- China

- /

- Electronic Equipment and Components

- /

- SZSE:300552

Revenues Tell The Story For Vanjee Technology Co., Ltd. (SZSE:300552) As Its Stock Soars 48%

Vanjee Technology Co., Ltd. (SZSE:300552) shares have continued their recent momentum with a 48% gain in the last month alone. The last month tops off a massive increase of 118% in the last year.

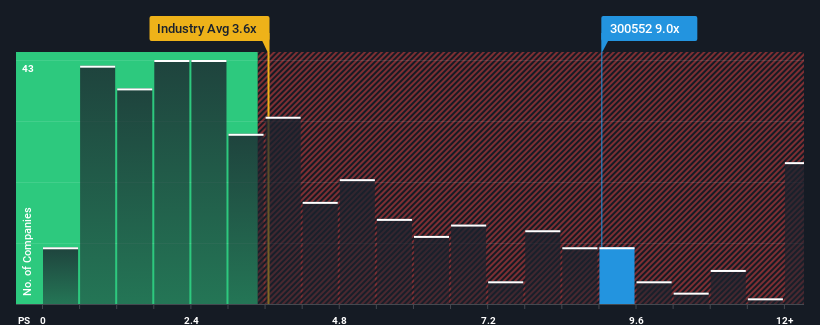

Following the firm bounce in price, you could be forgiven for thinking Vanjee Technology is a stock to steer clear of with a price-to-sales ratios (or "P/S") of 9x, considering almost half the companies in China's Electronic industry have P/S ratios below 3.6x. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

View our latest analysis for Vanjee Technology

How Vanjee Technology Has Been Performing

With revenue growth that's superior to most other companies of late, Vanjee Technology has been doing relatively well. The P/S is probably high because investors think this strong revenue performance will continue. However, if this isn't the case, investors might get caught out paying too much for the stock.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Vanjee Technology.What Are Revenue Growth Metrics Telling Us About The High P/S?

The only time you'd be truly comfortable seeing a P/S as steep as Vanjee Technology's is when the company's growth is on track to outshine the industry decidedly.

Taking a look back first, we see that the company grew revenue by an impressive 21% last year. However, this wasn't enough as the latest three year period has seen the company endure a nasty 43% drop in revenue in aggregate. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Turning to the outlook, the next year should generate growth of 45% as estimated by the only analyst watching the company. That's shaping up to be materially higher than the 26% growth forecast for the broader industry.

With this information, we can see why Vanjee Technology is trading at such a high P/S compared to the industry. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Final Word

Vanjee Technology's P/S has grown nicely over the last month thanks to a handy boost in the share price. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Our look into Vanjee Technology shows that its P/S ratio remains high on the merit of its strong future revenues. Right now shareholders are comfortable with the P/S as they are quite confident future revenues aren't under threat. It's hard to see the share price falling strongly in the near future under these circumstances.

Don't forget that there may be other risks. For instance, we've identified 1 warning sign for Vanjee Technology that you should be aware of.

If you're unsure about the strength of Vanjee Technology's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300552

Mediocre balance sheet and overvalued.

Market Insights

Community Narratives