- China

- /

- Entertainment

- /

- SZSE:300027

High Growth Tech Stocks to Watch in February 2025

Reviewed by Simply Wall St

As global markets navigate a complex landscape marked by fluctuating interest rates, AI competition fears, and mixed corporate earnings reports, investors are closely monitoring the tech sector's response to these challenges. In this environment, identifying high-growth tech stocks involves looking for companies that demonstrate resilience through innovation and adaptability to shifting market dynamics.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Shanghai Baosight SoftwareLtd | 21.82% | 25.22% | ★★★★★★ |

| Seojin SystemLtd | 35.41% | 39.86% | ★★★★★★ |

| eWeLLLtd | 26.41% | 28.82% | ★★★★★★ |

| Yggdrazil Group | 30.20% | 87.10% | ★★★★★★ |

| Medley | 20.95% | 27.32% | ★★★★★★ |

| Mental Health TechnologiesLtd | 25.83% | 113.12% | ★★★★★★ |

| Fine M-TecLTD | 36.52% | 135.02% | ★★★★★★ |

| JNTC | 29.48% | 104.37% | ★★★★★★ |

| Dmall | 29.53% | 88.37% | ★★★★★★ |

| Delton Technology (Guangzhou) | 20.25% | 29.52% | ★★★★★★ |

Click here to see the full list of 1230 stocks from our High Growth Tech and AI Stocks screener.

Let's uncover some gems from our specialized screener.

Hitevision (SZSE:002955)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Hitevision Co., Ltd. focuses on the research, design, development, production, and sale of interactive display products in China with a market capitalization of CN¥5.53 billion.

Operations: Hitevision Co., Ltd. specializes in interactive display products, leveraging its expertise in research, design, and production to drive sales within China. The company operates with a market capitalization of approximately CN¥5.53 billion, reflecting its significant presence in the technology sector.

Hitevision has demonstrated a robust growth trajectory with an annualized revenue increase of 15.8% and earnings growth of 25.1%, outpacing the broader CN market's average earnings growth rate by a slight margin. Despite challenges in the Electronic industry where it saw a -14.3% dip in earnings last year, its commitment to innovation is evident from its R&D investments, maintaining competitiveness within its sector. The company also actively engages in share repurchase programs, having recently completed a buyback of 2,398,850 shares for CNY 51.07 million, underscoring confidence in its financial health and future prospects.

- Take a closer look at Hitevision's potential here in our health report.

Explore historical data to track Hitevision's performance over time in our Past section.

Huayi Brothers Media (SZSE:300027)

Simply Wall St Growth Rating: ★★★★★★

Overview: Huayi Brothers Media Corporation is an entertainment media company with operations in China and internationally, and it has a market cap of CN¥6.88 billion.

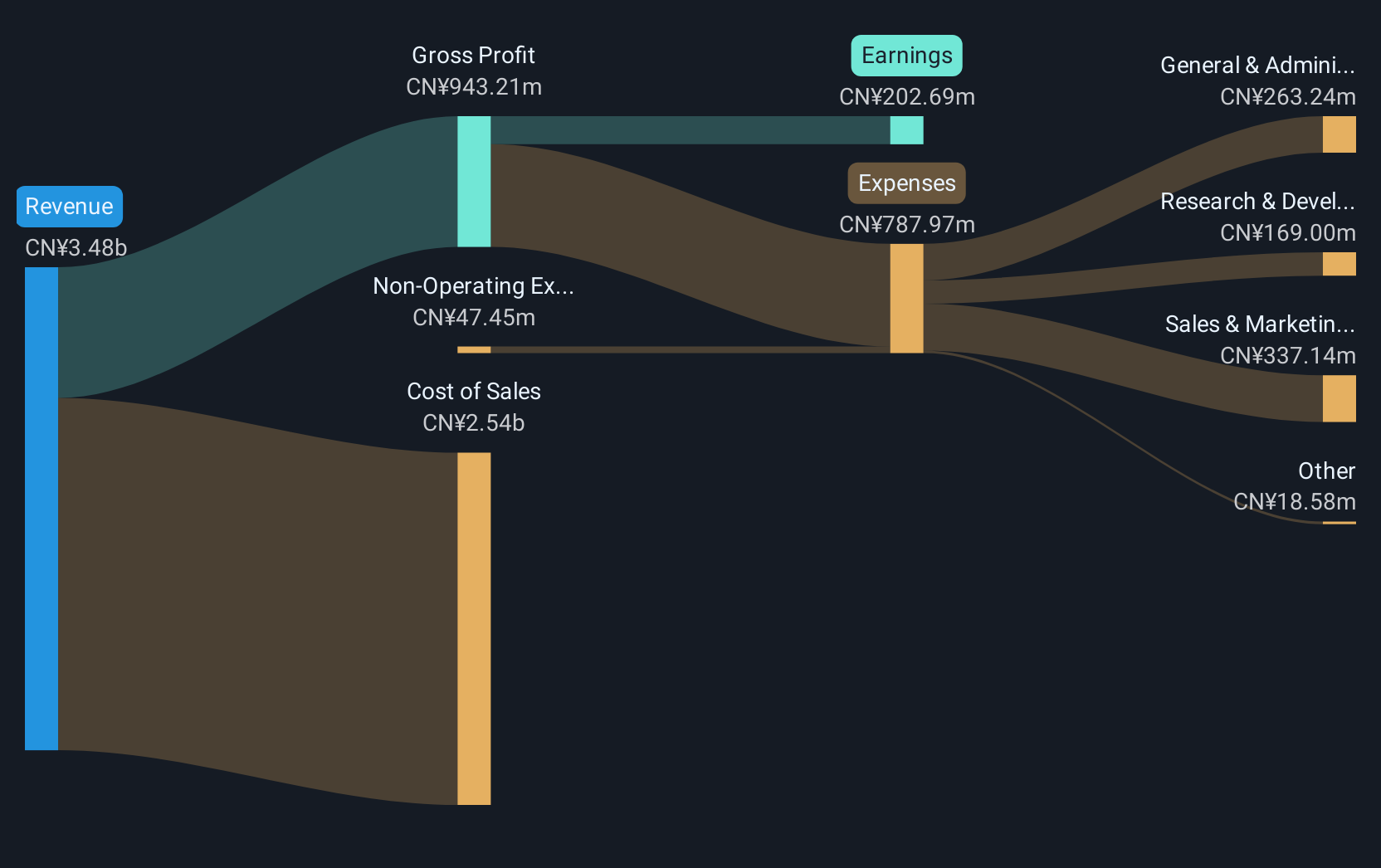

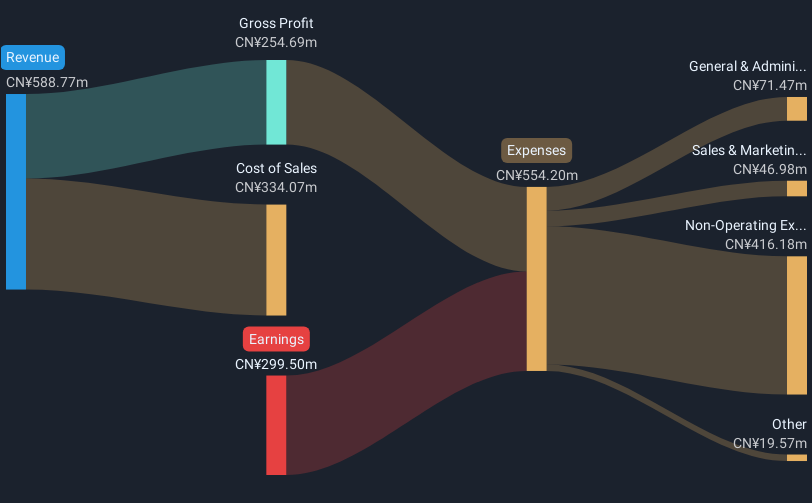

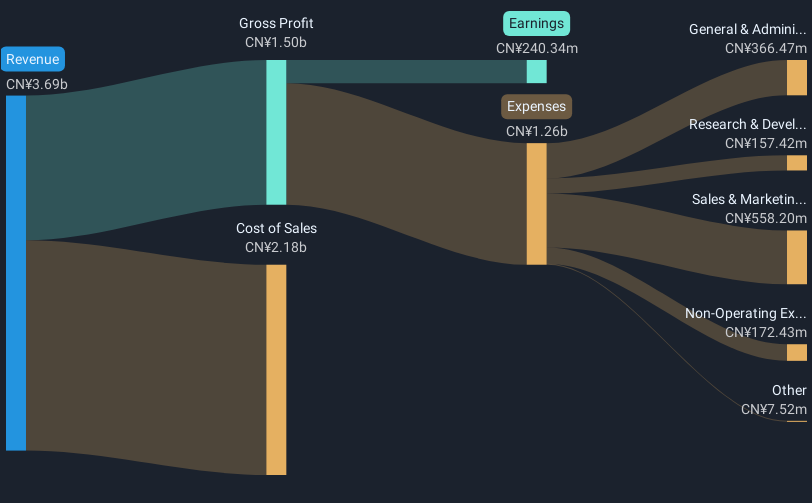

Operations: Huayi Brothers Media Corporation generates revenue primarily through film and television production, talent management, and cinema operations. The company focuses on creating and distributing entertainment content across various platforms in China and international markets.

Huayi Brothers Media is navigating a transformative phase with an impressive annualized revenue growth of 41.2% and projected earnings surge of 110.5%. This growth trajectory is supported by strategic shareholder meetings aimed at enhancing corporate governance and financial strategies, including the recent approval of a stock option incentive plan to motivate performance. Despite current unprofitability, the firm's aggressive R&D investment positions it well for future competitiveness in the entertainment sector, aligning with industry shifts towards digital and streaming services.

- Navigate through the intricacies of Huayi Brothers Media with our comprehensive health report here.

Evaluate Huayi Brothers Media's historical performance by accessing our past performance report.

Wuxi Boton Technology (SZSE:300031)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Wuxi Boton Technology Co., Ltd. operates in the industrial bulk material handling and mobile Internet sectors both in China and internationally, with a market cap of CN¥7.65 billion.

Operations: Wuxi Boton Technology focuses on industrial bulk material handling and mobile Internet services. The company generates revenue primarily from these two segments, with a notable emphasis on technological solutions for both domestic and international markets.

Wuxi Boton Technology demonstrates robust potential in the tech sector, with an annualized revenue growth of 16.7% and earnings growth projected at 25.1% per year, outpacing the Chinese market average of 13.3% and 25%, respectively. This growth is underpinned by significant R&D investments, which have recently amounted to a substantial portion of their revenue, reflecting a strong commitment to innovation and development in high-tech solutions. Despite challenges in scaling at the pace of global leaders, Wuxi Boton's strategic focus on enhancing its technological capabilities could position it favorably for future industry demands, especially as tech firms increasingly adopt advanced AI and software solutions to drive efficiency and innovation.

Taking Advantage

- Get an in-depth perspective on all 1230 High Growth Tech and AI Stocks by using our screener here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Huayi Brothers Media might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300027

Huayi Brothers Media

Operates as an entertainment media company in China and internationally.

Exceptional growth potential with imperfect balance sheet.

Similar Companies

Market Insights

Community Narratives