- China

- /

- Electronic Equipment and Components

- /

- SZSE:002829

Optimistic Investors Push Beijing StarNeto Technology Co., Ltd. (SZSE:002829) Shares Up 33% But Growth Is Lacking

Beijing StarNeto Technology Co., Ltd. (SZSE:002829) shareholders would be excited to see that the share price has had a great month, posting a 33% gain and recovering from prior weakness. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 44% in the last twelve months.

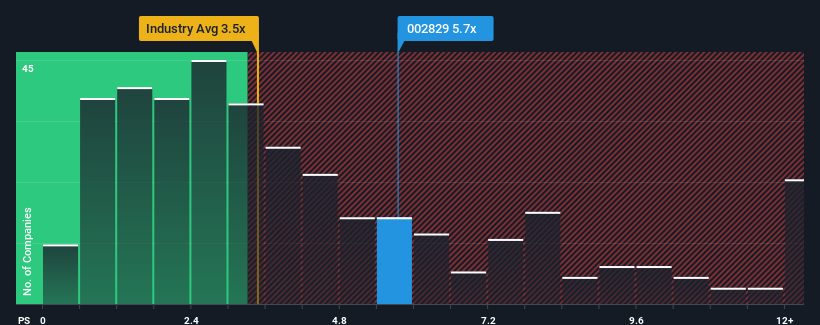

Since its price has surged higher, given around half the companies in China's Electronic industry have price-to-sales ratios (or "P/S") below 3.5x, you may consider Beijing StarNeto Technology as a stock to avoid entirely with its 5.7x P/S ratio. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for Beijing StarNeto Technology

How Has Beijing StarNeto Technology Performed Recently?

For instance, Beijing StarNeto Technology's receding revenue in recent times would have to be some food for thought. It might be that many expect the company to still outplay most other companies over the coming period, which has kept the P/S from collapsing. However, if this isn't the case, investors might get caught out paying too much for the stock.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Beijing StarNeto Technology's earnings, revenue and cash flow.Is There Enough Revenue Growth Forecasted For Beijing StarNeto Technology?

In order to justify its P/S ratio, Beijing StarNeto Technology would need to produce outstanding growth that's well in excess of the industry.

Retrospectively, the last year delivered a frustrating 40% decrease to the company's top line. Unfortunately, that's brought it right back to where it started three years ago with revenue growth being virtually non-existent overall during that time. So it appears to us that the company has had a mixed result in terms of growing revenue over that time.

Weighing that medium-term revenue trajectory against the broader industry's one-year forecast for expansion of 25% shows it's an unpleasant look.

With this in mind, we find it worrying that Beijing StarNeto Technology's P/S exceeds that of its industry peers. Apparently many investors in the company are way more bullish than recent times would indicate and aren't willing to let go of their stock at any price. There's a very good chance existing shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the recent negative growth rates.

The Key Takeaway

Shares in Beijing StarNeto Technology have seen a strong upwards swing lately, which has really helped boost its P/S figure. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that Beijing StarNeto Technology currently trades on a much higher than expected P/S since its recent revenues have been in decline over the medium-term. When we see revenue heading backwards and underperforming the industry forecasts, we feel the possibility of the share price declining is very real, bringing the P/S back into the realm of reasonability. If recent medium-term revenue trends continue, it will place shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

You need to take note of risks, for example - Beijing StarNeto Technology has 3 warning signs (and 1 which is significant) we think you should know about.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if Beijing StarNeto Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002829

Beijing StarNeto Technology

Provides inertial navigation, mobile satellite communications, passive electronic countermeasures, and unmanned systems in China.

Adequate balance sheet and overvalued.

Market Insights

Community Narratives