- China

- /

- Electronic Equipment and Components

- /

- SHSE:688112

Exploring 3 High Growth Tech Stocks in Asia

Reviewed by Simply Wall St

The Asian tech market is navigating a landscape marked by investor caution around AI valuations and broader economic concerns, mirroring trends seen in global markets. In this environment, identifying high-growth tech stocks requires a focus on companies with robust fundamentals and innovative capabilities that can thrive despite the prevailing uncertainties.

Top 10 High Growth Tech Companies In Asia

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Giant Network Group | 33.47% | 39.54% | ★★★★★★ |

| Suzhou TFC Optical Communication | 34.61% | 35.52% | ★★★★★★ |

| Zhongji Innolight | 34.27% | 34.88% | ★★★★★★ |

| Shengyi TechnologyLtd | 21.50% | 32.87% | ★★★★★★ |

| Fositek | 37.43% | 49.42% | ★★★★★★ |

| Shengyi Electronics | 24.67% | 33.32% | ★★★★★★ |

| Gold Circuit Electronics | 25.79% | 31.13% | ★★★★★★ |

| eWeLLLtd | 25.07% | 25.13% | ★★★★★★ |

| Co-Tech Development | 35.68% | 75.80% | ★★★★★★ |

| CARsgen Therapeutics Holdings | 100.40% | 118.16% | ★★★★★★ |

We're going to check out a few of the best picks from our screener tool.

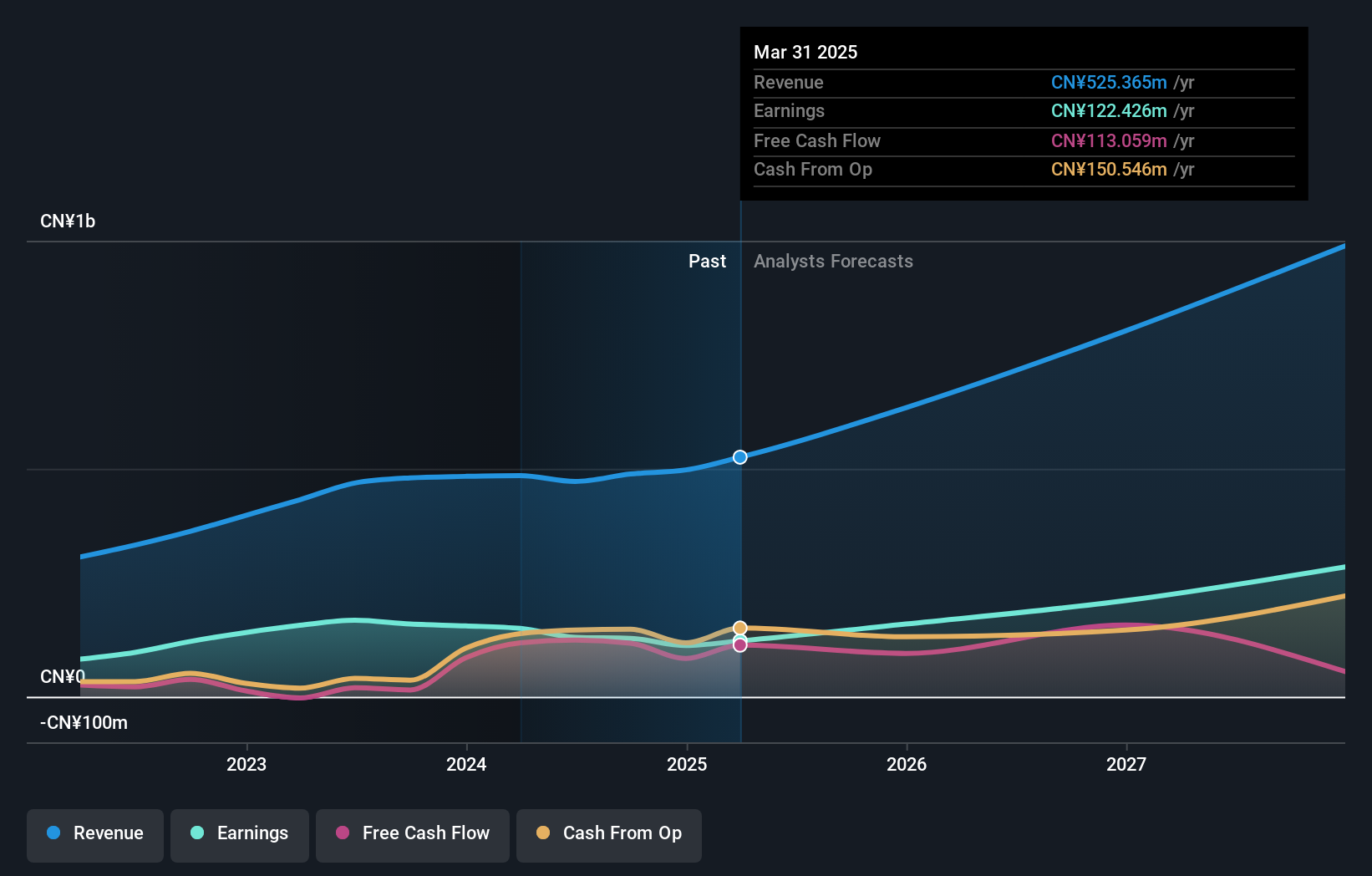

Siglent TechnologiesLtd (SHSE:688112)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Siglent Technologies CO.,Ltd. is engaged in the research, development, production, sale, and servicing of electronic test and measurement equipment both in China and internationally, with a market cap of CN¥5.70 billion.

Operations: Siglent Technologies generates revenue primarily through the sale of electronic test and measurement equipment. The company's operations span both domestic and international markets, contributing to its financial performance.

Siglent Technologies, amidst a robust tech landscape in Asia, showcases promising growth with its revenue and earnings trajectory outpacing the broader Chinese market. The company's recent financials reveal a 23.1% annual increase in revenue to CNY 431.48 million and a notable rise in net income to CNY 111.35 million, reflecting an earnings growth of 30.9% per year—significantly higher than the industry average of 27.6%. This performance is underpinned by strategic R&D investments that align with market demands, ensuring Siglent remains at the forefront of technological advancements while fostering sustainable growth.

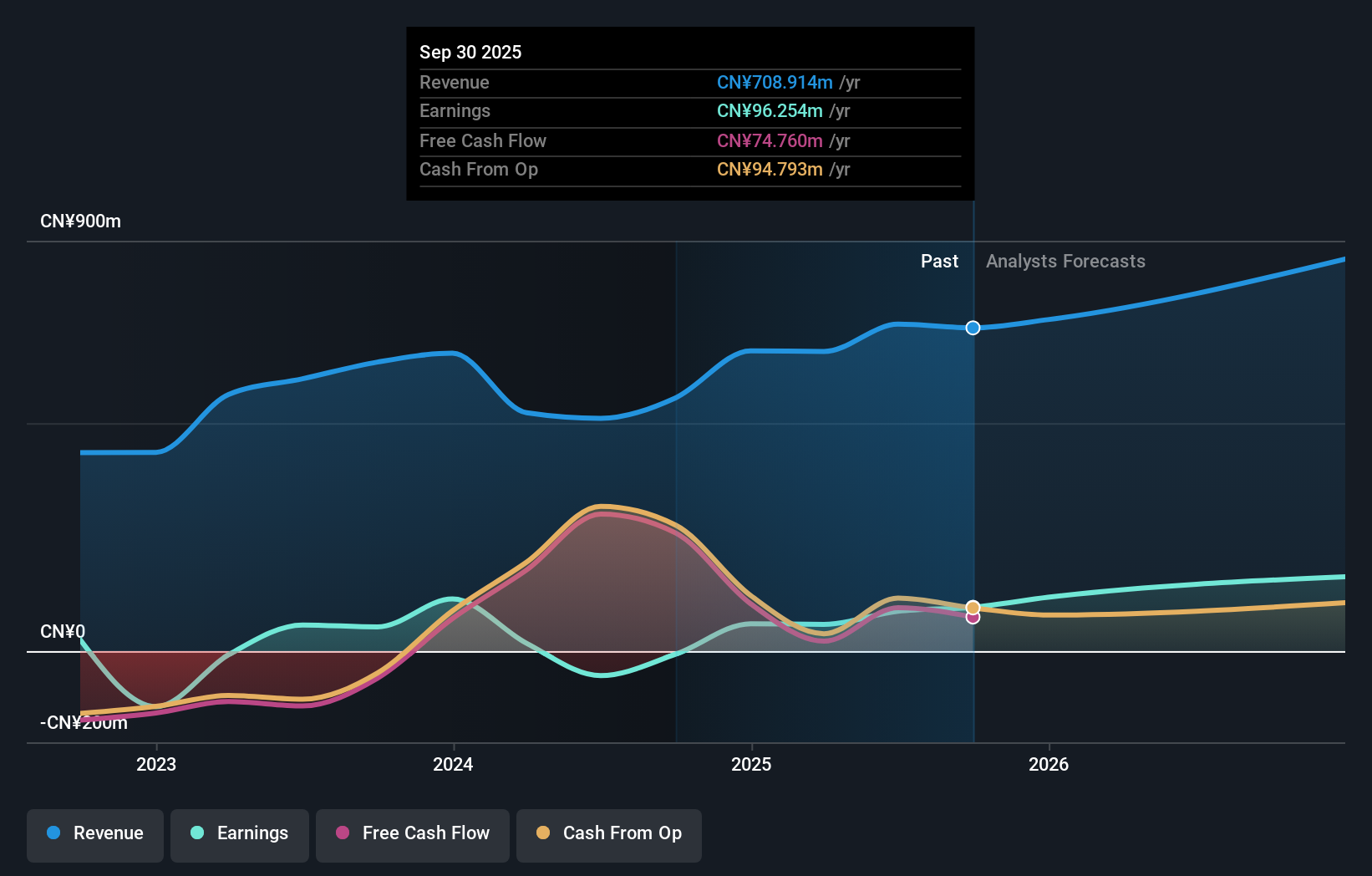

Shenzhen Sinovatio Technology (SZSE:002912)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Shenzhen Sinovatio Technology Co., Ltd. focuses on the R&D, production, and sales of network visualization infrastructure, network content security, data operation, and industrial Internet security products with a market cap of CN¥5.14 billion.

Operations: Sinovatio Technology specializes in developing and selling products related to network visualization, content security, data operations, and industrial Internet security. The company operates within a market valued at CN¥5.14 billion.

Shenzhen Sinovatio Technology, amid Asia's dynamic tech sector, has turned a corner by becoming profitable this year, showcasing a remarkable turnaround with its net loss significantly reduced from CNY 46.96 million to CNY 10.63 million as reported in the recent nine-month earnings. This improvement accompanies an impressive annual revenue growth of 16.2% and an even more striking projected annual earnings growth of 40.5%. These figures underscore the company's robust recovery trajectory and strategic focus on innovation, as evidenced by recent amendments to its corporate governance aimed at enhancing operational flexibility and responsiveness to market changes.

- Navigate through the intricacies of Shenzhen Sinovatio Technology with our comprehensive health report here.

Gain insights into Shenzhen Sinovatio Technology's past trends and performance with our Past report.

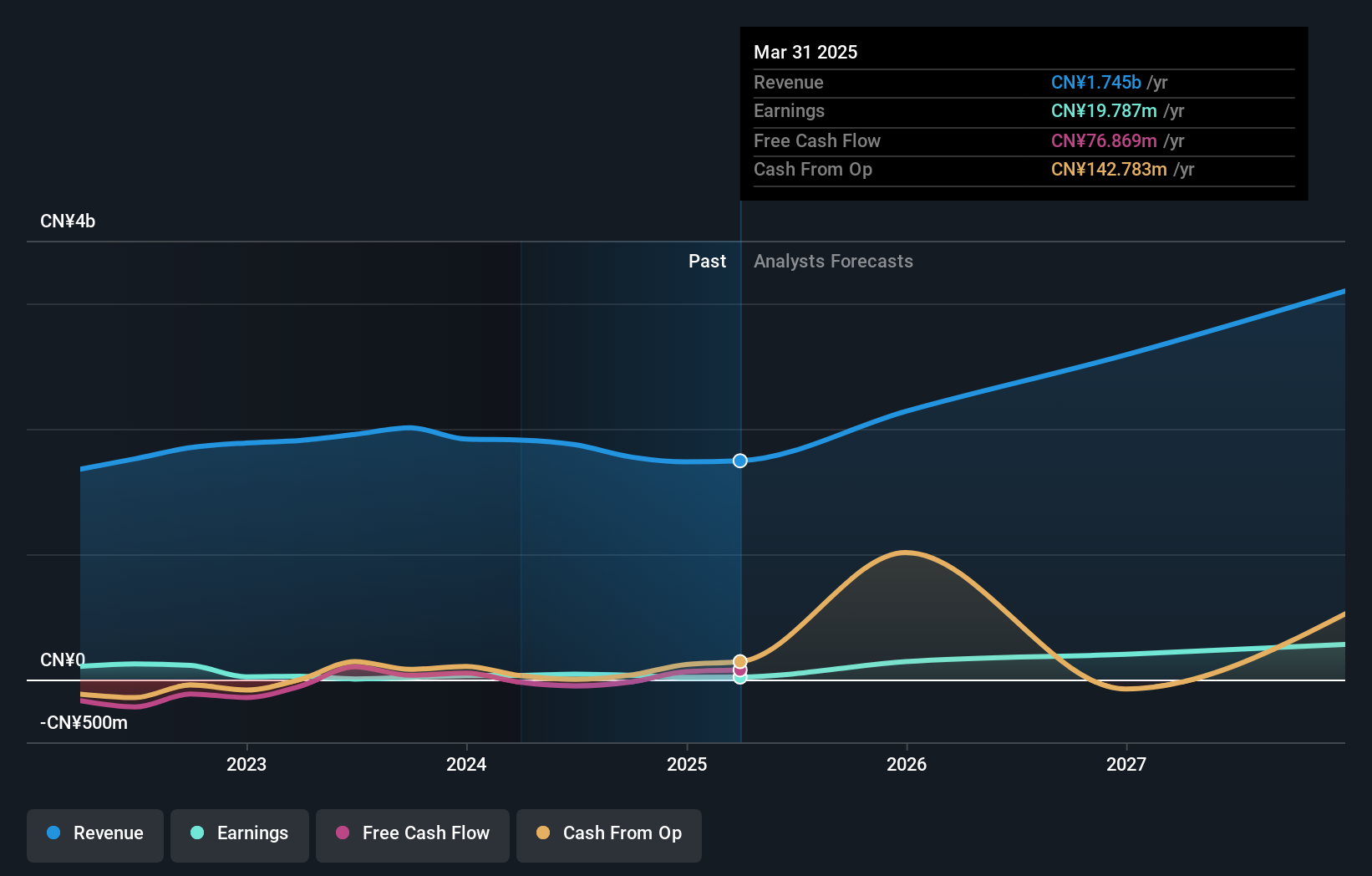

Shenzhen Sunline Tech (SZSE:300348)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Shenzhen Sunline Tech Co., Ltd. offers IT solutions and services to commercial banks and financial institutions both in China and internationally, with a market cap of CN¥11.39 billion.

Operations: Shenzhen Sunline Tech Co., Ltd. specializes in delivering IT solutions and services tailored for commercial banks and financial institutions across China and internationally. The company's revenue is primarily driven by its comprehensive suite of technology offerings designed to enhance banking operations, with a market cap of CN¥11.39 billion.

Shenzhen Sunline Tech, navigating through a challenging fiscal period, reported a shift from net income to a net loss of CNY 11.39 million in the recent nine months of 2025, contrasting sharply with the previous year's profit. Despite this setback, the company recorded a revenue increase to CNY 1,089.14 million from CNY 1,035.42 million year-over-year, marking a growth rate of 5.2%. This performance is underpinned by significant R&D investments aimed at driving future growth in the highly competitive tech sector of Asia; however, these efforts have yet to translate into bottom-line success as evidenced by their current financial standing and market positioning relative to industry peers.

- Click here to discover the nuances of Shenzhen Sunline Tech with our detailed analytical health report.

Explore historical data to track Shenzhen Sunline Tech's performance over time in our Past section.

Taking Advantage

- Unlock more gems! Our Asian High Growth Tech and AI Stocks screener has unearthed 191 more companies for you to explore.Click here to unveil our expertly curated list of 194 Asian High Growth Tech and AI Stocks.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688112

Siglent TechnologiesLtd

Researches, develops, produces, sells, and services electronic test and measurement equipment in China and internationally.

Flawless balance sheet with high growth potential.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success