3 Growth Companies With High Insider Ownership And Revenue Growth Up To 29%

Reviewed by Simply Wall St

In a week marked by significant declines in global markets, driven by economic slowdown worries and sector-specific challenges, investors are seeking stability and growth potential amidst the volatility. One way to identify promising opportunities is to look for growth companies with high insider ownership, as this often signals confidence from those closest to the business.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Lavvi Empreendimentos Imobiliários (BOVESPA:LAVV3) | 11.9% | 20.3% |

| Atlas Energy Solutions (NYSE:AESI) | 29.1% | 42.1% |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 33.7% |

| People & Technology (KOSDAQ:A137400) | 16.5% | 35.6% |

| Hartshead Resources (ASX:HHR) | 13.9% | 102.6% |

| On Holding (NYSE:ONON) | 28.4% | 24.4% |

| Laopu Gold (SEHK:6181) | 36.4% | 34.7% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 14.0% | 95.9% |

| Plenti Group (ASX:PLT) | 12.8% | 106.4% |

| EHang Holdings (NasdaqGM:EH) | 32.8% | 81.5% |

Here we highlight a subset of our preferred stocks from the screener.

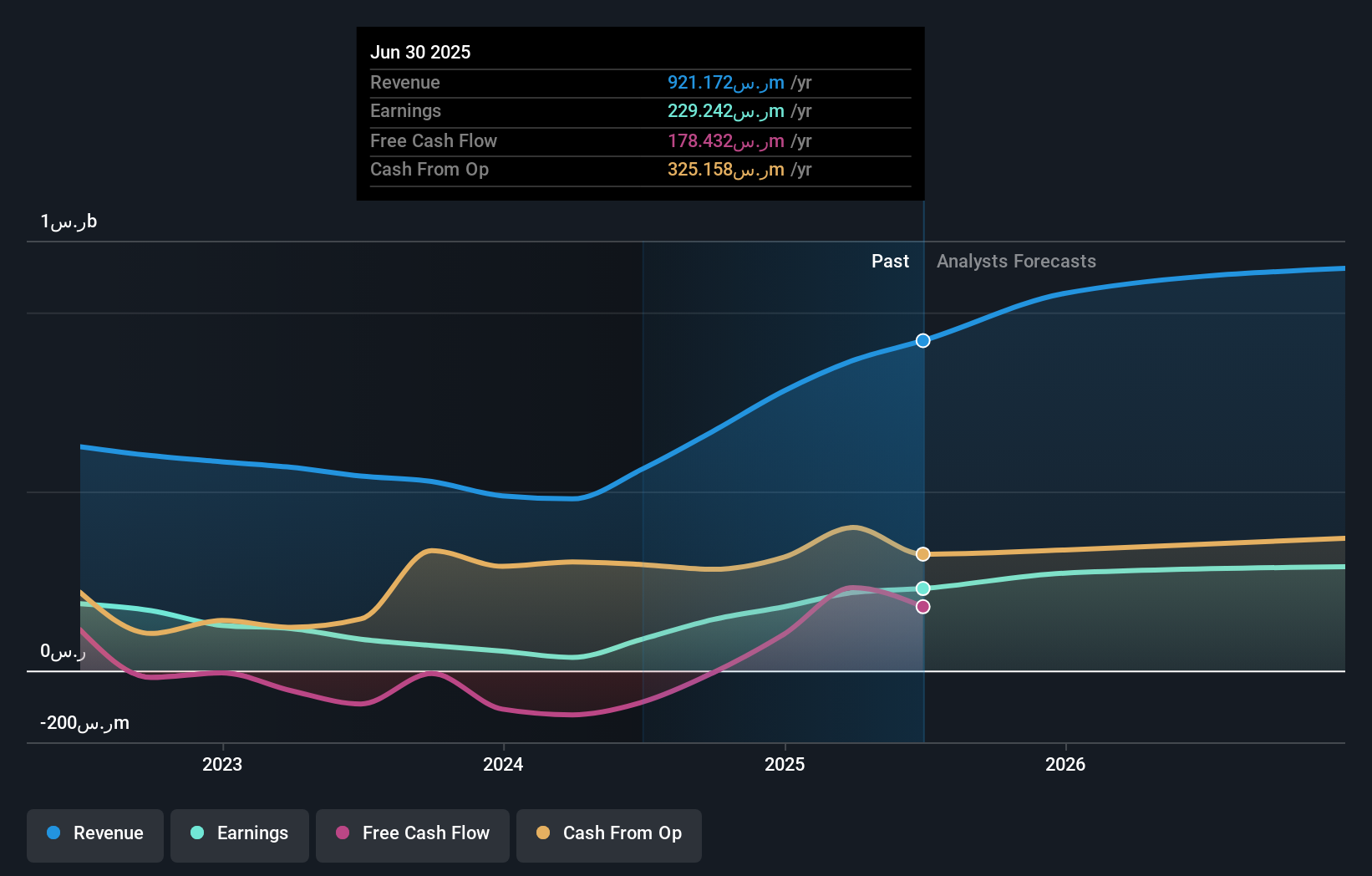

Al Masane Al Kobra Mining (SASE:1322)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Al Masane Al Kobra Mining Company operates in the Kingdom of Saudi Arabia, producing non-ferrous metal ores and precious metals, with a market cap of SAR61.37 billion.

Operations: The company's revenue segments include SAR352.62 million from the Al Masane Mine and SAR160.29 million from the Mount Guyan Mine.

Insider Ownership: 10.2%

Revenue Growth Forecast: 29.2% p.a.

Al Masane Al Kobra Mining (AMAK) shows significant growth potential with earnings forecasted to grow 59% per year, outpacing the SA market's average. Recent executive changes introduced Eng. Nihat Soyer as Acting CEO, bringing over 30 years of mining experience. The company also secured an exploration license for manganese in Al-Baha Province, potentially expanding its resource base. However, its current dividend yield of 2.27% is not well covered by earnings or free cash flows.

- Click here to discover the nuances of Al Masane Al Kobra Mining with our detailed analytical future growth report.

- Our expertly prepared valuation report Al Masane Al Kobra Mining implies its share price may be too high.

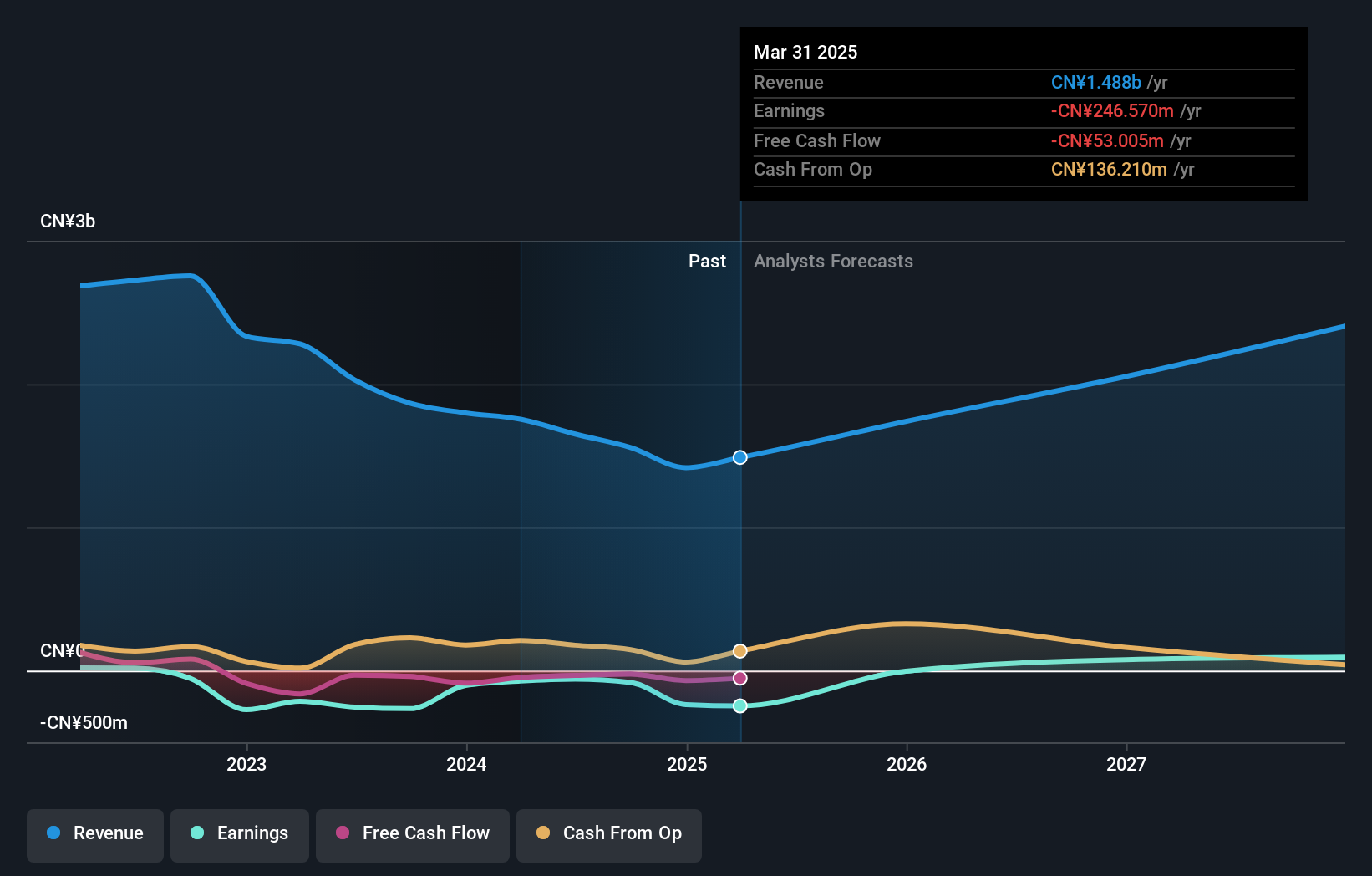

Gosuncn Technology Group (SZSE:300098)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Gosuncn Technology Group Co., Ltd. provides IoT products and services in China, with a market cap of CN¥6.90 billion.

Operations: Gosuncn Technology Group Co., Ltd. generates revenue from various IoT products and services in China, with a market cap of CN¥6.90 billion.

Insider Ownership: 19.5%

Revenue Growth Forecast: 14.2% p.a.

Gosuncn Technology Group has seen earnings grow 28.5% annually over the past 5 years and is forecast to become profitable within the next 3 years, with earnings expected to grow at 77.04% per year. Despite a volatile share price recently, insider ownership remains high. Recent half-year results showed a net loss of CNY 4.51 million, an improvement from last year's CNY 48.03 million loss, indicating potential recovery amid ongoing buyback activities totaling CNY 15.4 million in shares repurchased since October 2023.

- Dive into the specifics of Gosuncn Technology Group here with our thorough growth forecast report.

- The valuation report we've compiled suggests that Gosuncn Technology Group's current price could be inflated.

Insyde Software (TPEX:6231)

Simply Wall St Growth Rating: ★★★★★★

Overview: Insyde Software Corp. provides system firmware and software engineering services for companies in the mobile, desktop, server, and embedded systems industries worldwide, with a market cap of NT$22.55 billion.

Operations: Revenue from software and programming services amounts to NT$1.50 billion.

Insider Ownership: 10.3%

Revenue Growth Forecast: 21.2% p.a.

Insyde Software has demonstrated strong growth, with second-quarter sales rising to TWD 402.75 million from TWD 313.96 million a year ago and net income increasing to TWD 84.19 million from TWD 28.09 million. Despite recent share price volatility, the company is trading at a significant discount to its estimated fair value and is forecasted to grow earnings by 56.43% annually over the next three years, outpacing market expectations significantly.

- Get an in-depth perspective on Insyde Software's performance by reading our analyst estimates report here.

- The analysis detailed in our Insyde Software valuation report hints at an inflated share price compared to its estimated value.

Turning Ideas Into Actions

- Unlock our comprehensive list of 1512 Fast Growing Companies With High Insider Ownership by clicking here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TPEX:6231

Insyde Software

Provides system firmware and software engineering services for companies in the mobile, desktop, server, and embedded systems industries worldwide.

Exceptional growth potential with flawless balance sheet.