- China

- /

- Electronic Equipment and Components

- /

- SZSE:300349

Here's Why We Think Goldcard Smart Group (SZSE:300349) Is Well Worth Watching

It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. Unfortunately, these high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson. Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in Goldcard Smart Group (SZSE:300349). While this doesn't necessarily speak to whether it's undervalued, the profitability of the business is enough to warrant some appreciation - especially if its growing.

View our latest analysis for Goldcard Smart Group

How Fast Is Goldcard Smart Group Growing?

The market is a voting machine in the short term, but a weighing machine in the long term, so you'd expect share price to follow earnings per share (EPS) outcomes eventually. That makes EPS growth an attractive quality for any company. We can see that in the last three years Goldcard Smart Group grew its EPS by 4.7% per year. That might not be particularly high growth, but it does show that per-share earnings are moving steadily in the right direction.

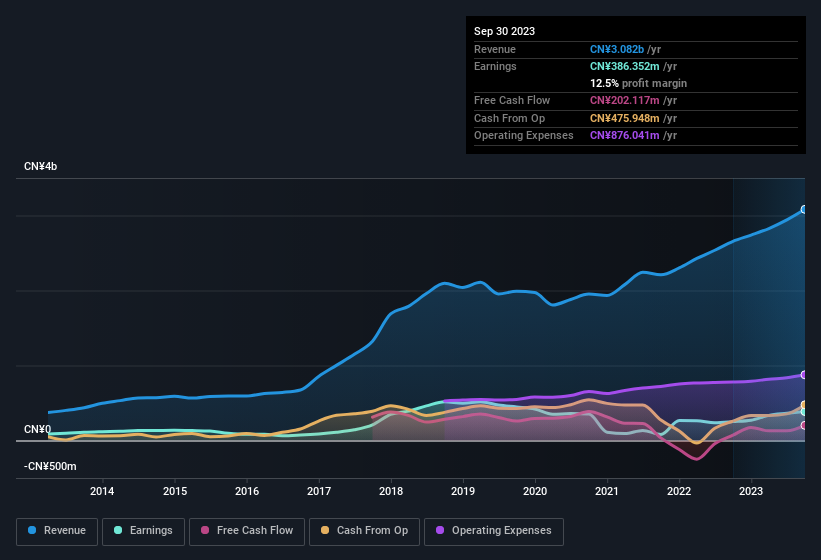

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. Our analysis has highlighted that Goldcard Smart Group's revenue from operations did not account for all of their revenue in the previous 12 months, so our analysis of its margins might not accurately reflect the underlying business. The good news is that Goldcard Smart Group is growing revenues, and EBIT margins improved by 2.9 percentage points to 13%, over the last year. Both of which are great metrics to check off for potential growth.

The chart below shows how the company's bottom and top lines have progressed over time. Click on the chart to see the exact numbers.

While we live in the present moment, there's little doubt that the future matters most in the investment decision process. So why not check this interactive chart depicting future EPS estimates, for Goldcard Smart Group?

Are Goldcard Smart Group Insiders Aligned With All Shareholders?

It's pleasing to see company leaders with putting their money on the line, so to speak, because it increases alignment of incentives between the people running the business, and its true owners. Shareholders will be pleased by the fact that insiders own Goldcard Smart Group shares worth a considerable sum. Indeed, they have a considerable amount of wealth invested in it, currently valued at CN¥1.1b. Coming in at 20% of the business, that holding gives insiders a lot of influence, and plenty of reason to generate value for shareholders. Very encouraging.

While it's always good to see some strong conviction in the company from insiders through heavy investment, it's also important for shareholders to ask if management compensation policies are reasonable. Our quick analysis into CEO remuneration would seem to indicate they are. The median total compensation for CEOs of companies similar in size to Goldcard Smart Group, with market caps between CN¥2.9b and CN¥12b, is around CN¥912k.

Goldcard Smart Group's CEO took home a total compensation package worth CN¥798k in the year leading up to December 2022. That comes in below the average for similar sized companies and seems pretty reasonable. CEO remuneration levels are not the most important metric for investors, but when the pay is modest, that does support enhanced alignment between the CEO and the ordinary shareholders. Generally, arguments can be made that reasonable pay levels attest to good decision-making.

Does Goldcard Smart Group Deserve A Spot On Your Watchlist?

One positive for Goldcard Smart Group is that it is growing EPS. That's nice to see. The growth of EPS may be the eye-catching headline for Goldcard Smart Group, but there's more to bring joy for shareholders. Boasting both modest CEO pay and considerable insider ownership, you'd argue this one is worthy of the watchlist, at least. You still need to take note of risks, for example - Goldcard Smart Group has 1 warning sign we think you should be aware of.

Although Goldcard Smart Group certainly looks good, it may appeal to more investors if insiders were buying up shares. If you like to see companies with insider buying, then check out this handpicked selection of Chinese companies that not only boast of strong growth but have also seen recent insider buying..

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300349

Goldcard Smart Group

Operates as utility digitalization solution provider for smart gas, smart water, and hydrogen metering in China.

Excellent balance sheet average dividend payer.

Market Insights

Community Narratives