- China

- /

- Electronic Equipment and Components

- /

- SHSE:688002

3 High Insider Ownership Growth Companies With Earnings Increasing By Up To 80%

Reviewed by Simply Wall St

As global markets navigate through a period marked by fluctuating inflation rates and cautious monetary policies, investors are keenly observing market trends and economic indicators. In such a climate, growth companies with high insider ownership can be particularly compelling, as substantial insider stakes often signal confidence in the company's future prospects from those who know it best.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Gaming Innovation Group (OB:GIG) | 22.1% | 36.2% |

| Seojin SystemLtd (KOSDAQ:A178320) | 26.4% | 48.1% |

| Elliptic Laboratories (OB:ELABS) | 31.6% | 124.6% |

| KebNi (OM:KEBNI B) | 37.8% | 90.4% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 15.2% | 84.1% |

| Calliditas Therapeutics (OM:CALTX) | 11.6% | 53% |

| La Française de l'Energie (ENXTPA:FDE) | 20.1% | 37.7% |

| Vow (OB:VOW) | 31.8% | 97.6% |

| Adocia (ENXTPA:ADOC) | 12.4% | 104.5% |

| OSE Immunotherapeutics (ENXTPA:OSE) | 24.9% | 92.9% |

Let's take a closer look at a couple of our picks from the screened companies.

Raytron TechnologyLtd (SHSE:688002)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Raytron Technology Co., Ltd. specializes in the research, development, design, manufacturing, and sales of uncooled infrared imaging and MEMS sensor technology in China, with a market capitalization of approximately CN¥13.38 billion.

Operations: The company generates revenue primarily from the sales of uncooled infrared imaging and MEMS sensor technology.

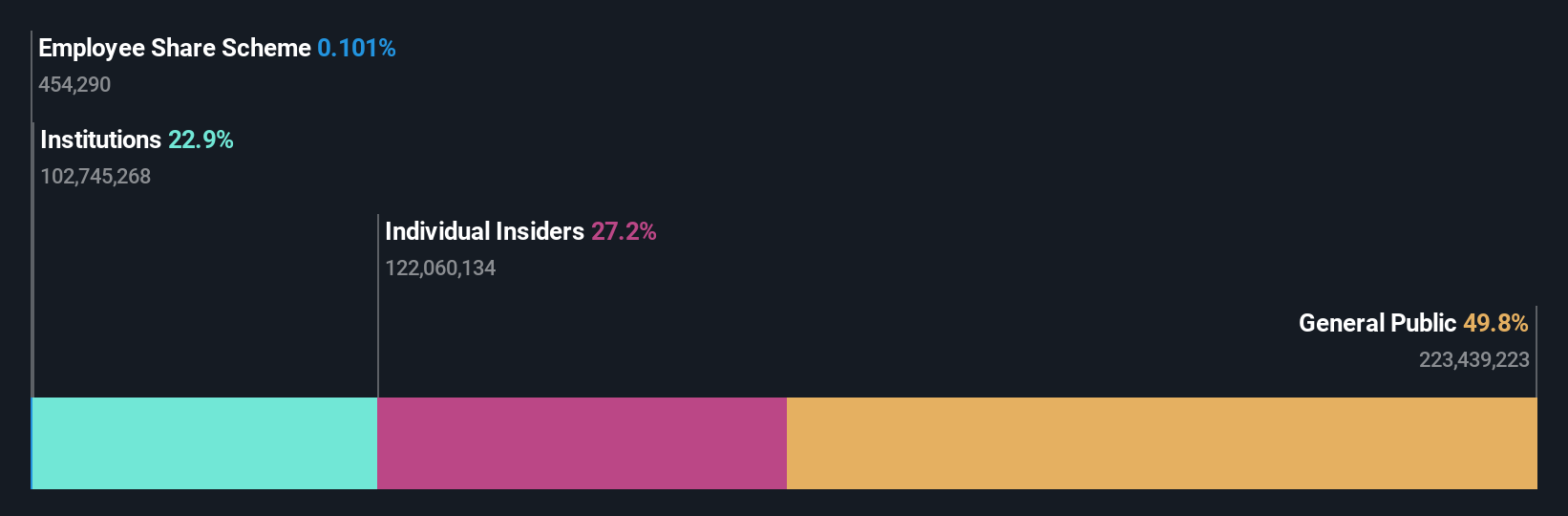

Insider Ownership: 26.8%

Earnings Growth Forecast: 27.9% p.a.

Raytron TechnologyLtd, with its recent share repurchase program of up to CNY 200 million, underscores a commitment to shareholder value and reflects confidence from management in the firm's prospects. The company's earnings have grown by 42.6% over the past year, significantly outpacing the CN market average. Despite a Price-To-Earnings ratio below market at 24.8x, Raytron faces challenges with forecasted low Return on Equity at 15.7% in three years and high share price volatility recently.

- Dive into the specifics of Raytron TechnologyLtd here with our thorough growth forecast report.

- Our expertly prepared valuation report Raytron TechnologyLtd implies its share price may be too high.

Gosuncn Technology Group (SZSE:300098)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Gosuncn Technology Group Co., Ltd. specializes in providing IoT products and services within China, with a market capitalization of approximately CN¥5.77 billion.

Operations: The company generates its revenue primarily from the sale of IoT products and services.

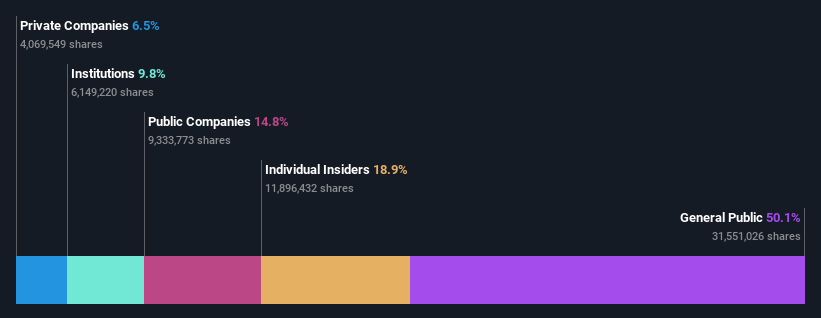

Insider Ownership: 19.4%

Earnings Growth Forecast: 80.3% p.a.

Gosuncn Technology Group, with high insider ownership, reflects a mixed financial trajectory. Recently transitioning from a net loss to modest profitability (CNY 7.8 million), the company shows improving fundamentals but faces revenue contraction from CNY 349.39 million to CNY 305.21 million year-over-year. Insider transactions have been quiet recently, indicating potential stability or cautious optimism among those closest to the company's operations. Despite challenges, Gosuncn is expected to grow earnings substantially and become profitable within three years, outpacing average market growth predictions in China.

- Click here and access our complete growth analysis report to understand the dynamics of Gosuncn Technology Group.

- Our valuation report here indicates Gosuncn Technology Group may be overvalued.

Visco Vision (TWSE:6782)

Simply Wall St Growth Rating: ★★★★★★

Overview: Visco Vision Inc., with a market cap of NT$16.38 billion, specializes in the manufacturing and international sales of silicone hydrogel contact lenses.

Operations: The company generates NT$2.40 billion from the manufacturing and trading of disposable contact lenses.

Insider Ownership: 18.9%

Earnings Growth Forecast: 41.2% p.a.

Visco Vision, characterized by high insider ownership, shows promising growth prospects with earnings expected to increase by 41.2% per year and revenue forecasted to rise at 22.3% annually, outstripping the TW market's average. However, its profit margins have declined from last year's 22.2% to 12.6%. Recent board meetings and earnings discussions highlight proactive management engagement amid a highly volatile share price over the past three months, suggesting both opportunities and risks in its trajectory.

- Click here to discover the nuances of Visco Vision with our detailed analytical future growth report.

- The valuation report we've compiled suggests that Visco Vision's current price could be inflated.

Next Steps

- Discover the full array of 1475 Fast Growing Companies With High Insider Ownership right here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688002

Raytron TechnologyLtd

Engages in the research and development, design, manufacturing, and sales of uncooled infrared imagining and MEMS sensor technology in China.

High growth potential with solid track record.