- China

- /

- Communications

- /

- SZSE:300548

High Growth Tech Stocks To Watch This January 2025

Reviewed by Simply Wall St

As global markets navigate the early days of President Trump's administration, U.S. stocks have been buoyed by optimism surrounding potential trade deals and AI-related investments, with major indices like the S&P 500 reaching new highs. In this environment of heightened interest in technology and innovation, high growth tech stocks stand out for their potential to capitalize on emerging trends such as artificial intelligence and data infrastructure expansion.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Shanghai Baosight SoftwareLtd | 21.82% | 25.22% | ★★★★★★ |

| eWeLLLtd | 26.41% | 28.82% | ★★★★★★ |

| Yggdrazil Group | 30.20% | 87.10% | ★★★★★★ |

| Ascelia Pharma | 76.15% | 47.16% | ★★★★★★ |

| Waystream Holding | 22.09% | 113.25% | ★★★★★★ |

| Medley | 20.95% | 27.32% | ★★★★★★ |

| Pharma Mar | 25.50% | 55.11% | ★★★★★★ |

| Mental Health TechnologiesLtd | 25.83% | 113.12% | ★★★★★★ |

| Fine M-TecLTD | 36.52% | 135.02% | ★★★★★★ |

| Initiator Pharma | 73.95% | 31.67% | ★★★★★★ |

Click here to see the full list of 1225 stocks from our High Growth Tech and AI Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Vitrolife (OM:VITR)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Vitrolife AB (publ) specializes in providing assisted reproduction products and has a market capitalization of approximately SEK29.52 billion.

Operations: Vitrolife AB (publ) generates revenue through three primary segments: Genetics, Consumables, and Technologies, with Consumables contributing the highest at SEK1.61 billion.

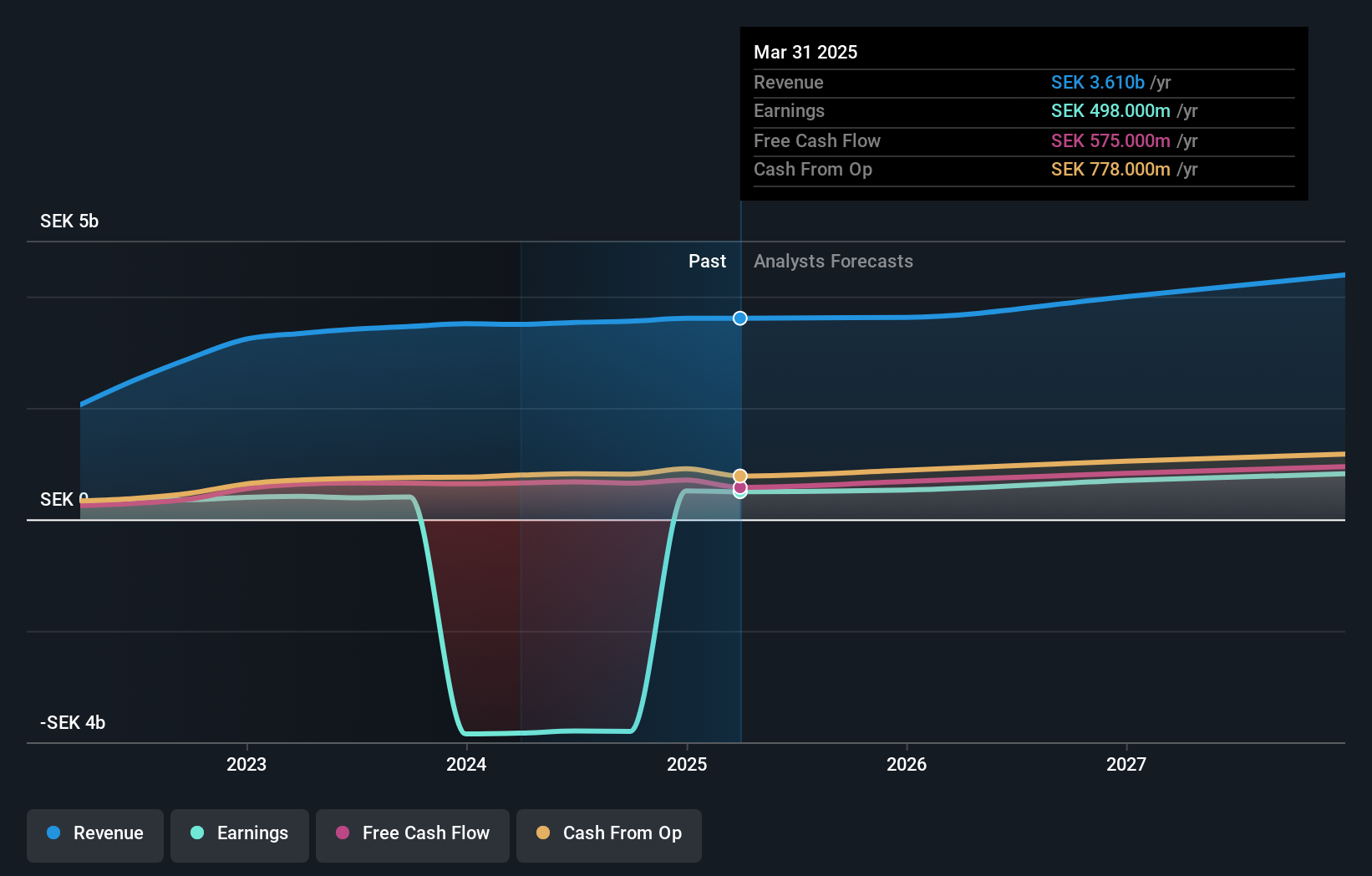

Vitrolife, poised for profitability within three years, showcases a robust annual revenue growth rate of 8.3%, outpacing the Swedish market's modest 1% expansion. This growth trajectory is complemented by an anticipated surge in earnings, projected at an impressive 96.84% annually. Despite current unprofitability and a below-benchmark forecasted Return on Equity of 5.9%, the firm's strategic R&D investments and recent executive shifts—highlighted by Helena Wennerström stepping in as acting CFO—signal a strengthening leadership aimed at navigating future challenges and capitalizing on emerging biotech opportunities.

- Delve into the full analysis health report here for a deeper understanding of Vitrolife.

Review our historical performance report to gain insights into Vitrolife's's past performance.

Yangtze Optical Electronic (SHSE:688143)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Yangtze Optical Electronic Co., Ltd. focuses on the R&D, production, and sale of special optical fiber and cable, optical devices, new materials, high-end equipment, and photoelectric systems in China with a market cap of CN¥3.27 billion.

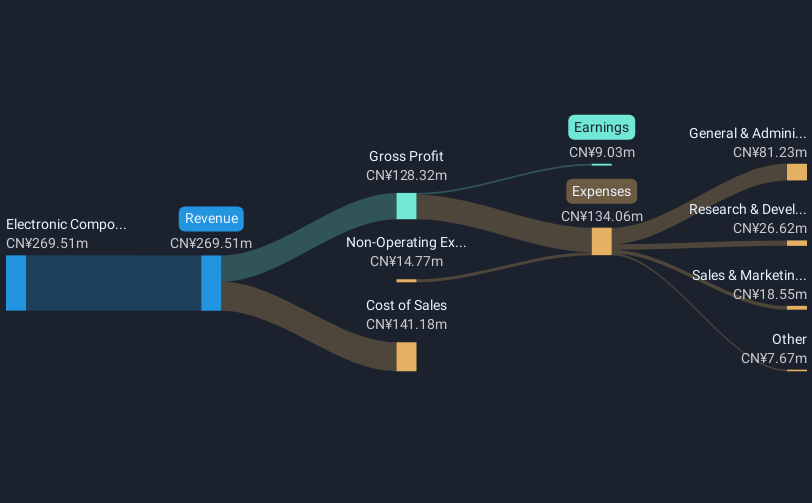

Operations: The company generates revenue primarily from electronic components and parts, contributing CN¥269.51 million to its financial performance.

Yangtze Optical Electronic, despite a challenging market backdrop with a 72.2% dip in earnings last year, is projecting an aggressive turnaround with expected annual earnings growth of 71.4%. This optimism is anchored by robust revenue acceleration at 47% annually, significantly outpacing the broader Chinese market's growth of 13.4%. Recent strategic moves include a share repurchase program where the company bought back shares worth CNY 20.66 million and a private placement aimed at bolstering its financial position. These steps underscore its commitment to leveraging its R&D prowess—currently standing at {rd_expense_string}—to innovate and potentially dominate in the high-stakes tech landscape.

Broadex Technologies (SZSE:300548)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Broadex Technologies Co., Ltd. focuses on the research, development, production, and sale of integrated optoelectronic devices for optical communications both in China and internationally, with a market capitalization of CN¥15.99 billion.

Operations: Broadex Technologies Co., Ltd. specializes in the development and sale of integrated optoelectronic devices used in optical communications, serving both domestic and international markets. The company operates with a market capitalization of CN¥15.99 billion, indicating its significant presence in the industry.

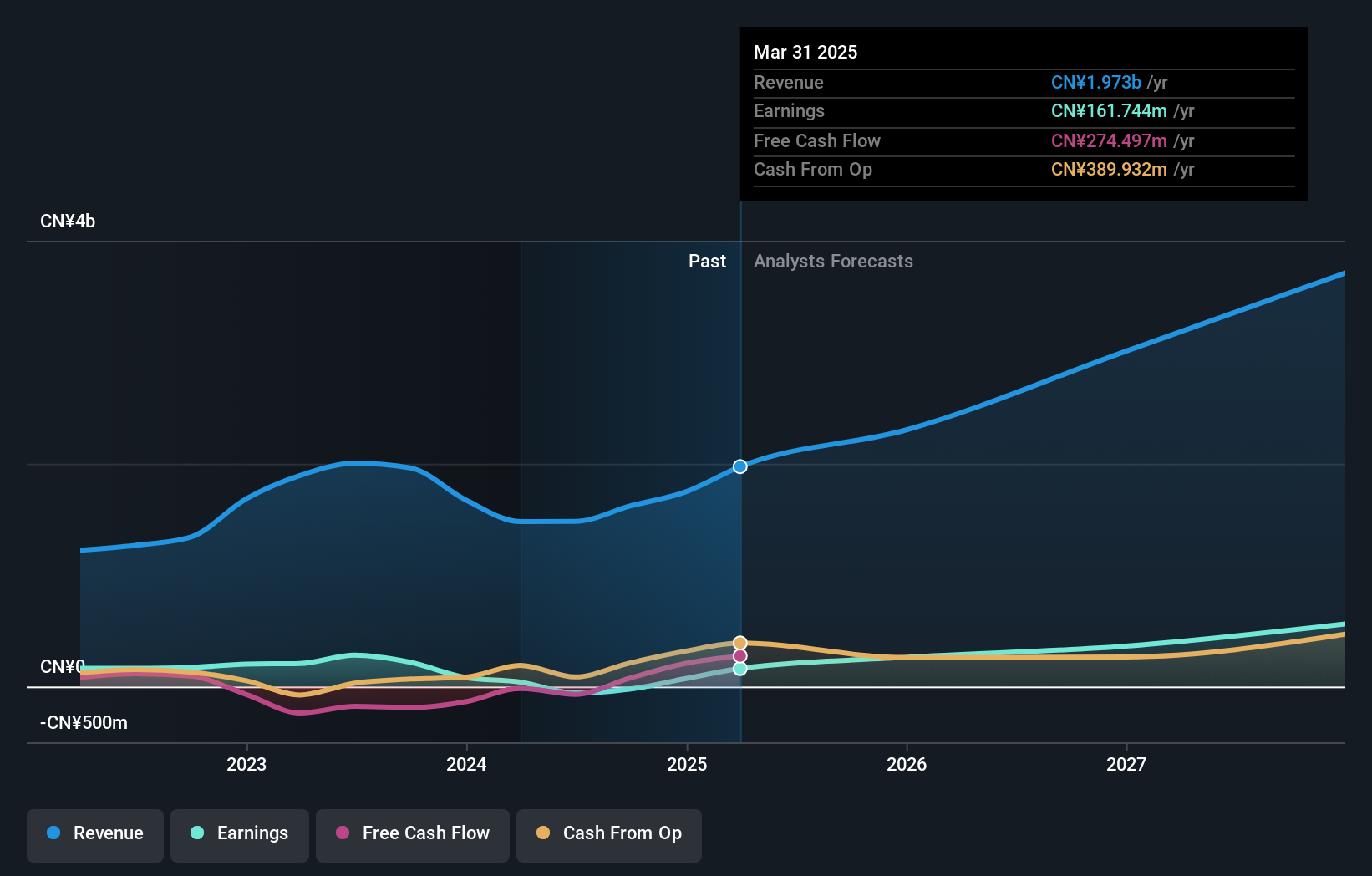

Broadex Technologies has demonstrated a significant commitment to growth in the tech sector, evidenced by its robust annual revenue increase of 24.3%. Despite recent earnings fluctuations, with net income dropping to CNY 37.5 million from CNY 140.81 million last year, the company's aggressive R&D spending is notable—aiming to fuel future innovations and market competitiveness. This strategic focus on development is further highlighted by recent corporate actions such as considering acquisitions and joint investments to expand its technological footprint and market reach.

- Click here and access our complete health analysis report to understand the dynamics of Broadex Technologies.

Assess Broadex Technologies' past performance with our detailed historical performance reports.

Taking Advantage

- Unlock our comprehensive list of 1225 High Growth Tech and AI Stocks by clicking here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Broadex Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300548

Broadex Technologies

Researches and develops, produces, and sells integrated optoelectronic devices in the field of optical communications in China and internationally.

High growth potential with solid track record.

Market Insights

Community Narratives