- China

- /

- Electronic Equipment and Components

- /

- SZSE:300354

Earnings Tell The Story For DongHua Testing Technology Co. , Ltd. (SZSE:300354) As Its Stock Soars 26%

DongHua Testing Technology Co. , Ltd. (SZSE:300354) shareholders would be excited to see that the share price has had a great month, posting a 26% gain and recovering from prior weakness. But the gains over the last month weren't enough to make shareholders whole, as the share price is still down 4.8% in the last twelve months.

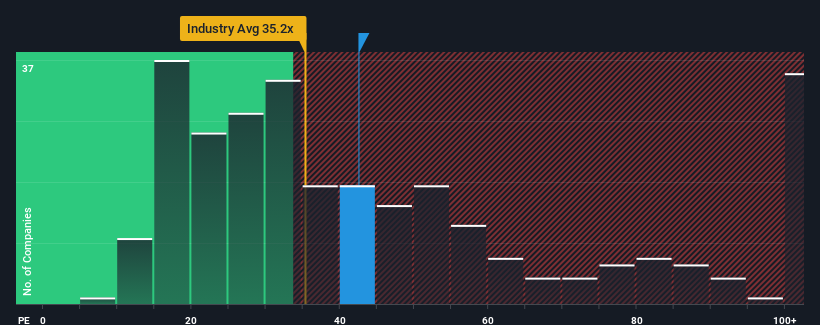

Since its price has surged higher, DongHua Testing Technology may be sending bearish signals at the moment with its price-to-earnings (or "P/E") ratio of 42.5x, since almost half of all companies in China have P/E ratios under 28x and even P/E's lower than 17x are not unusual. However, the P/E might be high for a reason and it requires further investigation to determine if it's justified.

Recent times have been pleasing for DongHua Testing Technology as its earnings have risen in spite of the market's earnings going into reverse. The P/E is probably high because investors think the company will continue to navigate the broader market headwinds better than most. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Check out our latest analysis for DongHua Testing Technology

How Is DongHua Testing Technology's Growth Trending?

In order to justify its P/E ratio, DongHua Testing Technology would need to produce impressive growth in excess of the market.

Retrospectively, the last year delivered an exceptional 50% gain to the company's bottom line. The latest three year period has also seen an excellent 339% overall rise in EPS, aided by its short-term performance. Therefore, it's fair to say the earnings growth recently has been superb for the company.

Shifting to the future, estimates from the dual analysts covering the company suggest earnings should grow by 80% over the next year. With the market only predicted to deliver 41%, the company is positioned for a stronger earnings result.

With this information, we can see why DongHua Testing Technology is trading at such a high P/E compared to the market. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Bottom Line On DongHua Testing Technology's P/E

The large bounce in DongHua Testing Technology's shares has lifted the company's P/E to a fairly high level. While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

As we suspected, our examination of DongHua Testing Technology's analyst forecasts revealed that its superior earnings outlook is contributing to its high P/E. Right now shareholders are comfortable with the P/E as they are quite confident future earnings aren't under threat. Unless these conditions change, they will continue to provide strong support to the share price.

Plus, you should also learn about these 2 warning signs we've spotted with DongHua Testing Technology.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300354

DongHua Testing Technology

Provides structural mechanical properties research and solutions for electrochemical workstations in China.

Exceptional growth potential with excellent balance sheet.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Staggered by dilution; positions for growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026