- China

- /

- Communications

- /

- SZSE:300167

Undervalued Penny Stocks To Watch In November 2024

Reviewed by Simply Wall St

Global markets have been navigating a complex landscape, with major indices experiencing volatility amid a busy earnings season and mixed economic signals. As investors sift through these developments, the allure of penny stocks—often smaller or newer companies—remains strong for those seeking growth opportunities at lower price points. Despite being an outdated term, penny stocks continue to hold relevance as they can offer potential upside when backed by solid financial health and fundamentals.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| BP Plastics Holding Bhd (KLSE:BPPLAS) | MYR1.24 | MYR343.4M | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$0.83 | HK$539.57M | ★★★★★★ |

| Rexit Berhad (KLSE:REXIT) | MYR0.785 | MYR135.97M | ★★★★★★ |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.49 | MYR2.56B | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.755 | A$139.45M | ★★★★☆☆ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.88 | MYR295.43M | ★★★★★★ |

| FRP Advisory Group (AIM:FRP) | £1.455 | £356.81M | ★★★★★★ |

| Wellcall Holdings Berhad (KLSE:WELLCAL) | MYR1.53 | MYR761.86M | ★★★★★★ |

| Kelington Group Berhad (KLSE:KGB) | MYR3.00 | MYR2.14B | ★★★★★☆ |

| Next 15 Group (AIM:NFG) | £3.865 | £384.4M | ★★★★☆☆ |

Click here to see the full list of 5,770 stocks from our Penny Stocks screener.

Let's uncover some gems from our specialized screener.

Qinghai Huading Industrial (SHSE:600243)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Qinghai Huading Industrial Co., Ltd. focuses on the research, development, production, and sale of CNC machine tools and elevator accessories in China with a market cap of CN¥1.96 billion.

Operations: No revenue segments are reported for this company.

Market Cap: CN¥1.96B

Qinghai Huading Industrial Co., Ltd. has shown a reduction in losses over the past five years, decreasing at an annual rate of 15.8%, despite being unprofitable. Recent earnings reports indicate a decrease in sales to CN¥185.37 million for the nine months ended September 30, 2024, compared to CN¥271.56 million from the previous year, with net losses narrowing slightly to CN¥17.62 million from CN¥28.37 million. The company maintains a stable cash runway exceeding two years and has more cash than debt, although its board is relatively inexperienced with an average tenure of 2.5 years.

- Dive into the specifics of Qinghai Huading Industrial here with our thorough balance sheet health report.

- Explore historical data to track Qinghai Huading Industrial's performance over time in our past results report.

Sunway (SHSE:603333)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Sunway Co., Ltd. is involved in the research, development, production, sale, and service of cable products in China with a market cap of CN¥2.59 billion.

Operations: The company generates revenue of CN¥1.80 billion from its manufacturing segment.

Market Cap: CN¥2.59B

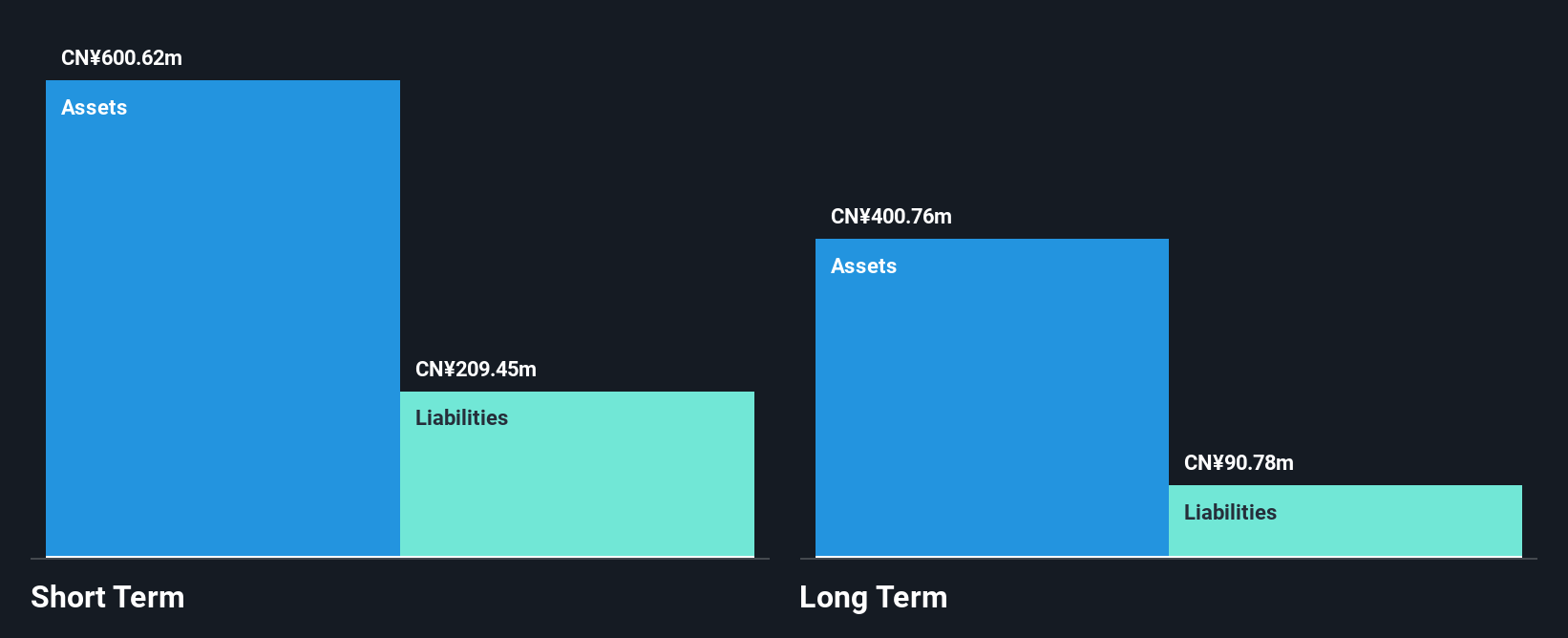

Sunway Co., Ltd. has faced challenges with declining earnings, reporting a net income of CN¥19 million for the nine months ending September 30, 2024, down from CN¥30.31 million the previous year. The company's revenue also decreased to CN¥1.20 billion from CN¥1.60 billion year-on-year. Despite these setbacks, Sunway's financial structure remains stable with short-term assets exceeding both short- and long-term liabilities significantly. However, its profit margins have narrowed to 0.5%, and earnings growth remains negative over recent years, indicating ongoing operational hurdles in its cable manufacturing segment in China.

- Click here and access our complete financial health analysis report to understand the dynamics of Sunway.

- Review our historical performance report to gain insights into Sunway's track record.

Shenzhen DivisionLtd (SZSE:300167)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Shenzhen Division Co., Ltd. focuses on the research, development, and sale of smart video and IoT core technology products and solutions primarily in China, with a market capitalization of CN¥718.79 million.

Operations: No specific revenue segments are reported for this company.

Market Cap: CN¥718.79M

Shenzhen Division Co., Ltd. has shown significant sales growth, reporting CN¥327.34 million for the nine months ending September 30, 2024, up from CN¥169.96 million a year prior. Despite this progress, the company remains unprofitable with a net loss of CN¥28.89 million but has reduced losses compared to last year's figures. The company's market volatility is high and its debt-to-equity ratio increased over five years; however, it trades significantly below estimated fair value and maintains sufficient cash runway for over three years even as free cash flow decreases annually by 22.1%.

- Unlock comprehensive insights into our analysis of Shenzhen DivisionLtd stock in this financial health report.

- Gain insights into Shenzhen DivisionLtd's past trends and performance with our report on the company's historical track record.

Seize The Opportunity

- Unlock our comprehensive list of 5,770 Penny Stocks by clicking here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300167

Shenzhen DivisionLtd

Engages in the research and development, and sale of smart video and IoT core technology products and solutions primarily in China.

Good value with adequate balance sheet.