- China

- /

- Communications

- /

- SZSE:300079

Investors three-year losses continue as Sumavision TechnologiesLtd (SZSE:300079) dips a further 10% this week, earnings continue to decline

Investing in stocks inevitably means buying into some companies that perform poorly. But the long term shareholders of Sumavision Technologies Co.,Ltd. (SZSE:300079) have had an unfortunate run in the last three years. So they might be feeling emotional about the 51% share price collapse, in that time. And the ride hasn't got any smoother in recent times over the last year, with the price 39% lower in that time. Shareholders have had an even rougher run lately, with the share price down 18% in the last 90 days.

After losing 10% this past week, it's worth investigating the company's fundamentals to see what we can infer from past performance.

See our latest analysis for Sumavision TechnologiesLtd

While Sumavision TechnologiesLtd made a small profit, in the last year, we think that the market is probably more focussed on the top line growth at the moment. Generally speaking, we'd consider a stock like this alongside loss-making companies, simply because the quantum of the profit is so low. It would be hard to believe in a more profitable future without growing revenues.

In the last three years Sumavision TechnologiesLtd saw its revenue shrink by 9.7% per year. That is not a good result. With revenue in decline, and profit but a dream, we can understand why the share price has been declining at 15% per year. Of course, it's the future that will determine whether today's price is a good one. We'd be pretty wary of this one until it makes a profit, because we don't specialize in finding turnaround situations.

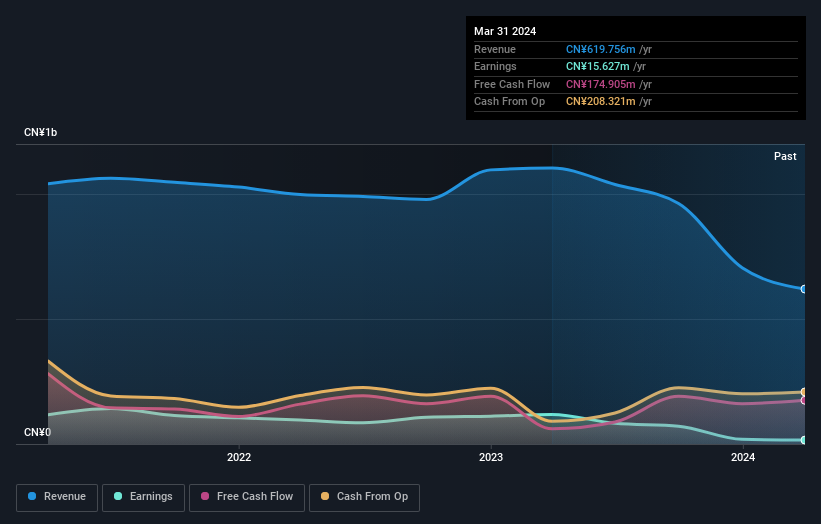

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

Balance sheet strength is crucial. It might be well worthwhile taking a look at our free report on how its financial position has changed over time.

A Different Perspective

While the broader market lost about 14% in the twelve months, Sumavision TechnologiesLtd shareholders did even worse, losing 39% (even including dividends). However, it could simply be that the share price has been impacted by broader market jitters. It might be worth keeping an eye on the fundamentals, in case there's a good opportunity. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 6% per year over five years. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. For example, we've discovered 3 warning signs for Sumavision TechnologiesLtd that you should be aware of before investing here.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: many of them are unnoticed AND have attractive valuation).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300079

Sumavision TechnologiesLtd

Provides video delivery solutions for broadcast, cable, satellite, internet, and mobile and telco video service worldwide.

Flawless balance sheet slight.