As global markets react to China's robust stimulus measures, U.S. stocks have reached record highs, buoyed by optimism in technology sectors and AI demand, despite some mixed economic indicators such as consumer confidence and housing data. In this context of heightened market activity and evolving economic conditions, identifying high growth tech stocks involves looking for companies that are well-positioned to capitalize on technological advancements and shifts in consumer behavior driven by these broader market trends.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Sarepta Therapeutics | 23.58% | 44.12% | ★★★★★★ |

| TG Therapeutics | 28.39% | 43.54% | ★★★★★★ |

| eWeLLLtd | 26.52% | 27.53% | ★★★★★★ |

| Seojin SystemLtd | 33.61% | 52.05% | ★★★★★★ |

| Medley | 24.98% | 30.36% | ★★★★★★ |

| Scandion Oncology | 40.71% | 75.34% | ★★★★★★ |

| KebNi | 34.75% | 86.11% | ★★★★★★ |

| Mental Health TechnologiesLtd | 27.88% | 79.61% | ★★★★★★ |

| Adveritas | 57.98% | 144.21% | ★★★★★★ |

| Travere Therapeutics | 26.51% | 69.33% | ★★★★★★ |

Click here to see the full list of 1279 stocks from our High Growth Tech and AI Stocks screener.

Let's dive into some prime choices out of from the screener.

Grifols (BME:GRF)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Grifols, S.A. is a plasma therapeutic company with operations in Spain, the United States, Canada, and internationally, and has a market cap of approximately €6.31 billion.

Operations: Grifols generates its revenue primarily from the Biopharma segment, which accounts for approximately €5.78 billion, followed by the Diagnostic segment with €651.33 million and Bio Supplies at €186.91 million.

Grifols, a key player in the biotech sector, is navigating a transformative phase with strategic executive shifts and robust R&D investment. With an impressive 28.3% projected annual earnings growth, the company significantly outpaces the broader Spanish market's 9.9%. This growth trajectory is bolstered by a 6% revenue increase forecast, also above Spain's average. Recent leadership changes aim to enhance corporate governance and focus on operational efficiencies, aligning with Grifols' commitment to innovation in biotechnology solutions and financial health improvement strategies.

- Dive into the specifics of Grifols here with our thorough health report.

Examine Grifols' past performance report to understand how it has performed in the past.

argenx (ENXTBR:ARGX)

Simply Wall St Growth Rating: ★★★★★★

Overview: argenx SE is a biotechnology company focused on developing therapies for autoimmune diseases across the United States, Japan, Europe, the Middle East, Africa, and China with a market cap of €29.70 billion.

Operations: argenx SE generates revenue primarily from its biotechnology segment, amounting to $1.66 billion. The company is focused on developing therapies for autoimmune diseases across multiple regions, including the United States and Asia.

argenx, amid a competitive landscape, stands out with its robust R&D commitment and promising clinical outcomes. The company's revenue is projected to surge by 26.4% annually, significantly outpacing the Belgian market's growth of 7.5%. This financial trajectory is underpinned by a striking expected annual profit growth of 58.44%, signaling potential profitability within three years. Recent breakthroughs include the FDA approval of VYVGART Hytrulo for CIDP treatment, reflecting argenx's focus on innovative autoimmune therapies that meet critical healthcare needs.

- Click here and access our complete health analysis report to understand the dynamics of argenx.

Assess argenx's past performance with our detailed historical performance reports.

Hebei Sinopack Electronic TechnologyLtd (SZSE:003031)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Hebei Sinopack Electronic Technology Co., Ltd. is engaged in the production of electronic ceramic materials, components, and third-generation semiconductor devices and modules, with a market capitalization of approximately CN¥20.99 billion.

Operations: Sinopack's revenue is primarily derived from electronic ceramic materials and components, contributing CN¥1.74 billion, and third-generation semiconductor devices and modules, generating CN¥1.43 billion.

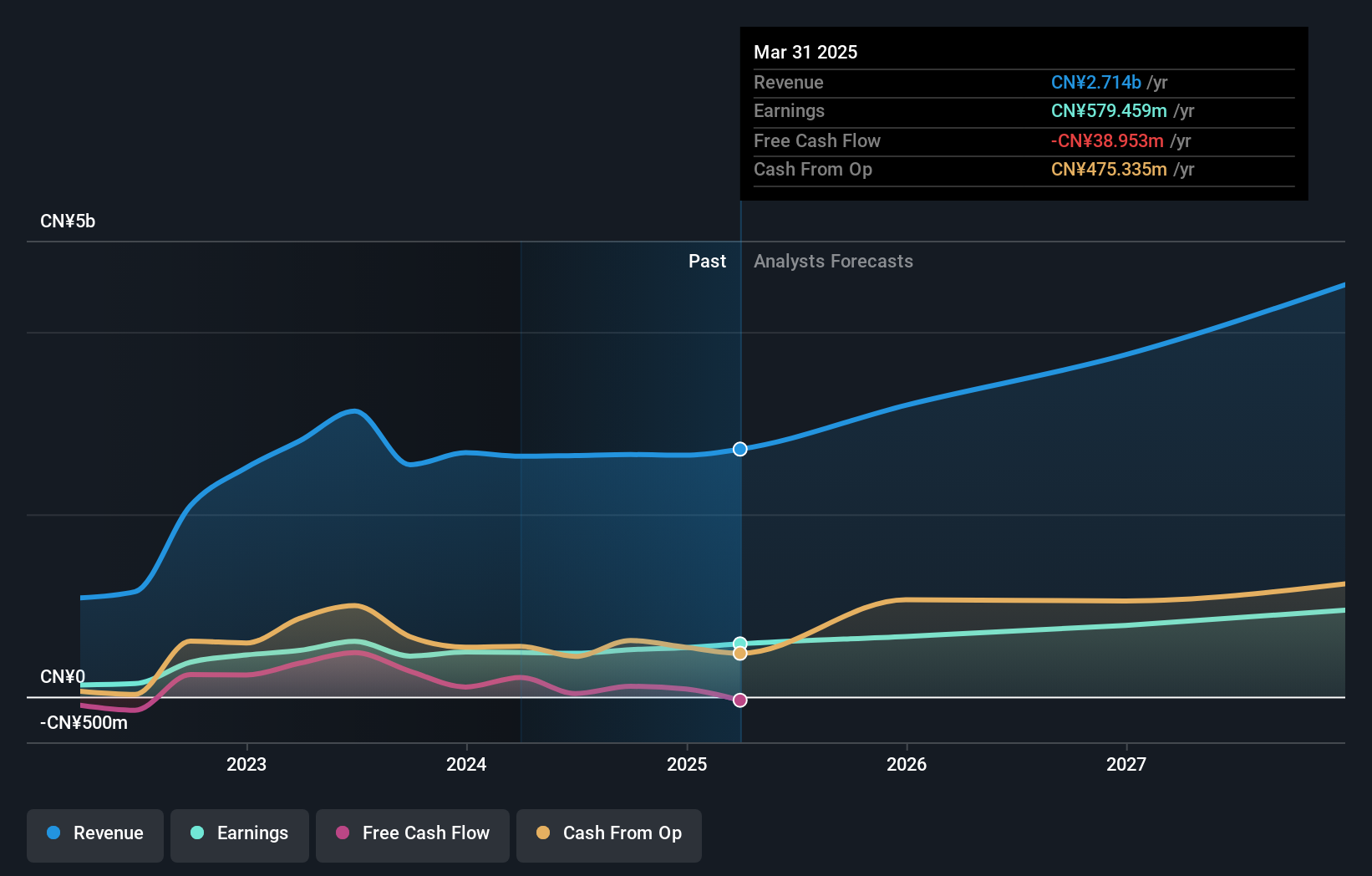

Hebei Sinopack Electronic TechnologyLtd. is navigating a challenging landscape with its robust R&D investment, which has surged to 31.8% of its revenue, aligning with an aggressive growth trajectory in tech innovation. Despite a slight dip in year-over-year earnings, the company's revenue growth remains strong at 30.2%, outpacing the broader Chinese market's expansion rate. Recently, shareholders convened to amend corporate statutes, potentially paving the way for strategic pivots that could enhance operational efficiencies and market responsiveness. This backdrop of solid revenue gains and substantial reinvestment in development projects positions Hebei Sinopack to capitalize on evolving tech demands while fortifying its competitive edge in high-tech sectors.

Summing It All Up

- Get an in-depth perspective on all 1279 High Growth Tech and AI Stocks by using our screener here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTBR:ARGX

argenx

A biotechnology company, engages in the developing of various therapies for the treatment of autoimmune diseases in the United States, Japan, Europe, Middle East, Africa, and China.

High growth potential with excellent balance sheet.