- China

- /

- Tech Hardware

- /

- SZSE:300205

Wuhan Tianyu Information Industry Co., Ltd. (SZSE:300205) Shares Fly 28% But Investors Aren't Buying For Growth

Wuhan Tianyu Information Industry Co., Ltd. (SZSE:300205) shareholders are no doubt pleased to see that the share price has bounced 28% in the last month, although it is still struggling to make up recently lost ground. Still, the 30-day jump doesn't change the fact that longer term shareholders have seen their stock decimated by the 56% share price drop in the last twelve months.

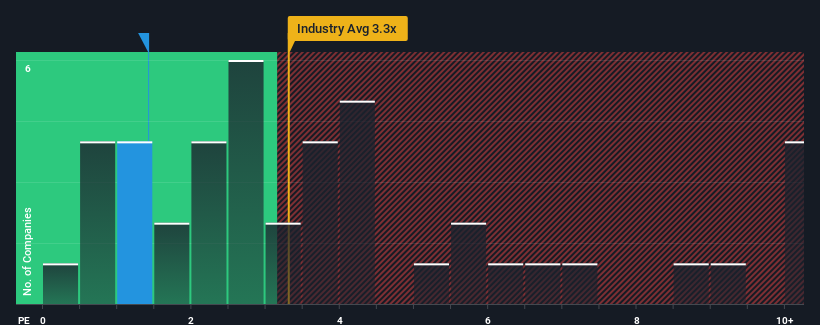

Although its price has surged higher, Wuhan Tianyu Information Industry may still be sending bullish signals at the moment with its price-to-sales (or "P/S") ratio of 1.4x, since almost half of all companies in the Tech industry in China have P/S ratios greater than 3.3x and even P/S higher than 6x are not unusual. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

Check out our latest analysis for Wuhan Tianyu Information Industry

What Does Wuhan Tianyu Information Industry's Recent Performance Look Like?

It looks like revenue growth has deserted Wuhan Tianyu Information Industry recently, which is not something to boast about. One possibility is that the P/S is low because investors think this benign revenue growth rate will likely underperform the broader industry in the near future. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Wuhan Tianyu Information Industry will help you shine a light on its historical performance.How Is Wuhan Tianyu Information Industry's Revenue Growth Trending?

There's an inherent assumption that a company should underperform the industry for P/S ratios like Wuhan Tianyu Information Industry's to be considered reasonable.

Taking a look back first, we see that there was hardly any revenue growth to speak of for the company over the past year. This isn't what shareholders were looking for as it means they've been left with a 6.5% decline in revenue over the last three years in total. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Weighing that medium-term revenue trajectory against the broader industry's one-year forecast for expansion of 25% shows it's an unpleasant look.

With this information, we are not surprised that Wuhan Tianyu Information Industry is trading at a P/S lower than the industry. Nonetheless, there's no guarantee the P/S has reached a floor yet with revenue going in reverse. Even just maintaining these prices could be difficult to achieve as recent revenue trends are already weighing down the shares.

The Final Word

The latest share price surge wasn't enough to lift Wuhan Tianyu Information Industry's P/S close to the industry median. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Our examination of Wuhan Tianyu Information Industry confirms that the company's shrinking revenue over the past medium-term is a key factor in its low price-to-sales ratio, given the industry is projected to grow. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. Given the current circumstances, it seems unlikely that the share price will experience any significant movement in either direction in the near future if recent medium-term revenue trends persist.

Having said that, be aware Wuhan Tianyu Information Industry is showing 4 warning signs in our investment analysis, and 2 of those are a bit unpleasant.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if Wuhan Tianyu Information Industry might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300205

Wuhan Tianyu Information Industry

Wuhan Tianyu Information Industry Co., Ltd.

Flawless balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives