Stock Analysis

High Growth Tech Stocks To Watch Including ZwsoftLtd And Two Others

Reviewed by Simply Wall St

As global markets continue to reach new heights, with small-cap indices like the Russell 2000 hitting record intraday highs, investor sentiment remains buoyed by domestic policy developments and geopolitical events. In this dynamic environment, identifying promising high-growth tech stocks such as Zwsoft Ltd and others becomes crucial for investors looking to capitalize on innovation-driven sectors that can thrive amid economic shifts and evolving market conditions.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Material Group | 20.45% | 24.01% | ★★★★★★ |

| Seojin SystemLtd | 35.41% | 39.86% | ★★★★★★ |

| Yggdrazil Group | 30.20% | 87.10% | ★★★★★★ |

| eWeLLLtd | 27.24% | 28.74% | ★★★★★★ |

| Waystream Holding | 22.09% | 113.25% | ★★★★★★ |

| Mental Health TechnologiesLtd | 24.68% | 97.53% | ★★★★★★ |

| Medley | 25.57% | 31.67% | ★★★★★★ |

| CD Projekt | 22.02% | 28.64% | ★★★★★★ |

| Fine M-TecLTD | 36.52% | 131.08% | ★★★★★★ |

| JNTC | 29.48% | 104.37% | ★★★★★★ |

Click here to see the full list of 1286 stocks from our High Growth Tech and AI Stocks screener.

We're going to check out a few of the best picks from our screener tool.

ZwsoftLtd (SHSE:688083)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Zwsoft Co., Ltd. is a company that develops and sells CAD/CAM/CAE software solutions in China, with a market cap of CN¥12.01 billion.

Operations: Zwsoft Co., Ltd. generates revenue primarily from the development and sale of CAD/CAM/CAE software solutions in China. The company's market cap stands at CN¥12.01 billion, reflecting its position in the software industry.

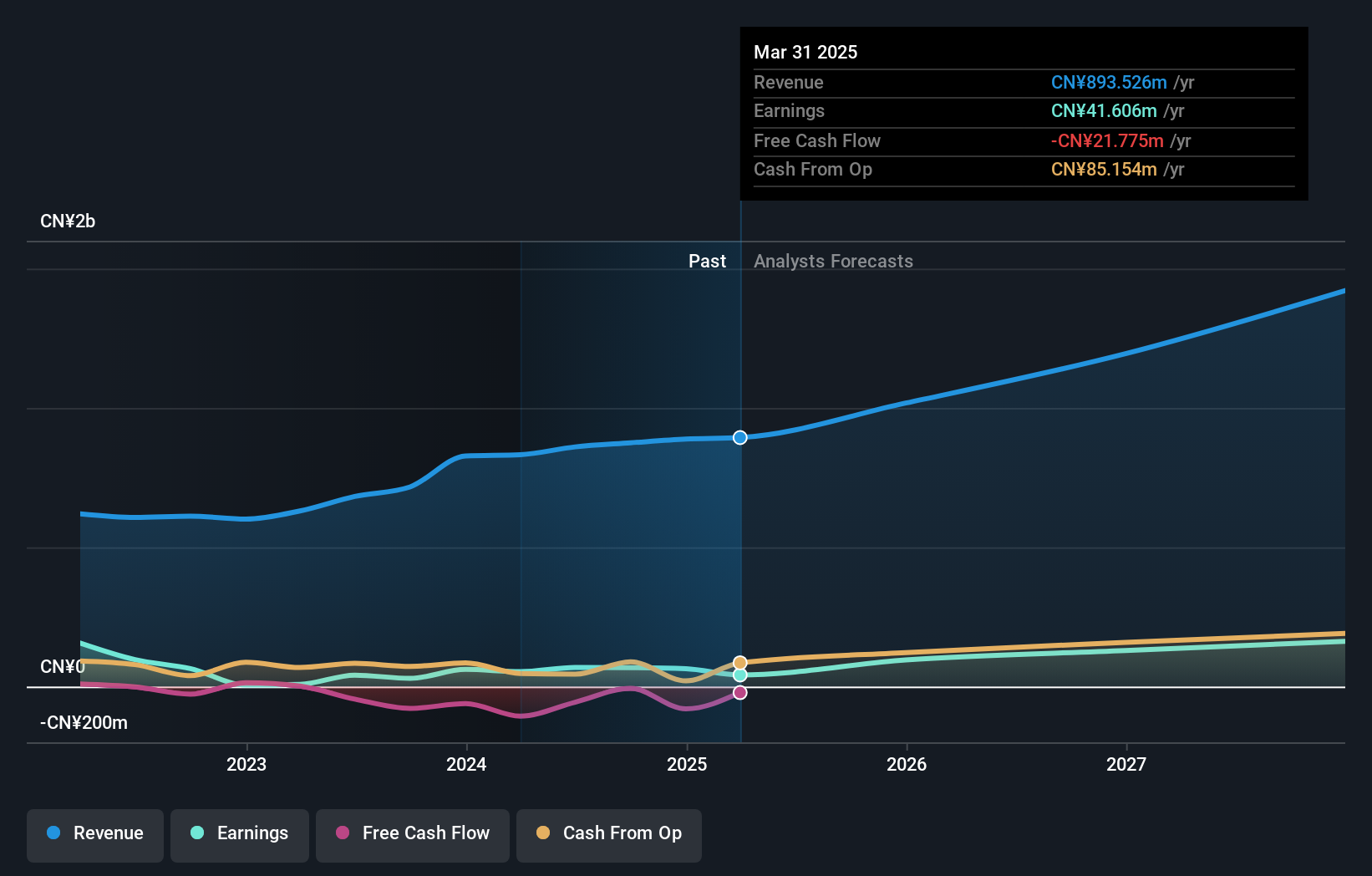

ZwsoftLtd, in the throes of rapid expansion, reported a striking 133.1% earnings growth over the past year, outpacing its industry's -11.2% downturn. This surge is underpinned by robust R&D investments which have consistently aligned with revenue growth; last year alone, R&D expenses were a significant portion of their revenue, illustrating a deep commitment to innovation. Additionally, forecasts suggest an impressive 32.3% annual profit growth over the next three years—substantially higher than the broader Chinese market's 26.3%. Despite these promising figures, it's crucial to note that ZwsoftLtd’s share price has shown high volatility recently and its return on equity in three years is projected at just 5.4%, signaling potential challenges in sustaining profitability long-term. Recent strategic maneuvers include a modest share buyback program completed last quarter where Zwsoft repurchased shares for CNY 2.92 million; this reflects a proactive approach to capital management but also underscores the scale of their market operations relative to larger tech entities. With revenue also expected to climb annually by 18%, faster than China’s market average of 13.9%, and considering recent substantial one-off gains impacting financial results (CN¥134.5M), investors should watch how these factors might influence ZwsoftLtd’s trajectory in an intensely competitive software sector.

- Take a closer look at ZwsoftLtd's potential here in our health report.

Evaluate ZwsoftLtd's historical performance by accessing our past performance report.

Zhejiang Hechuan Technology (SHSE:688320)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Zhejiang Hechuan Technology Co., Ltd. focuses on the research and development, manufacturing, sale, and application integration of industrial automation products with a market capitalization of CN¥6.53 billion.

Operations: Hechuan Technology specializes in industrial automation products, generating revenue primarily through the sale and integration of these technologies. The company's operations encompass research and development as well as manufacturing, contributing to its market presence within the industry.

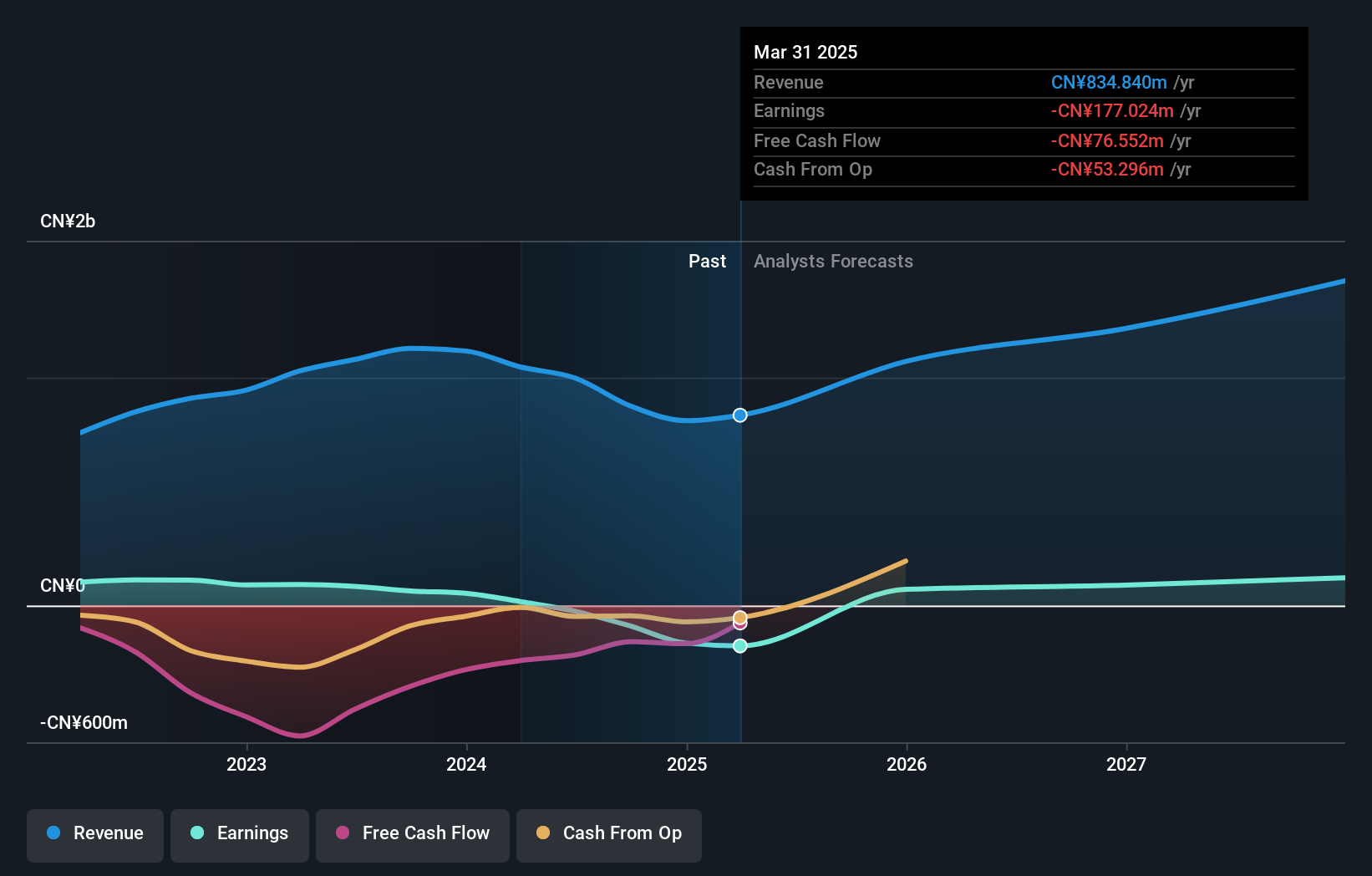

Zhejiang Hechuan Technology, amidst a challenging fiscal period with a reported net loss of CNY 80.63 million for the nine months ending September 2024, contrasts sharply with its previous year's net income of CNY 63.14 million. Despite these setbacks, the company's commitment to innovation remains evident with R&D expenses maintaining a significant correlation to revenue, indicative of its strategic focus on long-term technological advancements. Moreover, the company has actively managed its capital through share repurchases totaling CNY 62.13 million this year, reflecting confidence in its future prospects despite current volatility. With revenue expected to grow by an impressive 19.8% annually—surpassing China’s market average—Hechuan is positioning itself for recovery and growth in a fiercely competitive tech landscape.

- Click here and access our complete health analysis report to understand the dynamics of Zhejiang Hechuan Technology.

Gain insights into Zhejiang Hechuan Technology's past trends and performance with our Past report.

Sai MicroElectronics (SZSE:300456)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Sai MicroElectronics Inc. focuses on the development and sale of micro-electromechanical systems (MEMS) products in China, with a market capitalization of CN¥15.52 billion.

Operations: Sai MicroElectronics Inc. develops and sells MEMS products in China, with a focus on innovative technological solutions. The company leverages its expertise to capture market opportunities within the MEMS industry, contributing to its substantial market presence.

Sai MicroElectronics, navigating a turbulent period with a net loss of CNY 117.77 million for the nine months ending September 2024, starkly contrasts its prior year's net income of CNY 12.26 million. Despite this downturn, the firm's robust commitment to innovation is underscored by its R&D expenses which align closely with revenue trends, signaling an unwavering focus on technological advancements. This strategic emphasis is poised to bolster Sai MicroElectronics' market position as it projects a notable revenue growth rate of 30.1% annually—outpacing the broader Chinese market forecast of 13.9%. Furthermore, amidst these financial fluctuations, Sai MicroElectronics has demonstrated confidence in its trajectory by repurchasing shares within the fiscal year, reinforcing its optimistic outlook towards future profitability and sectorial impact.

- Unlock comprehensive insights into our analysis of Sai MicroElectronics stock in this health report.

Summing It All Up

- Unlock more gems! Our High Growth Tech and AI Stocks screener has unearthed 1283 more companies for you to explore.Click here to unveil our expertly curated list of 1286 High Growth Tech and AI Stocks.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if ZwsoftLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688083

ZwsoftLtd

Develops and sells CAD/CAM/CAE software solutions in China.