- China

- /

- Electronic Equipment and Components

- /

- SZSE:300354

Exploring High Growth Tech Stocks in Asia Including Shenzhen Jieshun Science and Technology IndustryLtd

Reviewed by Simply Wall St

Amidst global economic uncertainties and trade tensions, Asian markets have shown resilience, with technology sectors often leading the charge due to their innovative capabilities and potential for rapid growth. In this context, identifying high-growth tech stocks such as those in Asia requires focusing on companies that demonstrate strong fundamentals, adaptability to changing market conditions, and a clear path to leveraging technological advancements.

Top 10 High Growth Tech Companies In Asia

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Ugreen Group | 20.48% | 26.28% | ★★★★★★ |

| Accton Technology | 23.26% | 23.07% | ★★★★★★ |

| Zhejiang Lante Optics | 21.61% | 23.73% | ★★★★★★ |

| PharmaEssentia | 31.60% | 57.71% | ★★★★★★ |

| Fositek | 31.44% | 38.26% | ★★★★★★ |

| Eoptolink Technology | 32.53% | 32.58% | ★★★★★★ |

| Gold Circuit Electronics | 20.97% | 26.54% | ★★★★★★ |

| Shengyi Electronics | 26.23% | 37.08% | ★★★★★★ |

| eWeLLLtd | 24.95% | 24.40% | ★★★★★★ |

| CARsgen Therapeutics Holdings | 81.53% | 96.08% | ★★★★★★ |

Let's review some notable picks from our screened stocks.

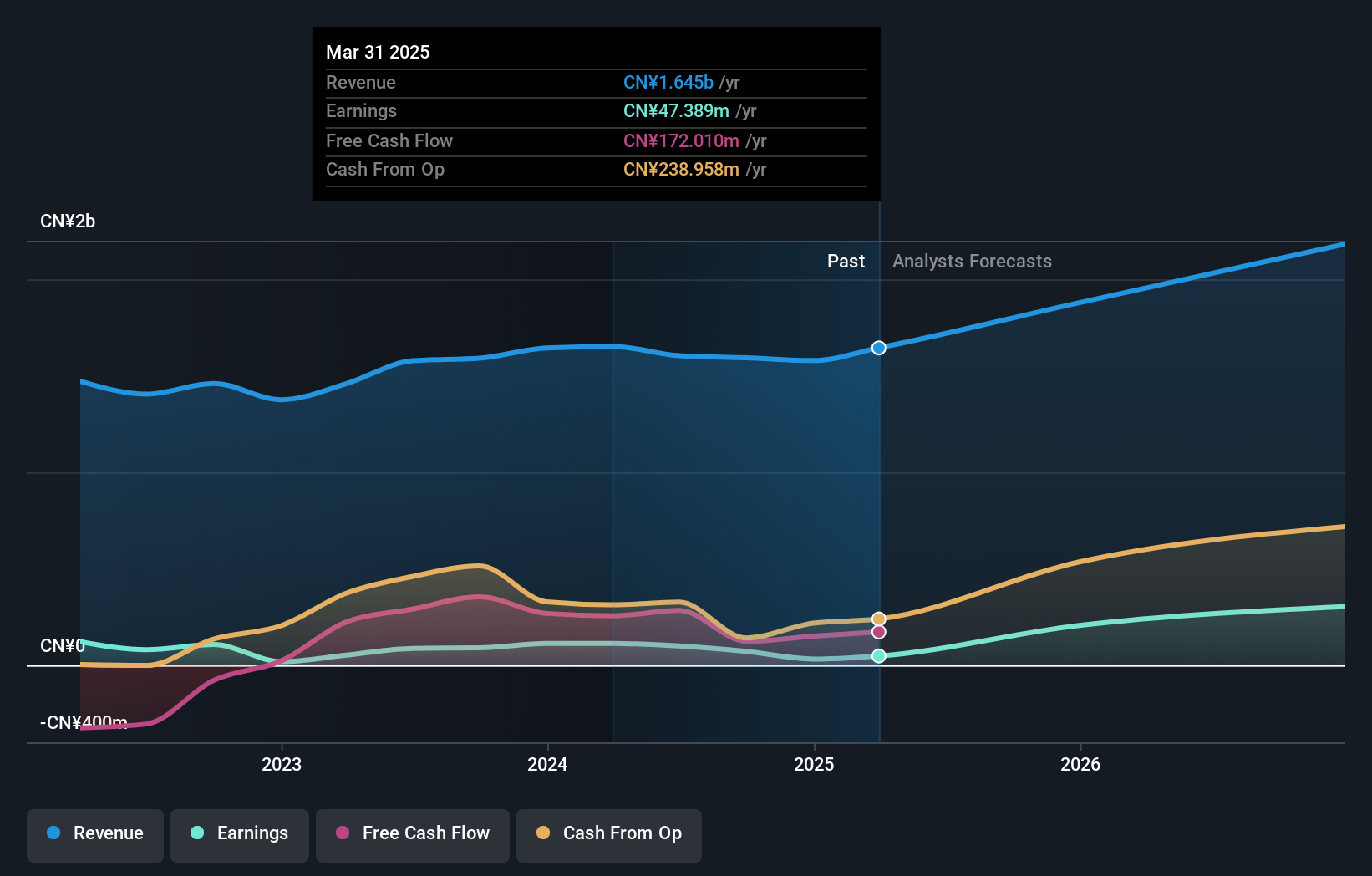

Shenzhen Jieshun Science and Technology IndustryLtd (SZSE:002609)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Shenzhen Jieshun Science and Technology Industry Co., Ltd. specializes in providing intelligent parking solutions and smart city services, with a market cap of CN¥7.43 billion.

Operations: Jieshun focuses on intelligent parking and smart city services, generating revenue primarily from these segments. The company has seen fluctuations in its net profit margin over recent periods.

Shenzhen Jieshun Science and Technology Industry Co., Ltd. is navigating a challenging landscape with its recent financial performance reflecting a significant earnings contraction by 58% over the past year, contrasting sharply with an industry average growth of 2.8%. Despite this downturn, the company's projected earnings growth stands at an impressive 77.3% annually, outpacing the broader Chinese market forecast of 23.7%. This resilience is underscored by its commitment to innovation, as evidenced by substantial R&D investments which are crucial for maintaining competitive edge in the fast-evolving tech sector. Recent corporate actions include amendments to company bylaws and a complete share repurchase program, signaling strategic shifts potentially aimed at bolstering future growth amidst current volatility in profit margins and one-off financial impacts totaling CN¥14.8M that have skewed recent earnings reports.

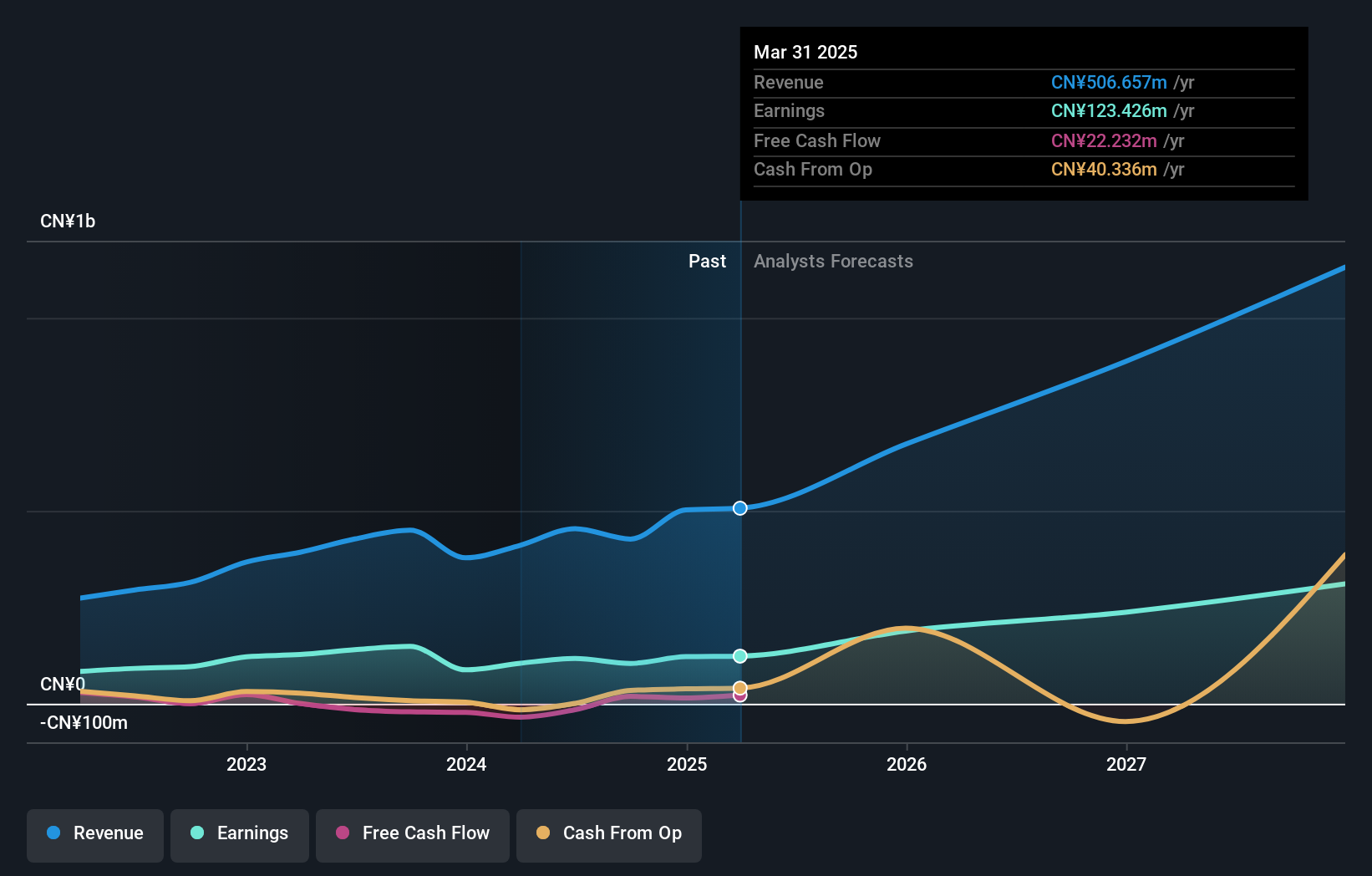

DongHua Testing Technology (SZSE:300354)

Simply Wall St Growth Rating: ★★★★★★

Overview: DongHua Testing Technology Co., Ltd. specializes in providing structural mechanical properties testing services in China and has a market cap of CN¥5.70 billion.

Operations: The company generates revenue primarily from its Instrumentation Testing segment, which contributes CN¥506.66 million.

DongHua Testing Technology is demonstrating robust growth with a notable annual revenue increase of 28.3% and earnings surging by 30.6%, outperforming the broader Chinese market's growth rate. This financial expansion is supported by strategic R&D investments, crucial for staying competitive in the swiftly evolving tech landscape. Recent corporate maneuvers, including amendments to company bylaws and a dividend payout of CNY 1.77 per 10 A shares, reflect proactive governance aimed at sustaining growth amidst dynamic market conditions. These developments underscore DongHua's potential to capitalize on future tech trends while maintaining its innovation-driven edge.

Jiangsu Tongxingbao Intelligent Transportation Technology (SZSE:301339)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Jiangsu Tongxingbao Intelligent Transportation Technology Co., Ltd. offers smart transportation platform solutions for highways, trunk roads, and urban transportation in China, with a market cap of CN¥10.46 billion.

Operations: The company generates revenue primarily from its computer peripherals segment, which amounted to CN¥907.84 million.

Jiangsu Tongxingbao Intelligent Transportation Technology is distinguishing itself in the high-growth tech sector in Asia with a remarkable revenue surge of 42.5% annually, outpacing the Chinese market's average growth. This performance is bolstered by an earnings increase of 34.5% per year, reflecting efficient operational execution and market penetration. The company's commitment to innovation is evident from its substantial R&D investments, aligning with recent strategic amendments aimed at enhancing corporate governance and shareholder engagement as seen in their July meetings. These factors collectively fortify Jiangsu Tongxingbao's position to leverage upcoming technological trends and maintain a competitive edge in the intelligent transportation industry.

- Dive into the specifics of Jiangsu Tongxingbao Intelligent Transportation Technology here with our thorough health report.

Learn about Jiangsu Tongxingbao Intelligent Transportation Technology's historical performance.

Seize The Opportunity

- Embark on your investment journey to our 170 Asian High Growth Tech and AI Stocks selection here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300354

DongHua Testing Technology

Provides structural mechanical properties research and solutions for electrochemical workstations in China.

Exceptional growth potential with excellent balance sheet.

Market Insights

Community Narratives