- China

- /

- Electronic Equipment and Components

- /

- SZSE:300279

Undiscovered Gems Three Stocks To Watch This November 2024

Reviewed by Simply Wall St

As global markets react to the recent U.S. election results, small-cap stocks have experienced a notable upswing, with the Russell 2000 Index leading gains despite remaining below its previous record highs. This environment of anticipated growth and regulatory shifts presents an intriguing backdrop for investors seeking potential opportunities in lesser-known stocks. Identifying a good stock often involves looking for companies that can navigate current economic conditions effectively while maintaining strong fundamentals and growth potential.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Marítima de Inversiones | NA | 86.64% | 24.51% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Linc | NA | 12.52% | 16.39% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| HOMAG Group | NA | -31.14% | 23.43% | ★★★★★☆ |

| Billion Industrial Holdings | 3.63% | 18.00% | -11.38% | ★★★★★☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Inversiones Doalca SOCIMI | 16.56% | 6.15% | 10.19% | ★★★★☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

Wuxi Hodgen Technology (SZSE:300279)

Simply Wall St Value Rating: ★★★★★★

Overview: Wuxi Hodgen Technology Co., Ltd. operates in the intelligent manufacturing and informatization sector in China, with a market cap of CN¥3.37 billion.

Operations: Wuxi Hodgen Technology generates revenue primarily from its intelligent manufacturing and informatization services. The company's financial performance includes a notable gross profit margin trend, reflecting its cost management and pricing strategies.

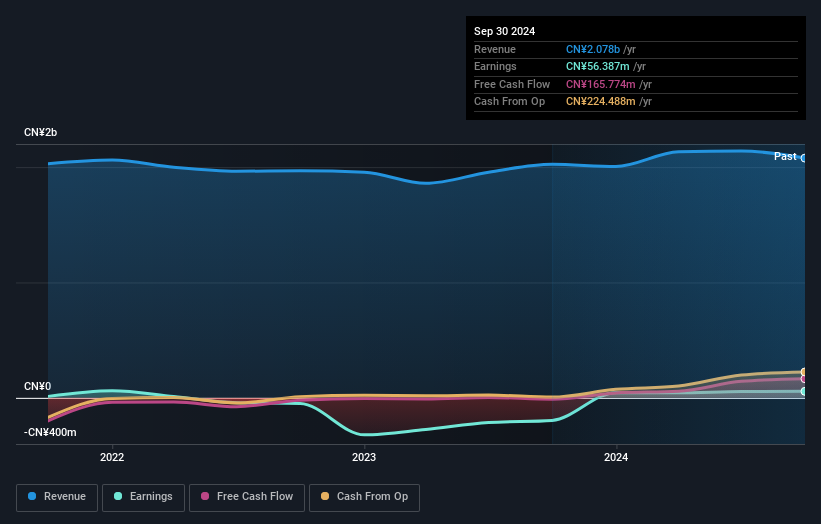

Wuxi Hodgen Technology, a growing player in the electronics industry, has shown promising financial health with its debt to equity ratio reducing from 91% to 60.4% over five years and a satisfactory net debt to equity ratio of 7.4%. The company is trading at a significant discount, about 87.9% below its estimated fair value, suggesting potential undervaluation. Recent earnings reports highlight growth with sales reaching CNY 1.57 billion for the first nine months of 2024 compared to CNY 1.49 billion last year and net income rising from CNY 41.27 million to CNY 52.88 million within the same period.

- Dive into the specifics of Wuxi Hodgen Technology here with our thorough health report.

Learn about Wuxi Hodgen Technology's historical performance.

C.UyemuraLtd (TSE:4966)

Simply Wall St Value Rating: ★★★★★★

Overview: C.Uyemura & Co., Ltd. is engaged in the research, development, manufacturing, and sale of plating chemicals, industrial chemicals, and non-ferrous metals both in Japan and internationally with a market cap of ¥170.59 billion.

Operations: C.Uyemura & Co., Ltd. generates revenue primarily from its Surface Treatment Materials Business, contributing ¥60.58 billion, and Surface Treatment Machinery Business, adding ¥14.53 billion. The Real Estate Rental Business also provides a notable revenue stream of ¥824.83 million.

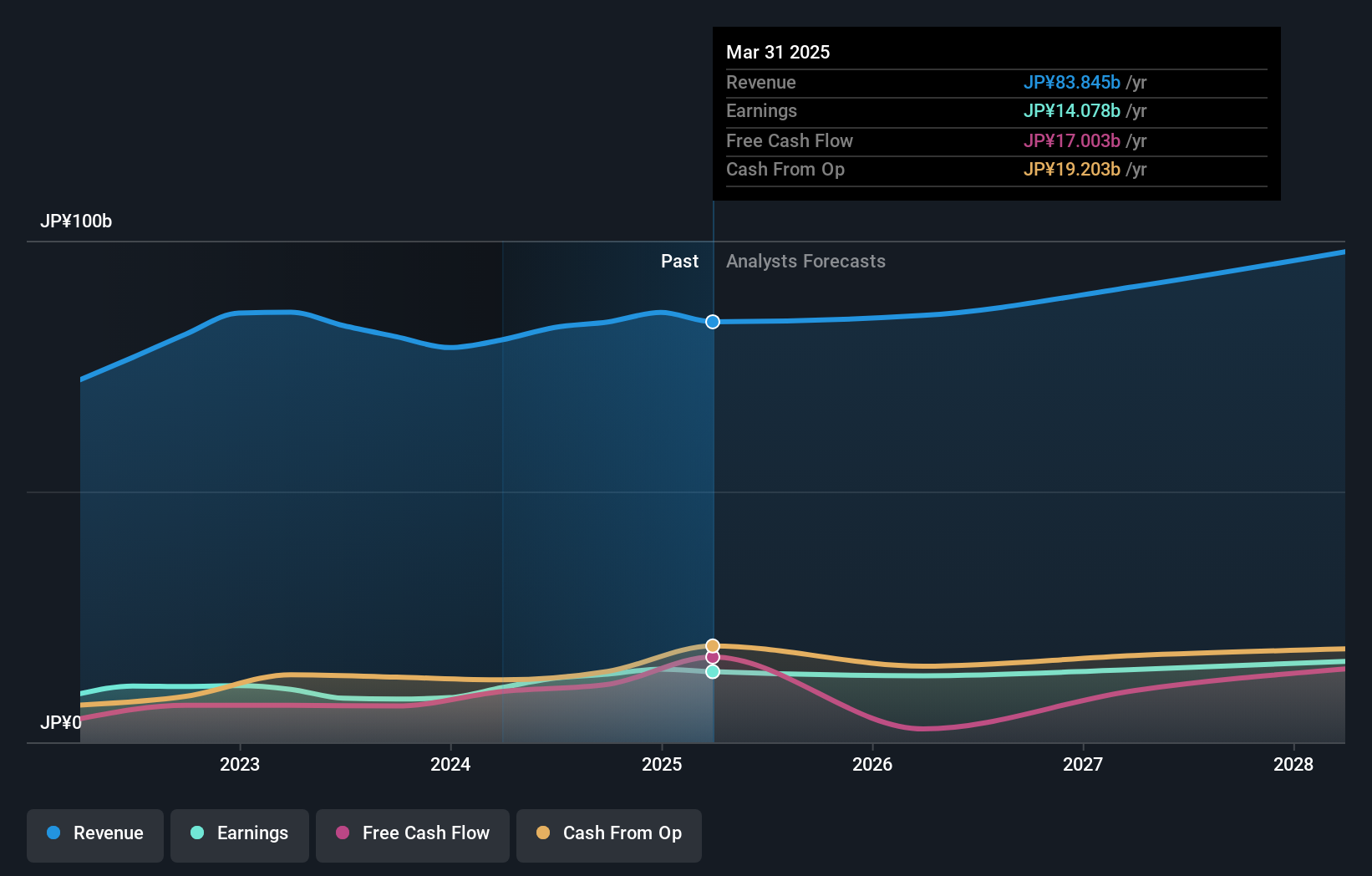

C. Uyemura Ltd., a notable player in the chemicals industry, shows promise with its earnings growing at 15.4% annually over the past five years, although recent growth of 3.6% lagged behind the industry’s 14%. The company appears undervalued, trading at 24.1% below estimated fair value, and boasts high-quality past earnings alongside a reduced debt-to-equity ratio from 0.9 to 0.4 over five years. Despite recent share price volatility, C.Uyemura remains profitable with free cash flow positivity and sufficient interest coverage, suggesting resilience in its financial operations as it prepares to announce Q2 results today (Nov 11).

- Navigate through the intricacies of C.UyemuraLtd with our comprehensive health report here.

Review our historical performance report to gain insights into C.UyemuraLtd's's past performance.

Glory (TSE:6457)

Simply Wall St Value Rating: ★★★★★☆

Overview: Glory Ltd. develops and manufactures cash handling machines and systems across Japan, the United States, Europe, and Asia with a market cap of ¥143.47 billion.

Operations: Glory generates revenue primarily from its cash handling machines and systems across multiple regions, with a market capitalization of ¥143.47 billion.

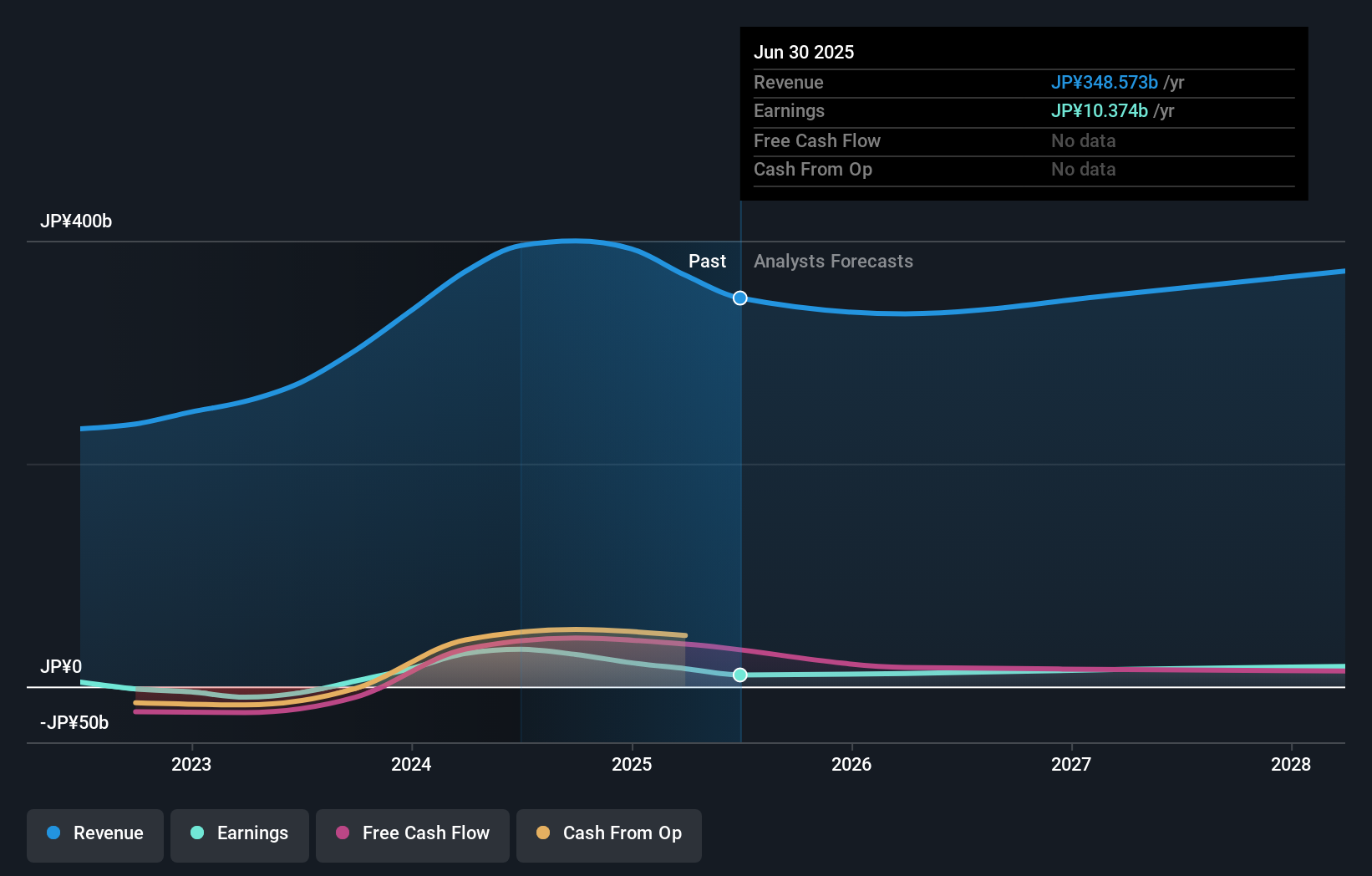

Glory, a promising company, is trading at nearly half its estimated fair value and boasts impressive earnings growth of 479% over the past year, far outpacing the Machinery industry's 1.4%. Despite an increase in its debt-to-equity ratio from 25.4% to 38.5% over five years, it remains satisfactory at 24.1%, with interest payments well-covered by EBIT at a multiple of 25.9 times. With positive free cash flow and high-quality earnings, Glory's recent board meeting hints at strategic moves like disposing treasury shares and acquiring more of Showcase Gig Inc., indicating active management decisions to enhance shareholder value.

- Take a closer look at Glory's potential here in our health report.

Gain insights into Glory's historical performance by reviewing our past performance report.

Where To Now?

- Get an in-depth perspective on all 4673 Undiscovered Gems With Strong Fundamentals by using our screener here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Wuxi Hodgen Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300279

Wuxi Hodgen Technology

Engages in the intelligent manufacturing and intelligent informatization business in China.

Flawless balance sheet with acceptable track record.