- South Korea

- /

- Electrical

- /

- KOSDAQ:A058610

Undiscovered Gems in Global Markets to Explore This November 2025

Reviewed by Simply Wall St

As global markets navigate the aftermath of the longest U.S. government shutdown in history and grapple with fluctuating interest rate expectations, small-cap stocks have faced particular challenges, as seen in the recent underperformance of the Russell 2000 Index. Amid these dynamic conditions, investors are increasingly on the lookout for undiscovered gems that offer potential growth opportunities despite broader market volatility and economic uncertainties. Identifying a good stock often involves finding companies with solid fundamentals and unique market positions that can thrive even when broader sentiment is cautious or mixed.

Top 10 Undiscovered Gems With Strong Fundamentals Globally

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Lion Rock Group | 5.00% | 14.21% | 13.26% | ★★★★★★ |

| VICOM | NA | 6.95% | 4.06% | ★★★★★★ |

| Thai Steel Cable | NA | 4.17% | 18.81% | ★★★★★★ |

| HG Metal Manufacturing | 3.75% | 8.47% | 6.94% | ★★★★★★ |

| YH Entertainment Group | 4.44% | -11.47% | -43.36% | ★★★★★★ |

| Uju Holding | 34.04% | 5.58% | -25.17% | ★★★★★★ |

| YuanShengTai Dairy Farm | 15.09% | 11.64% | -31.87% | ★★★★★☆ |

| JB Foods | 113.93% | 31.03% | 41.46% | ★★★★☆☆ |

| Tai Sin Electric | 37.42% | 10.92% | 7.66% | ★★★★☆☆ |

| Practic | NA | 4.86% | 6.64% | ★★★★☆☆ |

We'll examine a selection from our screener results.

Grupo Herdez. de (BMV:HERDEZ *)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Grupo Herdez, S.A.B. de C.V. is a food company that offers processed food products both in Mexico and internationally, with a market capitalization of MX$23.44 billion.

Operations: The company generates revenue through exports (MX$3.26 billion), momentum products (MX$4.97 billion), and canned food (MX$30.37 billion).

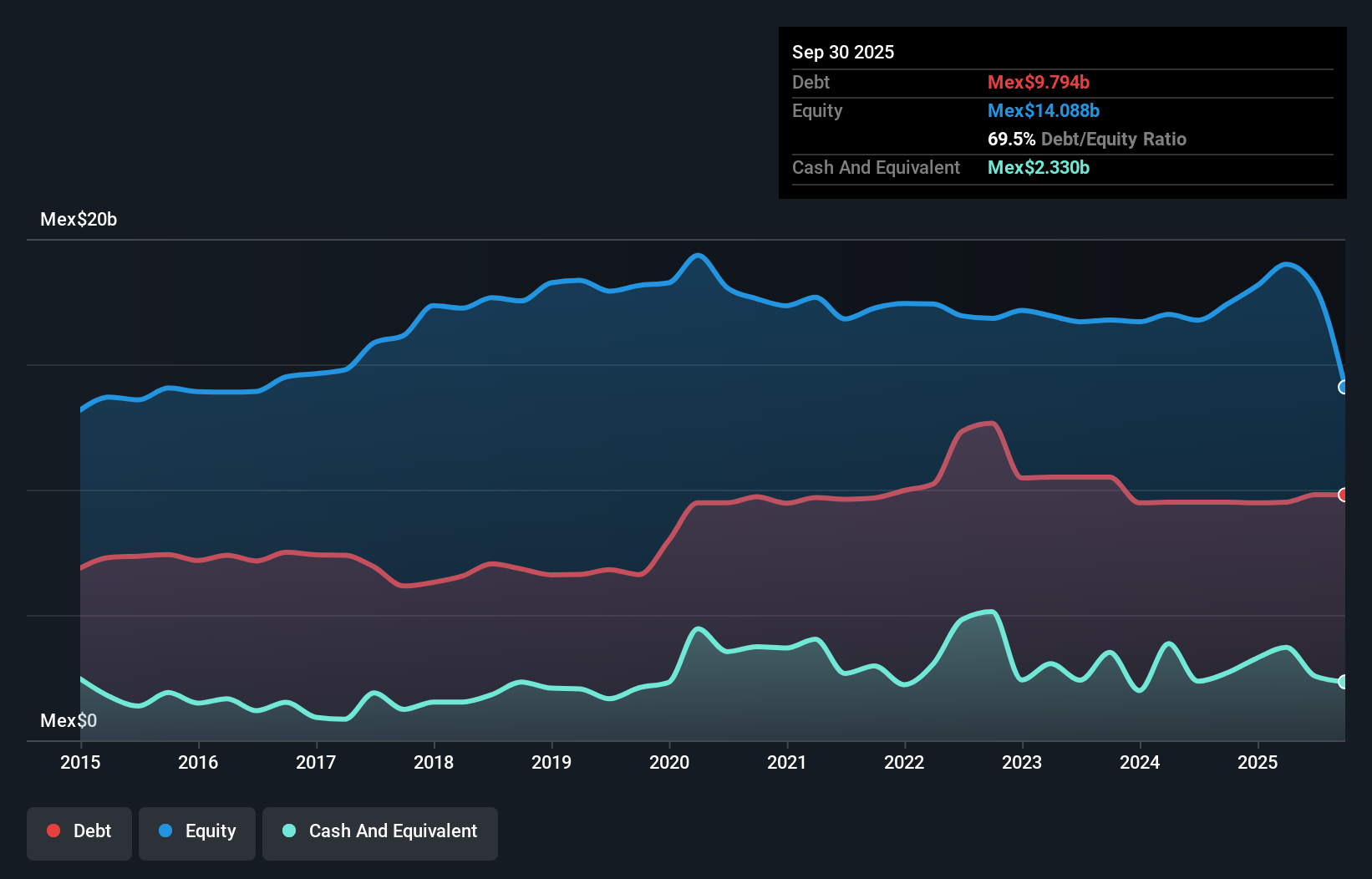

Grupo Herdez has demonstrated solid financial performance, with earnings growing 12.5% over the past year, surpassing the food industry average of 10.2%. Despite a volatile share price recently, its interest payments are well covered by EBIT at 7.4 times coverage. However, the company's debt to equity ratio has increased from 55.2% to 69.5% over five years, indicating rising leverage concerns despite positive free cash flow trends. Recent earnings showed net income climbing to MX$431 million in Q3 from MX$294 million a year earlier, reflecting improved profitability amidst sales of MX$9 billion compared to last year's similar figures.

SPG (KOSDAQ:A058610)

Simply Wall St Value Rating: ★★★★★☆

Overview: SPG Co., Ltd. is a South Korean company that manufactures and sells precision, industrial, and home-use motors, with a market capitalization of ₩670.87 billion.

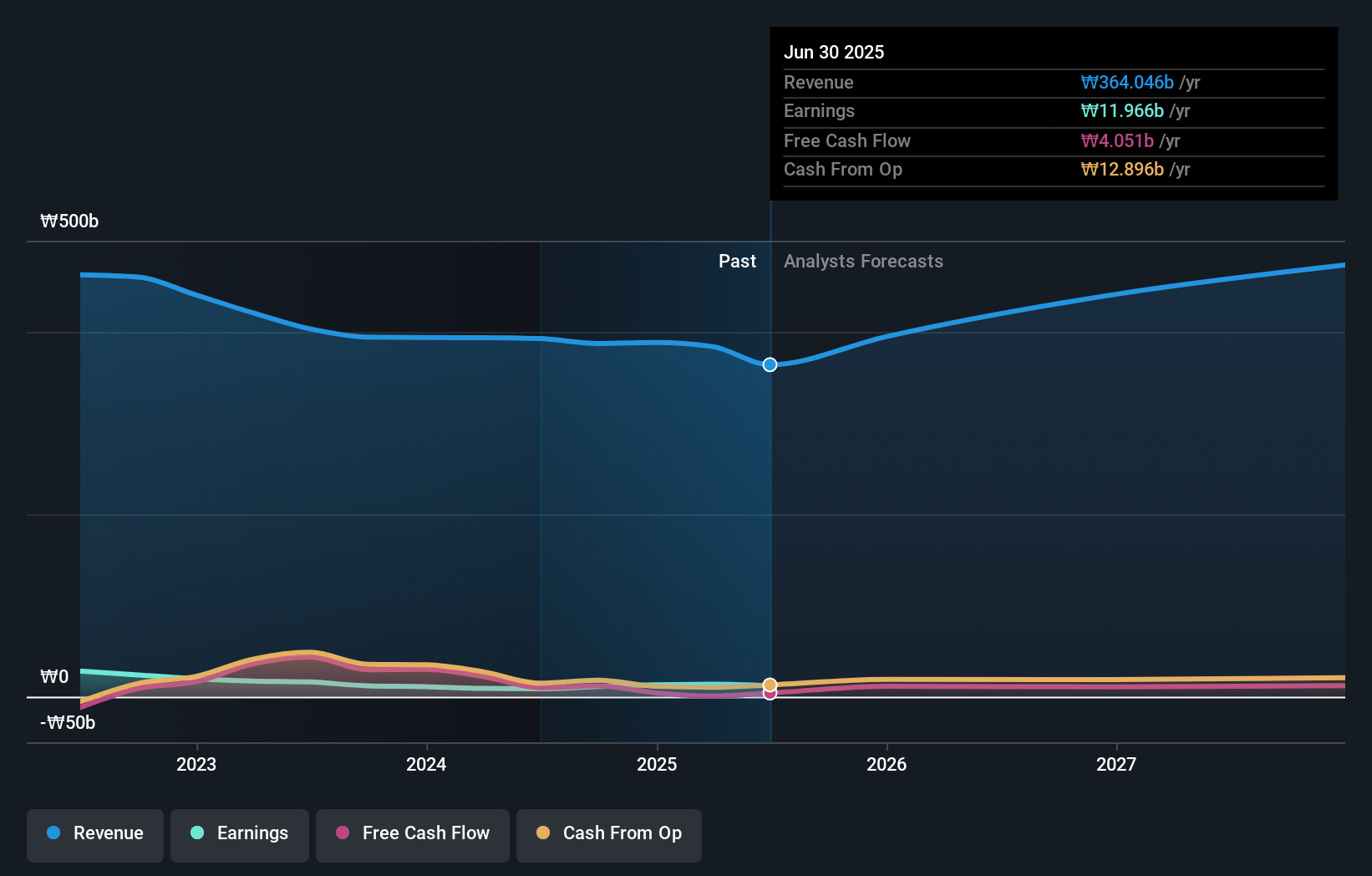

Operations: SPG Co., Ltd. generates revenue primarily from its electric equipment segment, amounting to ₩364.05 billion.

SPG Co., Ltd. is making waves with its robust financial footing, evidenced by a debt to equity ratio that has improved from 57.3% to 27.5% over five years, highlighting effective debt management. The company's interest payments are well cushioned by EBIT at a coverage of 6.1 times, ensuring financial stability despite recent share price volatility. With earnings growth of 39% last year surpassing the electrical industry's average of 3%, SPG's performance stands out in its sector. Moreover, the company declared a special cash dividend of KRW100 per share recently, reflecting confidence in its ongoing profitability and free cash flow positivity.

Beijing Highlander Digital Technology (SZSE:300065)

Simply Wall St Value Rating: ★★★★★★

Overview: Beijing Highlander Digital Technology Co., Ltd. operates in the technology sector, focusing on digital solutions and services, with a market cap of CN¥13 billion.

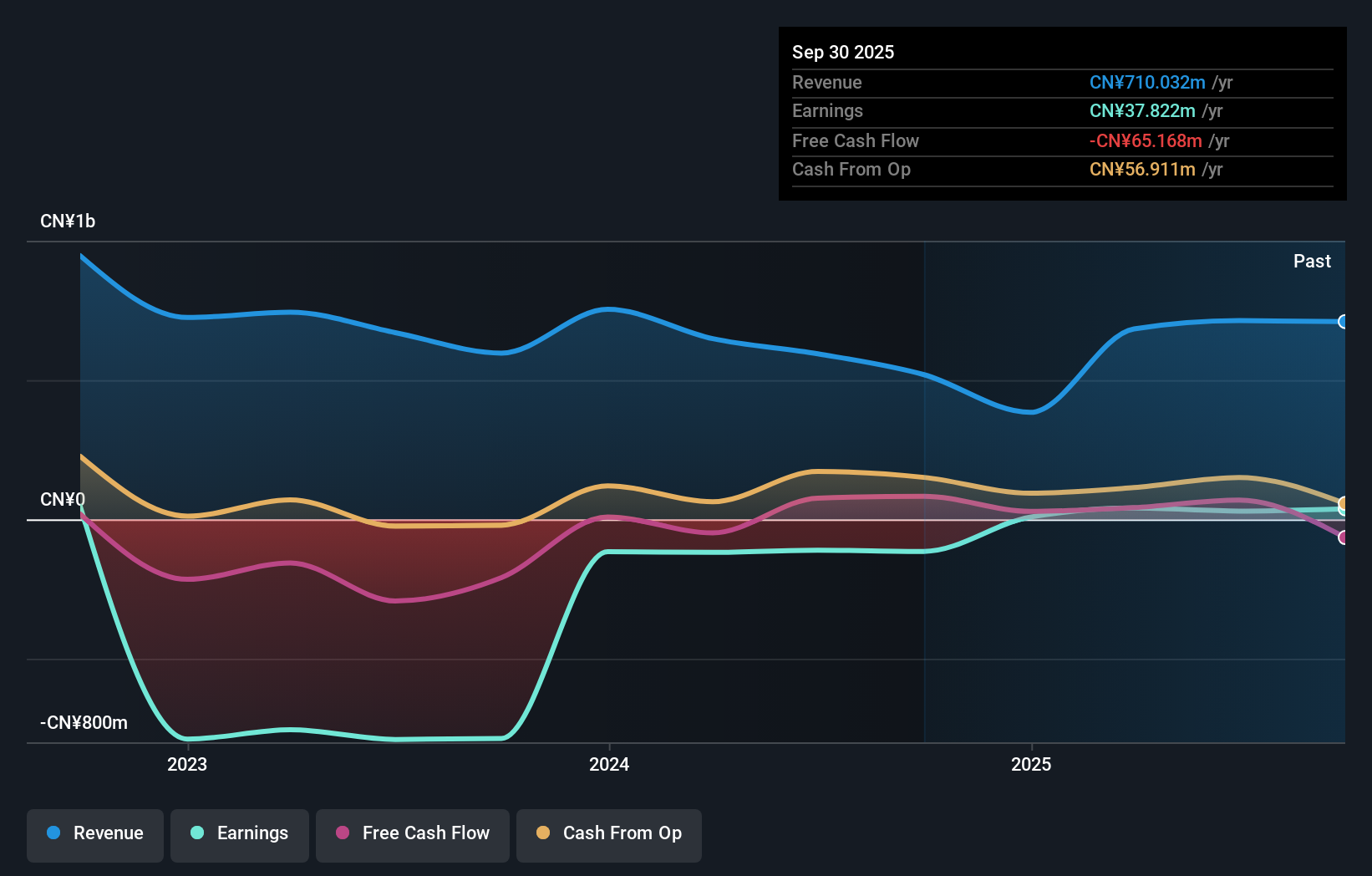

Operations: The company generates revenue primarily through digital solutions and services, with a market cap of CN¥13 billion. It has shown a notable trend in its net profit margin, which is currently at 5%.

Beijing Highlander Digital Technology, a smaller player in the tech landscape, has shown notable financial improvements. Over five years, its debt to equity ratio shrank from 14.3% to 2.2%, signaling better financial health. Recently becoming profitable, the company reported CNY 579.82 million in sales for nine months ending September 2025, up from CNY 253.72 million last year. Net income also rose to CNY 39.81 million compared to CNY 10.19 million previously, with earnings per share climbing from CNY 0.0141 to CNY 0.0553—an indication of its growing profitability and potential for future growth within the industry.

Taking Advantage

- Gain an insight into the universe of 3016 Global Undiscovered Gems With Strong Fundamentals by clicking here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSDAQ:A058610

SPG

Manufactures and sells precision motors, industrial motors, and motors for home use in South Korea.

Excellent balance sheet with proven track record.

Market Insights

Community Narratives