- China

- /

- Electronic Equipment and Components

- /

- SZSE:002654

Shenzhen Mason Technologies Co.,Ltd (SZSE:002654) Shares Fly 36% But Investors Aren't Buying For Growth

Shenzhen Mason Technologies Co.,Ltd (SZSE:002654) shares have had a really impressive month, gaining 36% after a shaky period beforehand. The last 30 days bring the annual gain to a very sharp 49%.

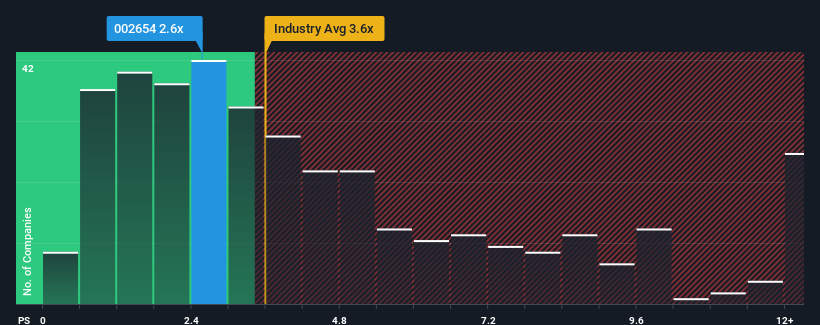

In spite of the firm bounce in price, Shenzhen Mason TechnologiesLtd may still be sending buy signals at present with its price-to-sales (or "P/S") ratio of 2.6x, considering almost half of all companies in the Electronic industry in China have P/S ratios greater than 3.6x and even P/S higher than 7x aren't out of the ordinary. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

See our latest analysis for Shenzhen Mason TechnologiesLtd

What Does Shenzhen Mason TechnologiesLtd's Recent Performance Look Like?

The revenue growth achieved at Shenzhen Mason TechnologiesLtd over the last year would be more than acceptable for most companies. Perhaps the market is expecting this acceptable revenue performance to take a dive, which has kept the P/S suppressed. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Shenzhen Mason TechnologiesLtd's earnings, revenue and cash flow.How Is Shenzhen Mason TechnologiesLtd's Revenue Growth Trending?

There's an inherent assumption that a company should underperform the industry for P/S ratios like Shenzhen Mason TechnologiesLtd's to be considered reasonable.

Taking a look back first, we see that the company managed to grow revenues by a handy 7.6% last year. Although, the latest three year period in total hasn't been as good as it didn't manage to provide any growth at all. So it appears to us that the company has had a mixed result in terms of growing revenue over that time.

In contrast to the company, the rest of the industry is expected to grow by 26% over the next year, which really puts the company's recent medium-term revenue decline into perspective.

With this information, we are not surprised that Shenzhen Mason TechnologiesLtd is trading at a P/S lower than the industry. However, we think shrinking revenues are unlikely to lead to a stable P/S over the longer term, which could set up shareholders for future disappointment. There's potential for the P/S to fall to even lower levels if the company doesn't improve its top-line growth.

The Key Takeaway

The latest share price surge wasn't enough to lift Shenzhen Mason TechnologiesLtd's P/S close to the industry median. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

It's no surprise that Shenzhen Mason TechnologiesLtd maintains its low P/S off the back of its sliding revenue over the medium-term. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. Given the current circumstances, it seems unlikely that the share price will experience any significant movement in either direction in the near future if recent medium-term revenue trends persist.

You always need to take note of risks, for example - Shenzhen Mason TechnologiesLtd has 2 warning signs we think you should be aware of.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:002654

Shenzhen Mason TechnologiesLtd

Researches, develops, designs, produces, and sells medium and high-end LED light source device packaging and LED application lighting products in China and internationally.

Proven track record with mediocre balance sheet.

Market Insights

Community Narratives