are way more bullish than recent times would indicate and aren't willing to let go of their stock at any price. Only the boldest would assume these prices are sustainable as a continuation of recent earnings trends is likely to weigh heavily on the share price eventually.

The Bottom Line On Shenyu Communication Technology's P/E

The strong share price surge has got Shenyu Communication Technology's P/E rushing to great heights as well. While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

Our examination of Shenyu Communication Technology revealed its three-year earnings trends aren't impacting its high P/E anywhere near as much as we would have predicted, given they look worse than current market expectations. When we see weak earnings with slower than market growth, we suspect the share price is at risk of declining, sending the high P/E lower. If recent medium-term earnings trends continue, it will place shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 1 warning sign with Shenyu Communication Technology, and understanding should be part of your investment process.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300563

Shenyu Communication Technology

Engages in the research and development, production, and sale of radio frequency (RF) coaxial cables in China and internationally.

Flawless balance sheet second-rate dividend payer.

Market Insights

Community Narratives