- China

- /

- Entertainment

- /

- SZSE:002517

High Growth Tech Stocks in Asia to Watch

Reviewed by Simply Wall St

As global markets grapple with mixed performances and heightened scrutiny on artificial intelligence spending, Asian tech stocks continue to capture investor attention amidst shifting economic landscapes. In this environment, identifying high-growth potential often involves looking for companies that demonstrate resilience and adaptability in navigating both regional challenges and broader market dynamics.

Top 10 High Growth Tech Companies In Asia

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Giant Network Group | 33.47% | 39.54% | ★★★★★★ |

| Shengyi TechnologyLtd | 21.50% | 32.87% | ★★★★★★ |

| Zhongji Innolight | 33.63% | 34.88% | ★★★★★★ |

| Fositek | 37.43% | 49.42% | ★★★★★★ |

| Shengyi Electronics | 24.67% | 33.32% | ★★★★★★ |

| Knowmerce | 42.51% | 33.23% | ★★★★★★ |

| Gold Circuit Electronics | 25.79% | 31.13% | ★★★★★★ |

| eWeLLLtd | 25.07% | 25.13% | ★★★★★★ |

| Co-Tech Development | 35.68% | 75.80% | ★★★★★★ |

| CARsgen Therapeutics Holdings | 100.40% | 118.16% | ★★★★★★ |

Let's review some notable picks from our screened stocks.

Kingnet Network (SZSE:002517)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Kingnet Network Co., Ltd. specializes in the development, operation, and distribution of mobile applications and games, with a market capitalization of CN¥44.67 billion.

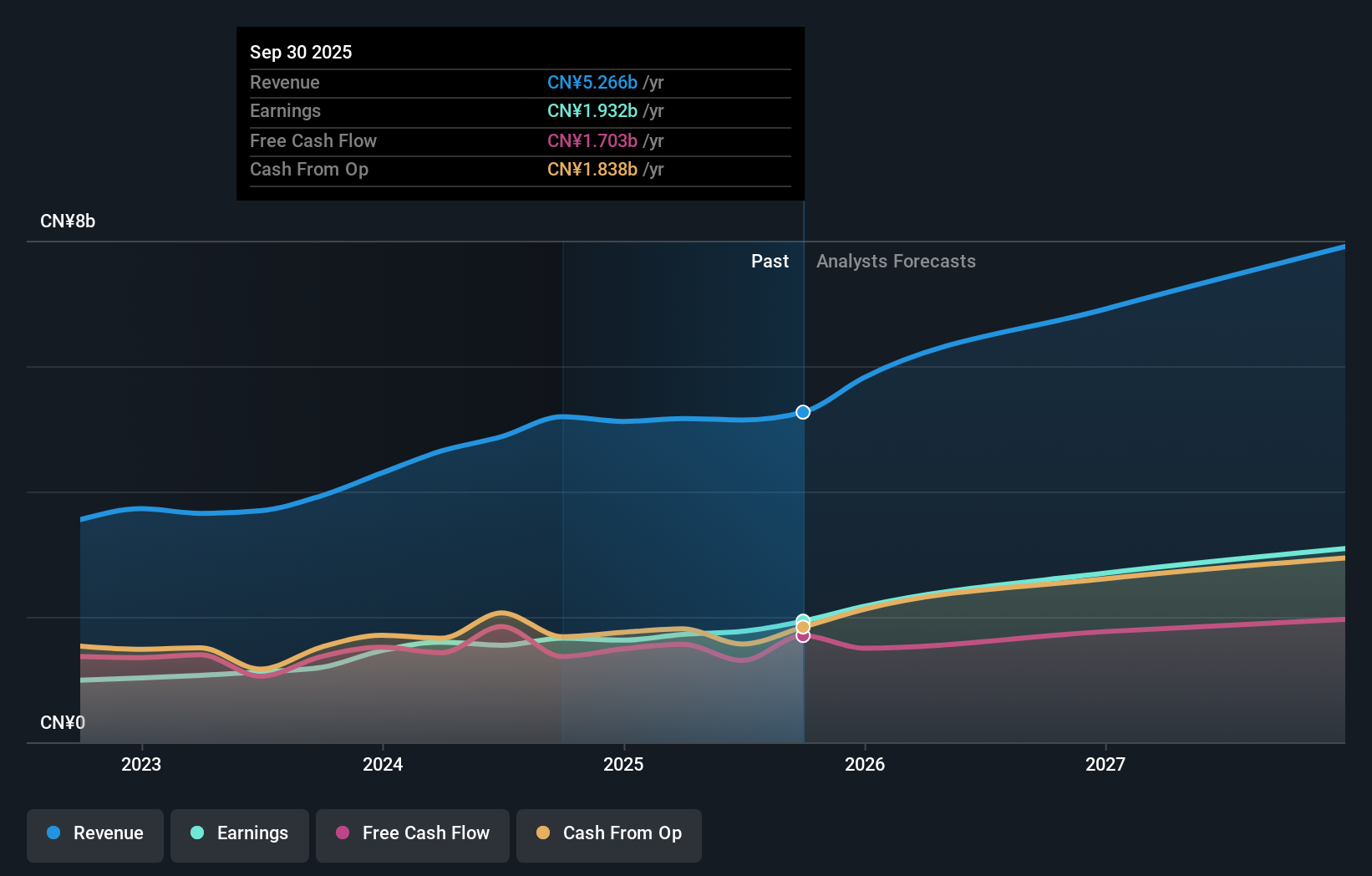

Operations: The company focuses on the development, operation, and distribution of mobile applications and games, generating revenue primarily from its Internet Software and Services segment, which amounted to CN¥5.27 billion.

Kingnet Network has demonstrated robust financial performance, with revenue growing to CNY 4.08 billion in the first nine months of 2025, up from CNY 3.93 billion in the same period last year. This growth is coupled with a significant increase in net income, which rose to CNY 1.58 billion from CNY 1.28 billion, reflecting a strong profit trajectory. Additionally, the company's strategic share repurchase program underlines its confidence in long-term value creation, having recently completed a buyback of shares worth nearly CNY 200 million aimed at enhancing shareholder returns and supporting employee stock plans.

- Dive into the specifics of Kingnet Network here with our thorough health report.

Evaluate Kingnet Network's historical performance by accessing our past performance report.

Eoptolink Technology (SZSE:300502)

Simply Wall St Growth Rating: ★★★★★★

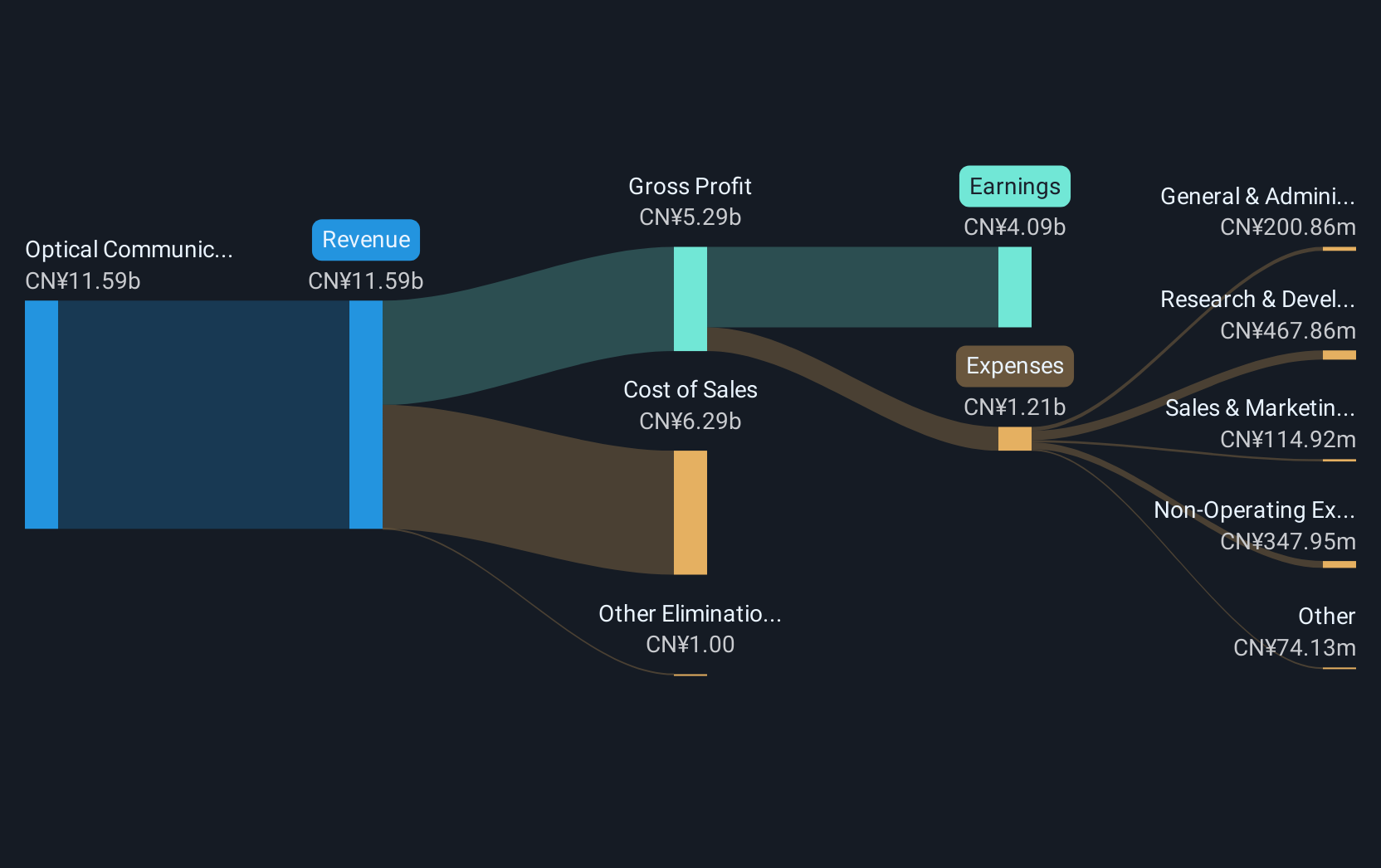

Overview: Eoptolink Technology Inc., Ltd. specializes in the research, development, production, and sale of optical modules for optical communication applications both in China and internationally, with a market cap of CN¥325.23 billion.

Operations: Eoptolink focuses on optical communication equipment, generating revenue of CN¥20.02 billion from this segment.

Eoptolink Technology has shown a remarkable trajectory, with its nine-month sales soaring to CNY 16.5 billion, a more than threefold increase from the previous year's CNY 5.13 billion. This surge is mirrored in its net income, which escalated to CNY 6.33 billion from CNY 1.65 billion, reflecting an earnings growth of nearly 294.7% year-over-year. These figures underscore Eoptolink's rapid expansion and operational efficiency in a competitive tech landscape where innovation and strategic market positioning are critical for sustained growth. Moreover, the company's R&D commitment is evident from its substantial investment in innovation, crucial for maintaining technological leadership and fostering future revenue streams in the high-stakes electronic industry sector.

Digital Garage (TSE:4819)

Simply Wall St Growth Rating: ★★★★☆☆

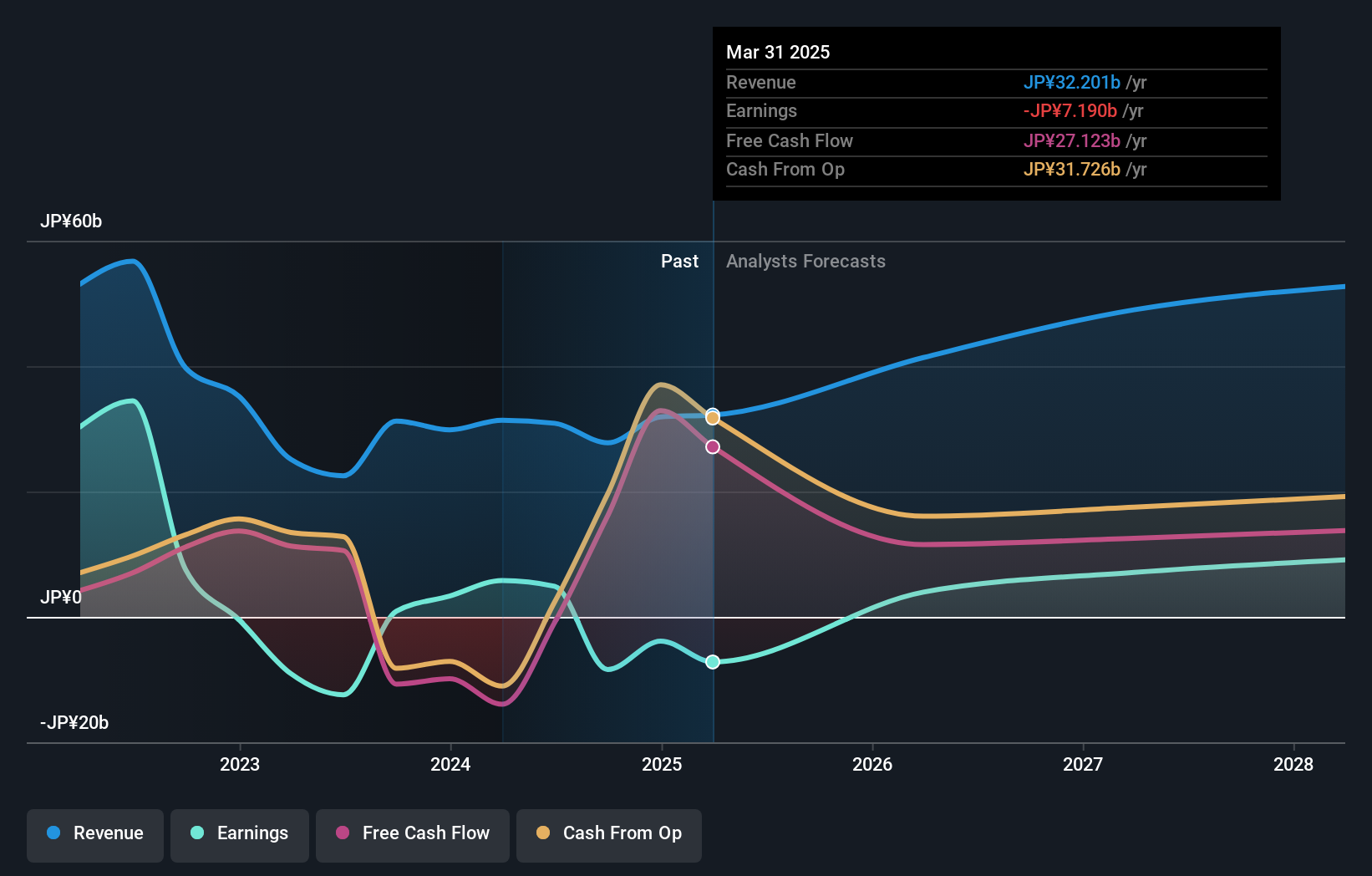

Overview: Digital Garage, Inc. is a Japanese context company with a market capitalization of ¥141.81 billion, focusing on internet business support and digital marketing services.

Operations: The company generates revenue primarily through its internet business support and digital marketing services. With a market capitalization of ¥141.81 billion, it focuses on leveraging digital platforms to offer innovative solutions in Japan's tech industry.

Amid regulatory shifts and strategic alliances, Digital Garage is positioning itself as a pivotal player in the evolving gaming market. The company's recent partnership with Coda aims to leverage out-of-app monetization, enhancing revenue streams for publishers globally while adapting to new laws like Japan’s Act on Promotion of Competition for Specified Smartphone Software. This move aligns with broader industry trends towards direct publisher-to-consumer engagement, reducing reliance on traditional app stores and their associated fees. Digital Garage's robust payment infrastructure, which processes over ¥7.5 trillion annually, supports this transition by offering diverse payment solutions that cater to both local and international markets. Moreover, the acquisition by Resona Holdings increases corporate stability and potential influence in strategic decisions, signaling strong future prospects in high-growth sectors.

- Delve into the full analysis health report here for a deeper understanding of Digital Garage.

Assess Digital Garage's past performance with our detailed historical performance reports.

Summing It All Up

- Take a closer look at our Asian High Growth Tech and AI Stocks list of 191 companies by clicking here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kingnet Network might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002517

Kingnet Network

Engages in the development, operation, and distribution of mobile and operations.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives