- China

- /

- Electronic Equipment and Components

- /

- SZSE:002579

Little Excitement Around Huizhou China Eagle Electronic Technology Inc.'s (SZSE:002579) Revenues

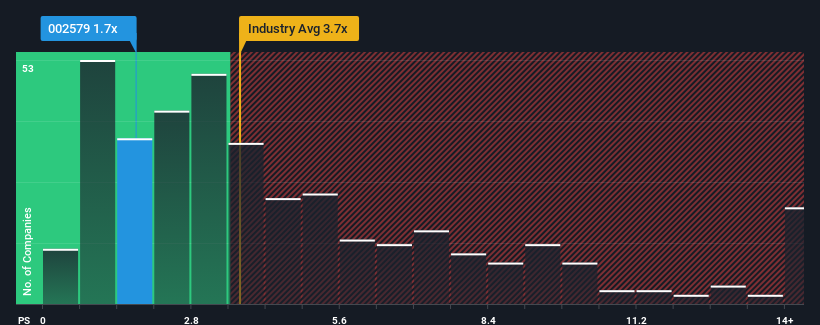

Huizhou China Eagle Electronic Technology Inc.'s (SZSE:002579) price-to-sales (or "P/S") ratio of 1.7x might make it look like a buy right now compared to the Electronic industry in China, where around half of the companies have P/S ratios above 3.7x and even P/S above 7x are quite common. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for Huizhou China Eagle Electronic Technology

What Does Huizhou China Eagle Electronic Technology's Recent Performance Look Like?

As an illustration, revenue has deteriorated at Huizhou China Eagle Electronic Technology over the last year, which is not ideal at all. It might be that many expect the disappointing revenue performance to continue or accelerate, which has repressed the P/S. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Although there are no analyst estimates available for Huizhou China Eagle Electronic Technology, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.How Is Huizhou China Eagle Electronic Technology's Revenue Growth Trending?

In order to justify its P/S ratio, Huizhou China Eagle Electronic Technology would need to produce sluggish growth that's trailing the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 8.9%. This has erased any of its gains during the last three years, with practically no change in revenue being achieved in total. Accordingly, shareholders probably wouldn't have been overly satisfied with the unstable medium-term growth rates.

This is in contrast to the rest of the industry, which is expected to grow by 26% over the next year, materially higher than the company's recent medium-term annualised growth rates.

In light of this, it's understandable that Huizhou China Eagle Electronic Technology's P/S sits below the majority of other companies. Apparently many shareholders weren't comfortable holding on to something they believe will continue to trail the wider industry.

The Bottom Line On Huizhou China Eagle Electronic Technology's P/S

While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

As we suspected, our examination of Huizhou China Eagle Electronic Technology revealed its three-year revenue trends are contributing to its low P/S, given they look worse than current industry expectations. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. Unless the recent medium-term conditions improve, they will continue to form a barrier for the share price around these levels.

Don't forget that there may be other risks. For instance, we've identified 2 warning signs for Huizhou China Eagle Electronic Technology that you should be aware of.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're here to simplify it.

Discover if Huizhou CEE Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:002579

Huizhou CEE Technology

Focuses on the research and development, production, sales and service of printed circuit boards in China and internationally.

Slightly overvalued with questionable track record.

Market Insights

Community Narratives