- China

- /

- Tech Hardware

- /

- SZSE:300551

Shanghai Guao Electronic Technology Co., Ltd. (SZSE:300551) May Have Run Too Fast Too Soon With Recent 27% Price Plummet

Shanghai Guao Electronic Technology Co., Ltd. (SZSE:300551) shareholders won't be pleased to see that the share price has had a very rough month, dropping 27% and undoing the prior period's positive performance. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 39% share price drop.

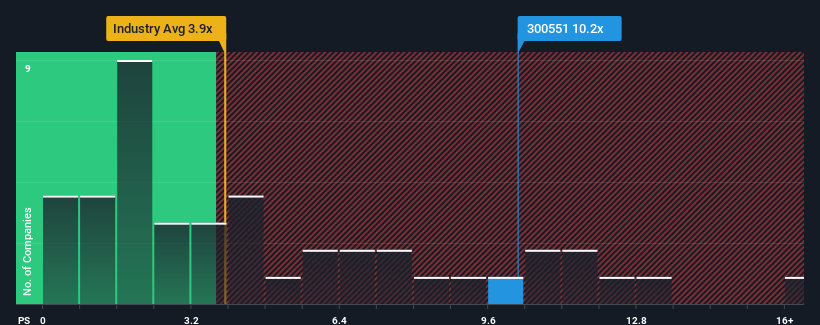

In spite of the heavy fall in price, when almost half of the companies in China's Tech industry have price-to-sales ratios (or "P/S") below 3.9x, you may still consider Shanghai Guao Electronic Technology as a stock not worth researching with its 10.2x P/S ratio. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for Shanghai Guao Electronic Technology

How Has Shanghai Guao Electronic Technology Performed Recently?

As an illustration, revenue has deteriorated at Shanghai Guao Electronic Technology over the last year, which is not ideal at all. Perhaps the market believes the company can do enough to outperform the rest of the industry in the near future, which is keeping the P/S ratio high. However, if this isn't the case, investors might get caught out paying too much for the stock.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Shanghai Guao Electronic Technology will help you shine a light on its historical performance.What Are Revenue Growth Metrics Telling Us About The High P/S?

The only time you'd be truly comfortable seeing a P/S as steep as Shanghai Guao Electronic Technology's is when the company's growth is on track to outshine the industry decidedly.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 43%. Still, the latest three year period has seen an excellent 35% overall rise in revenue, in spite of its unsatisfying short-term performance. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been more than adequate for the company.

This is in contrast to the rest of the industry, which is expected to grow by 17% over the next year, materially higher than the company's recent medium-term annualised growth rates.

In light of this, it's alarming that Shanghai Guao Electronic Technology's P/S sits above the majority of other companies. It seems most investors are ignoring the fairly limited recent growth rates and are hoping for a turnaround in the company's business prospects. There's a good chance existing shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with recent growth rates.

The Key Takeaway

Even after such a strong price drop, Shanghai Guao Electronic Technology's P/S still exceeds the industry median significantly. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

The fact that Shanghai Guao Electronic Technology currently trades on a higher P/S relative to the industry is an oddity, since its recent three-year growth is lower than the wider industry forecast. When we observe slower-than-industry revenue growth alongside a high P/S ratio, we assume there to be a significant risk of the share price decreasing, which would result in a lower P/S ratio. Unless the recent medium-term conditions improve markedly, it's very challenging to accept these the share price as being reasonable.

And what about other risks? Every company has them, and we've spotted 2 warning signs for Shanghai Guao Electronic Technology you should know about.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300551

Shanghai Guao Electronic Technology

Shanghai Guao Electronic Technology Co., Ltd.

Flawless balance sheet very low.

Market Insights

Community Narratives