- China

- /

- Tech Hardware

- /

- SZSE:002912

Shenzhen Sinovatio Technology Co., Ltd. (SZSE:002912) Stocks Shoot Up 37% But Its P/S Still Looks Reasonable

Despite an already strong run, Shenzhen Sinovatio Technology Co., Ltd. (SZSE:002912) shares have been powering on, with a gain of 37% in the last thirty days. But the gains over the last month weren't enough to make shareholders whole, as the share price is still down 9.7% in the last twelve months.

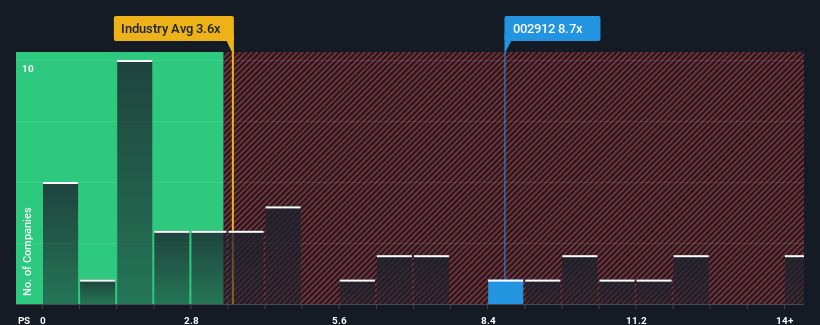

After such a large jump in price, when almost half of the companies in China's Tech industry have price-to-sales ratios (or "P/S") below 3.6x, you may consider Shenzhen Sinovatio Technology as a stock not worth researching with its 8.7x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

Check out our latest analysis for Shenzhen Sinovatio Technology

How Shenzhen Sinovatio Technology Has Been Performing

Shenzhen Sinovatio Technology could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. It might be that many expect the dour revenue performance to recover substantially, which has kept the P/S from collapsing. However, if this isn't the case, investors might get caught out paying too much for the stock.

Want the full picture on analyst estimates for the company? Then our free report on Shenzhen Sinovatio Technology will help you uncover what's on the horizon.Do Revenue Forecasts Match The High P/S Ratio?

There's an inherent assumption that a company should far outperform the industry for P/S ratios like Shenzhen Sinovatio Technology's to be considered reasonable.

Retrospectively, the last year delivered a frustrating 12% decrease to the company's top line. As a result, revenue from three years ago have also fallen 35% overall. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Looking ahead now, revenue is anticipated to climb by 37% during the coming year according to the lone analyst following the company. Meanwhile, the rest of the industry is forecast to only expand by 18%, which is noticeably less attractive.

With this in mind, it's not hard to understand why Shenzhen Sinovatio Technology's P/S is high relative to its industry peers. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Final Word

The strong share price surge has lead to Shenzhen Sinovatio Technology's P/S soaring as well. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

We've established that Shenzhen Sinovatio Technology maintains its high P/S on the strength of its forecasted revenue growth being higher than the the rest of the Tech industry, as expected. At this stage investors feel the potential for a deterioration in revenues is quite remote, justifying the elevated P/S ratio. It's hard to see the share price falling strongly in the near future under these circumstances.

You always need to take note of risks, for example - Shenzhen Sinovatio Technology has 2 warning signs we think you should be aware of.

If these risks are making you reconsider your opinion on Shenzhen Sinovatio Technology, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:002912

Shenzhen Sinovatio Technology

Engages in the research and development, production, and sales of network visualization infrastructure, network content security, data operation, and industrial Internet security products.

Flawless balance sheet with reasonable growth potential.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success