- China

- /

- Electronic Equipment and Components

- /

- SZSE:002990

Maxvision Technology Corp.'s (SZSE:002990) 29% Jump Shows Its Popularity With Investors

Maxvision Technology Corp. (SZSE:002990) shareholders are no doubt pleased to see that the share price has bounced 29% in the last month, although it is still struggling to make up recently lost ground. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 24% in the last twelve months.

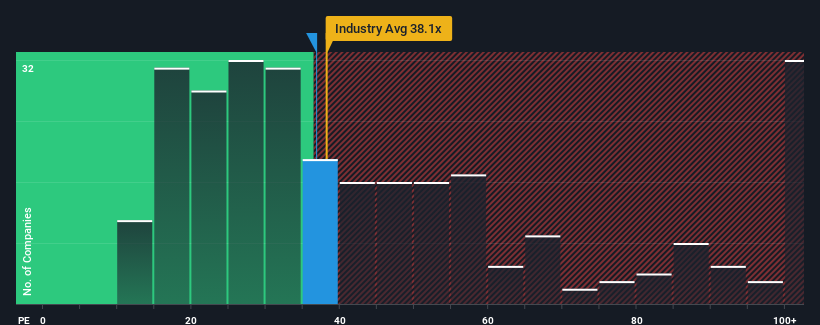

After such a large jump in price, given around half the companies in China have price-to-earnings ratios (or "P/E's") below 30x, you may consider Maxvision Technology as a stock to potentially avoid with its 36.8x P/E ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/E.

With its earnings growth in positive territory compared to the declining earnings of most other companies, Maxvision Technology has been doing quite well of late. It seems that many are expecting the company to continue defying the broader market adversity, which has increased investors’ willingness to pay up for the stock. If not, then existing shareholders might be a little nervous about the viability of the share price.

Check out our latest analysis for Maxvision Technology

What Are Growth Metrics Telling Us About The High P/E?

In order to justify its P/E ratio, Maxvision Technology would need to produce impressive growth in excess of the market.

If we review the last year of earnings growth, the company posted a terrific increase of 84%. Still, incredibly EPS has fallen 35% in total from three years ago, which is quite disappointing. Therefore, it's fair to say the earnings growth recently has been undesirable for the company.

Shifting to the future, estimates from the one analyst covering the company suggest earnings should grow by 111% over the next year. Meanwhile, the rest of the market is forecast to only expand by 41%, which is noticeably less attractive.

With this information, we can see why Maxvision Technology is trading at such a high P/E compared to the market. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Final Word

Maxvision Technology shares have received a push in the right direction, but its P/E is elevated too. We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

As we suspected, our examination of Maxvision Technology's analyst forecasts revealed that its superior earnings outlook is contributing to its high P/E. At this stage investors feel the potential for a deterioration in earnings isn't great enough to justify a lower P/E ratio. It's hard to see the share price falling strongly in the near future under these circumstances.

Many other vital risk factors can be found on the company's balance sheet. Take a look at our free balance sheet analysis for Maxvision Technology with six simple checks on some of these key factors.

You might be able to find a better investment than Maxvision Technology. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:002990

Maxvision Technology

Researches, develops, produces, and sells intelligent products and system solutions in China, the Middle East, Africa, Southeast Asia, and internationally.

Flawless balance sheet and fair value.

Market Insights

Community Narratives