Stock Analysis

- China

- /

- Electronic Equipment and Components

- /

- SZSE:300161

Shareholders in Wuhan Huazhong Numerical ControlLtd (SZSE:300161) have lost 60%, as stock drops 8.6% this past week

Investing in stocks comes with the risk that the share price will fall. Anyone who held Wuhan Huazhong Numerical Control Co.,Ltd. (SZSE:300161) over the last year knows what a loser feels like. In that relatively short period, the share price has plunged 60%. The silver lining (for longer term investors) is that the stock is still 13% higher than it was three years ago. Furthermore, it's down 24% in about a quarter. That's not much fun for holders.

After losing 8.6% this past week, it's worth investigating the company's fundamentals to see what we can infer from past performance.

See our latest analysis for Wuhan Huazhong Numerical ControlLtd

Wuhan Huazhong Numerical ControlLtd wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Shareholders of unprofitable companies usually desire strong revenue growth. Some companies are willing to postpone profitability to grow revenue faster, but in that case one would hope for good top-line growth to make up for the lack of earnings.

In the last twelve months, Wuhan Huazhong Numerical ControlLtd increased its revenue by 13%. While that may seem decent it isn't great considering the company is still making a loss. Without profits, and with revenue growth sluggish, you get a 60% loss for shareholders, over the year. We'd want to see evidence that future revenue growth will be stronger before getting too interested. Of course, the market can be too impatient at times. Why not take a closer look at this one so you're ready to pounce if growth does accelerate.

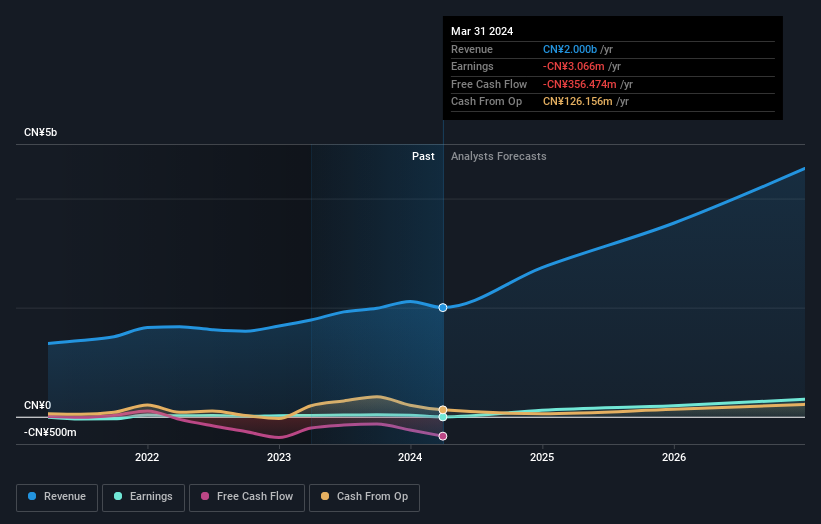

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

Balance sheet strength is crucial. It might be well worthwhile taking a look at our free report on how its financial position has changed over time.

A Different Perspective

While the broader market lost about 17% in the twelve months, Wuhan Huazhong Numerical ControlLtd shareholders did even worse, losing 60% (even including dividends). Having said that, it's inevitable that some stocks will be oversold in a falling market. The key is to keep your eyes on the fundamental developments. On the bright side, long term shareholders have made money, with a gain of 5% per year over half a decade. It could be that the recent sell-off is an opportunity, so it may be worth checking the fundamental data for signs of a long term growth trend. You might want to assess this data-rich visualization of its earnings, revenue and cash flow.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

Valuation is complex, but we're helping make it simple.

Find out whether Wuhan Huazhong Numerical ControlLtd is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're helping make it simple.

Find out whether Wuhan Huazhong Numerical ControlLtd is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300161

Wuhan Huazhong Numerical ControlLtd

Wuhan Huazhong Numerical Control System, Inc.

High growth potential and fair value.