- China

- /

- Electronic Equipment and Components

- /

- SZSE:300502

Xiaomi Leads These 3 High Growth Tech Stocks In Asia

Reviewed by Simply Wall St

Amidst a backdrop of cooling labor markets and fluctuating manufacturing activity in the U.S., Asian tech stocks are gaining attention as investors look for growth opportunities in a dynamic global environment. In this context, identifying robust tech companies with innovative capabilities and strong market presence can be crucial, as they may be well-positioned to capitalize on emerging trends such as artificial intelligence and digital transformation.

Top 10 High Growth Tech Companies In Asia

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Suzhou TFC Optical Communication | 29.78% | 30.32% | ★★★★★★ |

| Shengyi Electronics | 22.99% | 35.16% | ★★★★★★ |

| Shanghai Huace Navigation Technology | 24.44% | 23.48% | ★★★★★★ |

| Fositek | 26.71% | 33.90% | ★★★★★★ |

| Range Intelligent Computing Technology Group | 27.31% | 28.63% | ★★★★★★ |

| eWeLLLtd | 24.95% | 24.40% | ★★★★★★ |

| PharmaResearch | 24.40% | 25.85% | ★★★★★★ |

| Nanya New Material TechnologyLtd | 22.72% | 63.29% | ★★★★★★ |

| Global Security Experts | 20.56% | 28.04% | ★★★★★★ |

| JNTC | 54.24% | 87.93% | ★★★★★★ |

Underneath we present a selection of stocks filtered out by our screen.

Xiaomi (SEHK:1810)

Simply Wall St Growth Rating: ★★★★☆☆

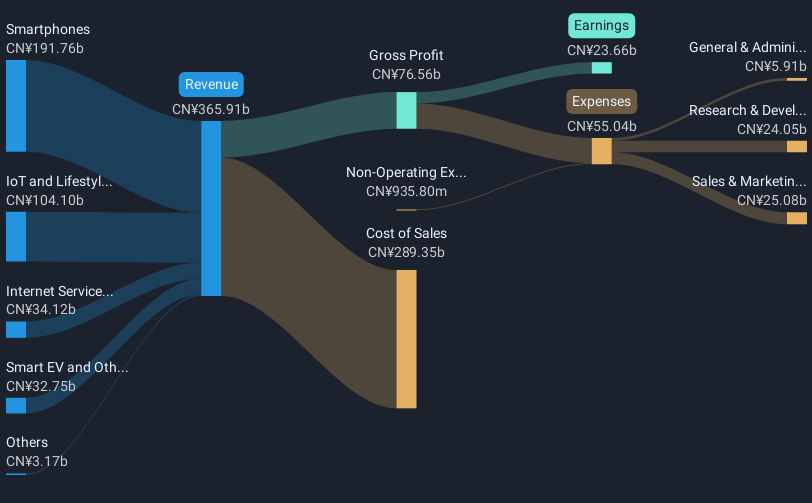

Overview: Xiaomi Corporation is an investment holding company that focuses on the development and sales of smartphones both in Mainland China and internationally, with a market capitalization of HK$1.41 trillion.

Operations: Xiaomi Corporation generates revenue primarily from the sales of smartphones, which account for CN¥195.89 billion, and IoT and lifestyle products, contributing CN¥116.07 billion. The company also earns from internet services with a revenue of CN¥35.14 billion and smart EV and other new initiatives bringing in CN¥51.31 billion.

Xiaomi's strategic moves are shaping its trajectory in the high-growth tech landscape of Asia, particularly through recent alliances and innovative expansions. With a robust 16.5% annual revenue growth and an even more impressive 20.4% spike in earnings, Xiaomi is leveraging partnerships like those with Moloco to enhance its global advertising efficacy using advanced machine learning algorithms. This collaboration not only boosts ad performance but also integrates Xiaomi's extensive user base into a broader advertising ecosystem, optimizing outreach across its diverse product lines, including the newly ventured electric vehicles segment under its Human x Car x Home Smart Ecosystem strategy. These initiatives underscore Xiaomi’s agility in adapting to dynamic market demands while consistently enhancing shareholder value through strategic market expansions and technological integrations.

Eoptolink Technology (SZSE:300502)

Simply Wall St Growth Rating: ★★★★★★

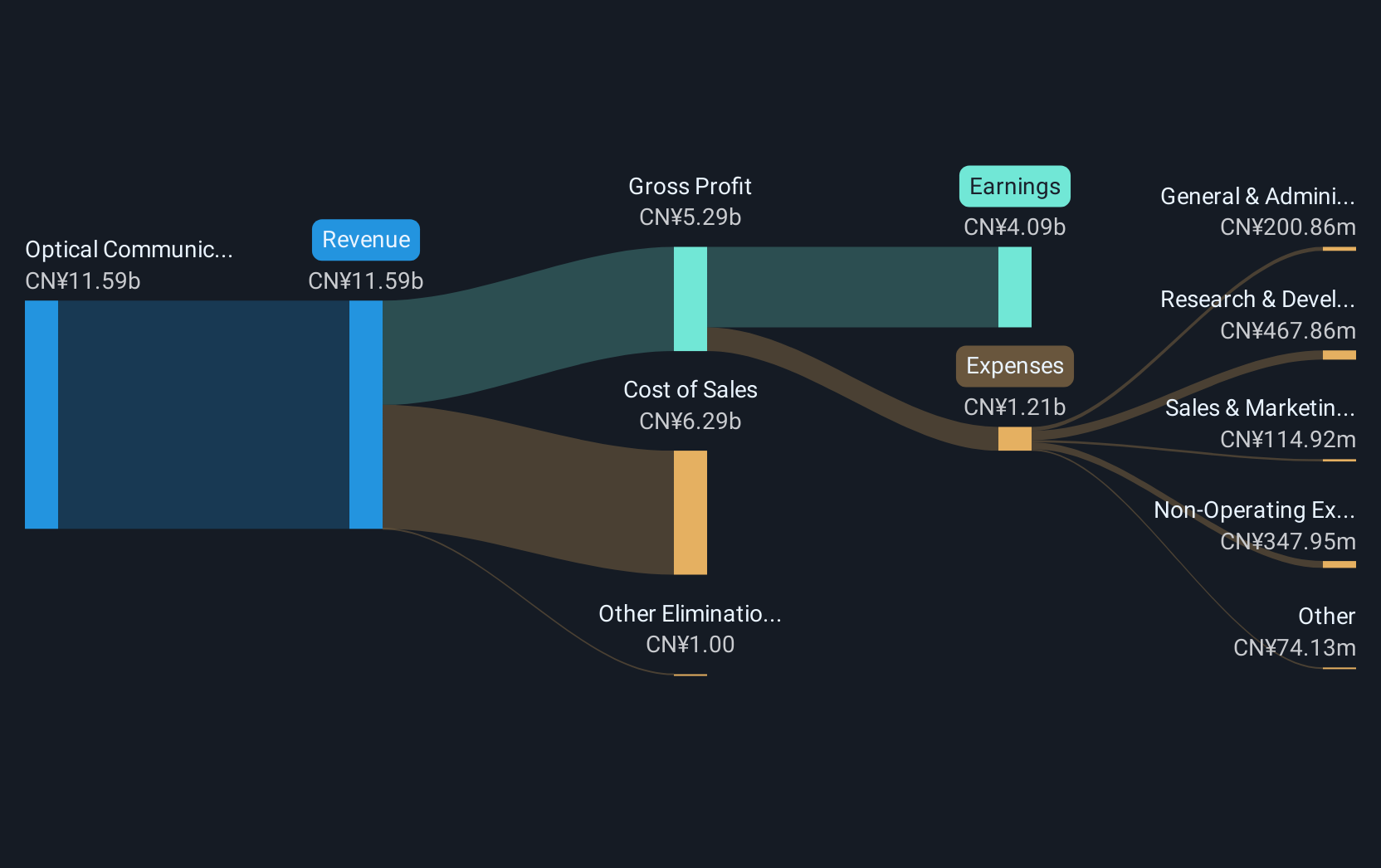

Overview: Eoptolink Technology Inc., Ltd. is involved in the research, development, production, and sales of optical modules both in China and internationally, with a market cap of CN¥97.61 billion.

Operations: Eoptolink Technology focuses on the optical communication equipment sector, generating revenue of CN¥11.59 billion from this segment. The company's operations span research, development, production, and sales activities within China and international markets.

Eoptolink Technology, a key player in Asia's tech sector, is demonstrating robust growth with a notable 31.2% increase in annual revenue and an impressive 30.9% surge in annual earnings. The company's commitment to innovation is evident from its R&D expenditure, which has consistently aligned with industry demands for advanced optical solutions. Recently, Eoptolink introduced the industry's first 800G optical transceiver supporting Multicore Fiber at OFC 2025, addressing the critical need for higher bandwidth and simplified cable management in data centers—a move that not only enhances its product lineup but also positions it favorably within the high-growth tech landscape of Asia.

Asia Vital Components (TWSE:3017)

Simply Wall St Growth Rating: ★★★★★★

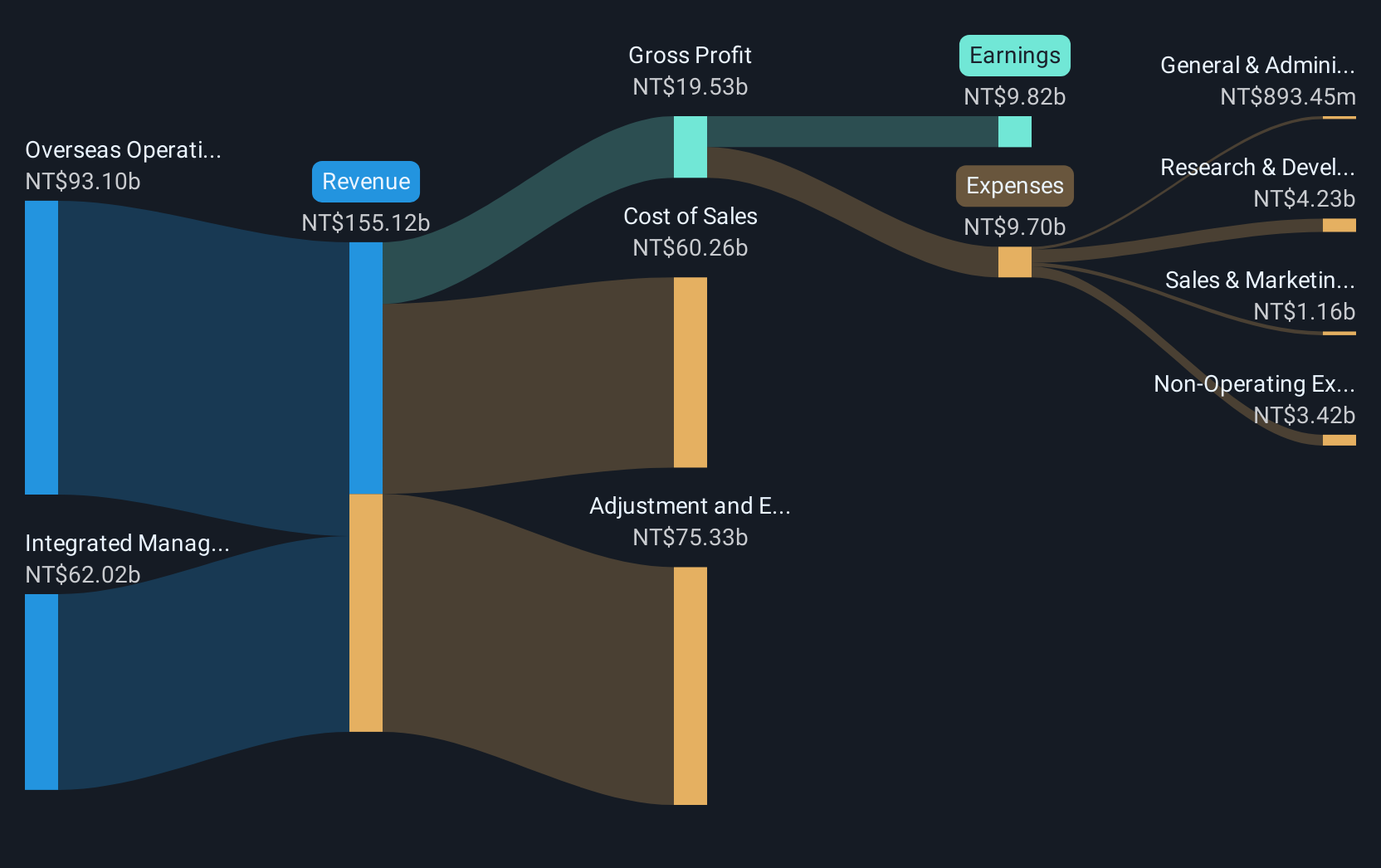

Overview: Asia Vital Components Co., Ltd. specializes in providing thermal solutions globally and has a market capitalization of NT$280.69 billion.

Operations: The company generates revenue primarily through its Overseas Operating Department and Integrated Management Division, contributing NT$93.10 billion and NT$62.02 billion, respectively.

Asia Vital Components has demonstrated a notable growth trajectory with a 52.4% increase in quarterly revenue year-over-year, reaching TWD 23.33 billion. This surge is complemented by an impressive annual earnings growth of 67.6%, outpacing the tech industry's average of 12.3%. The company's strategic expansion into Vietnam through the establishment of AVC Development Co., Ltd., underscores its commitment to leveraging emerging markets for growth, while recent executive and board changes reflect a dynamic approach to governance and strategic direction, positioning it well within Asia's competitive tech landscape.

Taking Advantage

- Take a closer look at our Asian High Growth Tech and AI Stocks list of 490 companies by clicking here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Eoptolink Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300502

Eoptolink Technology

Engages in the research and development, production and sales of optical modules in China and internationally.

Exceptional growth potential with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives