- China

- /

- Electronic Equipment and Components

- /

- SZSE:002937

Ningbo Sunrise Elc Technology Co.,Ltd (SZSE:002937) Held Back By Insufficient Growth Even After Shares Climb 30%

The Ningbo Sunrise Elc Technology Co.,Ltd (SZSE:002937) share price has done very well over the last month, posting an excellent gain of 30%. Longer-term shareholders would be thankful for the recovery in the share price since it's now virtually flat for the year after the recent bounce.

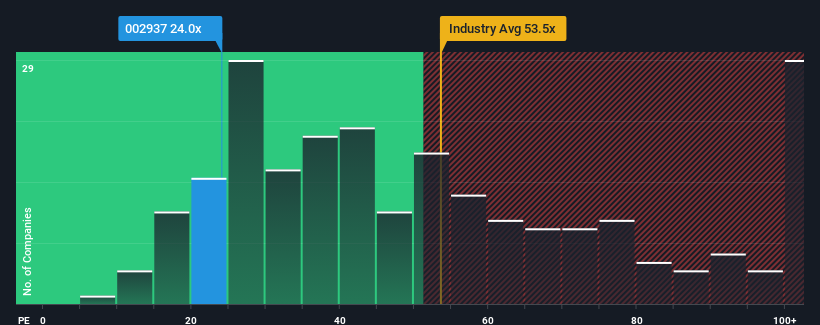

Even after such a large jump in price, given about half the companies in China have price-to-earnings ratios (or "P/E's") above 39x, you may still consider Ningbo Sunrise Elc TechnologyLtd as an attractive investment with its 24x P/E ratio. However, the P/E might be low for a reason and it requires further investigation to determine if it's justified.

Ningbo Sunrise Elc TechnologyLtd's negative earnings growth of late has neither been better nor worse than most other companies. It might be that many expect the company's earnings performance to degrade further, which has repressed the P/E. You'd much rather the company wasn't bleeding earnings if you still believe in the business. In saying that, existing shareholders may feel hopeful about the share price if the company's earnings continue tracking the market.

View our latest analysis for Ningbo Sunrise Elc TechnologyLtd

How Is Ningbo Sunrise Elc TechnologyLtd's Growth Trending?

There's an inherent assumption that a company should underperform the market for P/E ratios like Ningbo Sunrise Elc TechnologyLtd's to be considered reasonable.

If we review the last year of earnings, the company posted a result that saw barely any deviation from a year ago. Although pleasingly EPS has lifted 121% in aggregate from three years ago, notwithstanding the last 12 months. So we can start by confirming that the company has done a great job of growing earnings over that time.

Looking ahead now, EPS is anticipated to climb by 26% during the coming year according to the one analyst following the company. That's shaping up to be materially lower than the 37% growth forecast for the broader market.

In light of this, it's understandable that Ningbo Sunrise Elc TechnologyLtd's P/E sits below the majority of other companies. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

The Final Word

Ningbo Sunrise Elc TechnologyLtd's stock might have been given a solid boost, but its P/E certainly hasn't reached any great heights. We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

As we suspected, our examination of Ningbo Sunrise Elc TechnologyLtd's analyst forecasts revealed that its inferior earnings outlook is contributing to its low P/E. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. It's hard to see the share price rising strongly in the near future under these circumstances.

You should always think about risks. Case in point, we've spotted 1 warning sign for Ningbo Sunrise Elc TechnologyLtd you should be aware of.

Of course, you might also be able to find a better stock than Ningbo Sunrise Elc TechnologyLtd. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if Ningbo Sunrise Elc TechnologyLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:002937

Ningbo Sunrise Elc TechnologyLtd

Engages in the manufactures and sale of precision components.

Excellent balance sheet and slightly overvalued.

Market Insights

Community Narratives