- China

- /

- Electronic Equipment and Components

- /

- SZSE:300088

Wuhu Token Sciences Co., Ltd.'s (SZSE:300088) Share Price Boosted 54% But Its Business Prospects Need A Lift Too

The Wuhu Token Sciences Co., Ltd. (SZSE:300088) share price has done very well over the last month, posting an excellent gain of 54%. Looking further back, the 18% rise over the last twelve months isn't too bad notwithstanding the strength over the last 30 days.

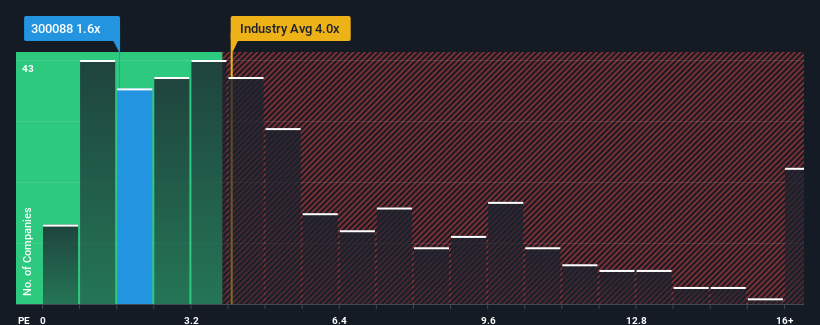

Even after such a large jump in price, Wuhu Token Sciences' price-to-sales (or "P/S") ratio of 1.6x might still make it look like a strong buy right now compared to the wider Electronic industry in China, where around half of the companies have P/S ratios above 4x and even P/S above 8x are quite common. However, the P/S might be quite low for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for Wuhu Token Sciences

How Wuhu Token Sciences Has Been Performing

Recent times have been advantageous for Wuhu Token Sciences as its revenues have been rising faster than most other companies. One possibility is that the P/S ratio is low because investors think this strong revenue performance might be less impressive moving forward. If the company manages to stay the course, then investors should be rewarded with a share price that matches its revenue figures.

Want the full picture on analyst estimates for the company? Then our free report on Wuhu Token Sciences will help you uncover what's on the horizon.How Is Wuhu Token Sciences' Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as depressed as Wuhu Token Sciences' is when the company's growth is on track to lag the industry decidedly.

If we review the last year of revenue growth, the company posted a terrific increase of 56%. The latest three year period has also seen an excellent 59% overall rise in revenue, aided by its short-term performance. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Turning to the outlook, the next year should generate growth of 13% as estimated by the three analysts watching the company. With the industry predicted to deliver 26% growth, the company is positioned for a weaker revenue result.

With this in consideration, its clear as to why Wuhu Token Sciences' P/S is falling short industry peers. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

The Final Word

Shares in Wuhu Token Sciences have risen appreciably however, its P/S is still subdued. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

As expected, our analysis of Wuhu Token Sciences' analyst forecasts confirms that the company's underwhelming revenue outlook is a major contributor to its low P/S. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

Plus, you should also learn about these 4 warning signs we've spotted with Wuhu Token Sciences (including 1 which is potentially serious).

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're here to simplify it.

Discover if Wuhu Token Sciences might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300088

Wuhu Token Sciences

Engages in the research and development, processing, manufacture, sale, and service of key touch display device materials in China.

Excellent balance sheet with reasonable growth potential and pays a dividend.

Market Insights

Community Narratives