3 Growth Companies To Watch With At Least 19% Insider Ownership

Reviewed by Simply Wall St

In a week marked by volatility and competitive pressures in the AI sector, global markets have experienced mixed performances, with U.S. stocks mostly lower despite some positive earnings surprises. As investors navigate these turbulent conditions, identifying growth companies with significant insider ownership can offer insights into potential market resilience and management confidence.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Duc Giang Chemicals Group (HOSE:DGC) | 31.4% | 25.7% |

| Seojin SystemLtd (KOSDAQ:A178320) | 32.1% | 39.9% |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 41.2% |

| SKS Technologies Group (ASX:SKS) | 29.7% | 24.8% |

| Laopu Gold (SEHK:6181) | 36.4% | 36.4% |

| Pricol (NSEI:PRICOLLTD) | 25.4% | 25.2% |

| Medley (TSE:4480) | 34.1% | 27.3% |

| Fine M-TecLTD (KOSDAQ:A441270) | 17.2% | 135% |

| HANA Micron (KOSDAQ:A067310) | 18.3% | 119.4% |

| Fulin Precision (SZSE:300432) | 13.6% | 71% |

Below we spotlight a couple of our favorites from our exclusive screener.

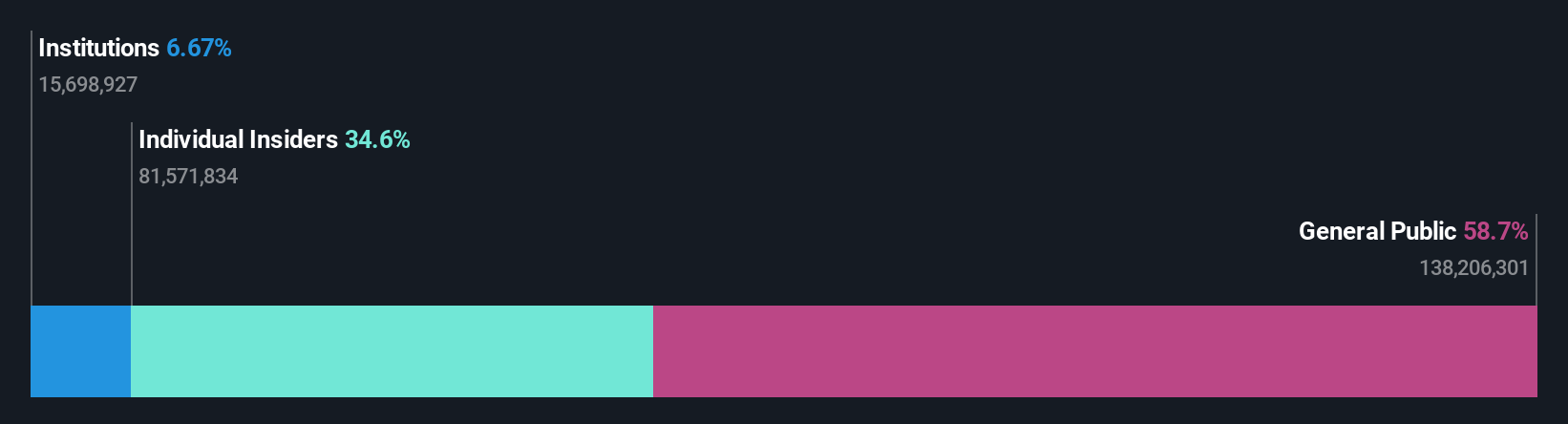

Sensirion Holding (SWX:SENS)

Simply Wall St Growth Rating: ★★★★☆☆

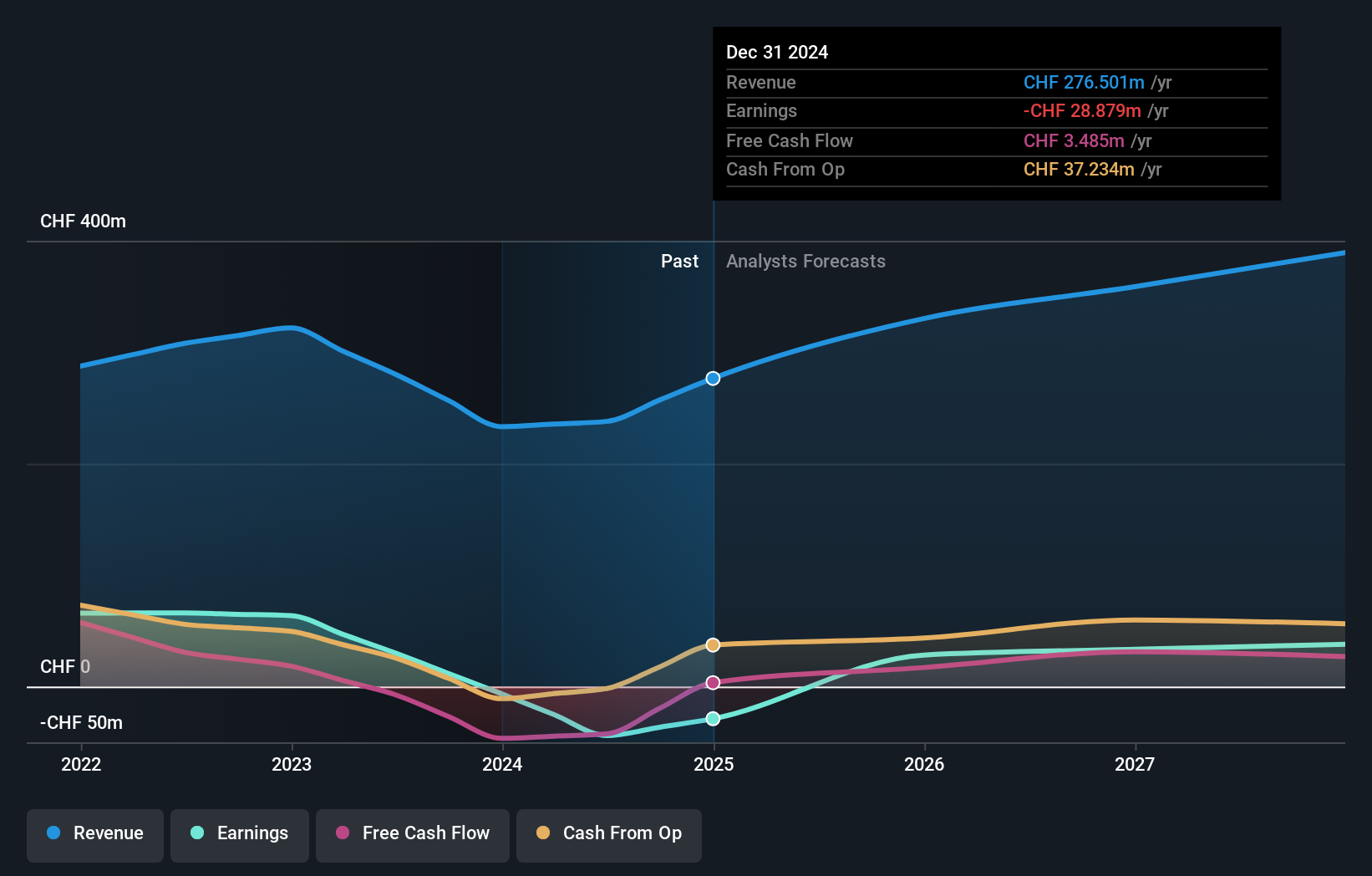

Overview: Sensirion Holding AG, along with its subsidiaries, develops, produces, sells, and services sensor systems, modules, and components globally with a market cap of CHF1.03 billion.

Operations: The company's revenue segment primarily comprises sensor systems, modules, and components, generating CHF237.91 million.

Insider Ownership: 19.9%

Sensirion Holding is forecasted to become profitable within three years, with earnings expected to grow 102.58% annually, surpassing average market growth. The company trades at 74.5% below its estimated fair value and analysts predict a 26.6% rise in stock price, despite recent share price volatility. While revenue growth is projected at 13% per year, faster than the Swiss market's 4.3%, the Return on Equity remains low at an anticipated 12.3%.

- Click here and access our complete growth analysis report to understand the dynamics of Sensirion Holding.

- The valuation report we've compiled suggests that Sensirion Holding's current price could be quite moderate.

Dongguan Mentech Optical & Magnetic (SZSE:002902)

Simply Wall St Growth Rating: ★★★★★☆

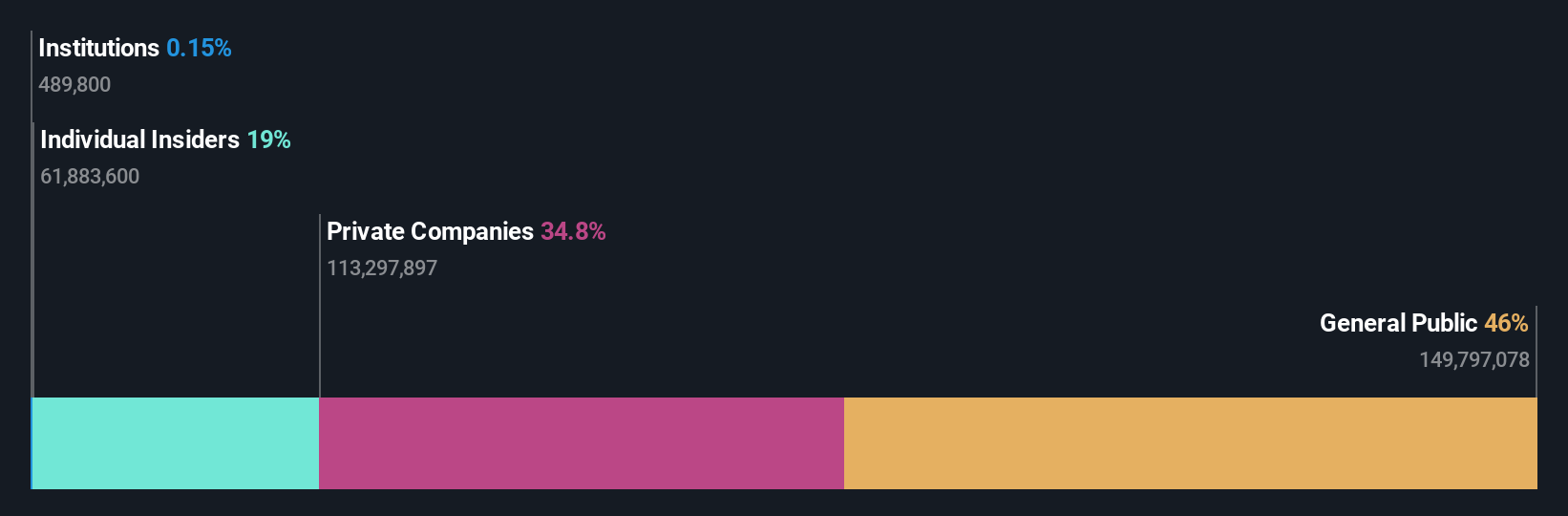

Overview: Dongguan Mentech Optical & Magnetic Co., Ltd. operates in the optical and magnetic components industry with a market cap of CN¥4.66 billion.

Operations: Dongguan Mentech Optical & Magnetic Co., Ltd. generates its revenue from the optical and magnetic components industry.

Insider Ownership: 34.8%

Dongguan Mentech Optical & Magnetic is poised for significant growth, with its revenue expected to rise 44.8% annually, outpacing the Chinese market's average. The company is forecasted to become profitable in three years, marking above-average market growth. Despite recent share price volatility, Mentech's strategic partnership with Visma | Lease a Bike Team highlights its global expansion and commitment to cycling intelligence technology, enhancing its product ecosystem and positioning it strongly in the professional cycling sector.

- Dive into the specifics of Dongguan Mentech Optical & Magnetic here with our thorough growth forecast report.

- Our valuation report unveils the possibility Dongguan Mentech Optical & Magnetic's shares may be trading at a premium.

Zhejiang Zhongxin Fluoride MaterialsLtd (SZSE:002915)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Zhejiang Zhongxin Fluoride Materials Co., Ltd is engaged in the research, development, production, and sale of fluorine fine chemicals in China with a market cap of CN¥4.28 billion.

Operations: Revenue Segments (in millions of CN¥): Zhejiang Zhongxin Fluoride Materials Co., Ltd generates its revenue from the research, development, production, and sale of fluorine fine chemicals in China.

Insider Ownership: 20.7%

Zhejiang Zhongxin Fluoride Materials is projected to experience substantial growth, with revenue expected to increase at 30.8% annually, surpassing the Chinese market average. The company aims for profitability within three years, indicating robust potential despite recent share price volatility and its removal from the S&P Global BMI Index. However, concerns remain regarding its financial position as debt coverage by operating cash flow is inadequate and Return on Equity is forecasted to be low at 11.5%.

- Get an in-depth perspective on Zhejiang Zhongxin Fluoride MaterialsLtd's performance by reading our analyst estimates report here.

- Our comprehensive valuation report raises the possibility that Zhejiang Zhongxin Fluoride MaterialsLtd is priced higher than what may be justified by its financials.

Where To Now?

- Discover the full array of 1476 Fast Growing Companies With High Insider Ownership right here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Zhejiang Zhongxin Fluoride MaterialsLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002915

Zhejiang Zhongxin Fluoride MaterialsLtd

Zhejiang Zhongxin Fluoride Materials Co.,Ltd production and research and development of fluorine-containing pharmaceutical, pesticide, and electronic material intermediates in China.

Reasonable growth potential with very low risk.

Market Insights

Community Narratives