- China

- /

- Metals and Mining

- /

- SZSE:301261

Undiscovered Gems In February 2025

Reviewed by Simply Wall St

As global markets navigate a landscape marked by volatile corporate earnings and geopolitical tensions, small-cap stocks remain under the radar amidst broader market fluctuations. Despite challenges such as AI competition fears and tariff risks, these smaller companies often present unique opportunities for investors seeking growth potential in less explored areas of the market. In this context, identifying stocks with strong fundamentals and innovative business models can be particularly rewarding for those looking to uncover undiscovered gems.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Cresco | 6.62% | 8.15% | 9.94% | ★★★★★★ |

| DoshishaLtd | NA | 2.43% | 2.36% | ★★★★★★ |

| NOROO PAINT & COATINGS | 12.38% | 4.96% | 8.97% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| ITOCHU-SHOKUHIN | NA | 0.74% | 13.97% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Wan Hwa Enterprise | NA | -7.43% | -7.24% | ★★★★★★ |

| First Copper Technology | 17.03% | 3.07% | 19.66% | ★★★★★★ |

| New Asia Construction & Development | 65.89% | 5.34% | 12.05% | ★★★★★☆ |

| Nippon Sharyo | 59.09% | -1.22% | -12.92% | ★★★★☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

Shenzhen Rapoo Technology (SZSE:002577)

Simply Wall St Value Rating: ★★★★★★

Overview: Shenzhen Rapoo Technology Co., Ltd. is engaged in the research, development, design, manufacture, and sale of wired and wireless peripheral products globally with a market capitalization of approximately CN¥5.99 billion.

Operations: Rapoo Technology generates its revenue primarily from the sale of wired and wireless peripheral products. The company focuses on managing its cost structure to optimize profitability, with particular attention to production and operational efficiencies.

Shenzhen Rapoo Technology stands out with a robust 69% earnings growth over the past year, far surpassing the tech industry's average of 3%. This small company is debt-free, ensuring no concerns over interest payments. However, its recent financials were significantly influenced by a non-recurring gain of CN¥11.7 million. Despite this boost, the stock has experienced high volatility in the last three months. On a positive note, it remains free cash flow positive and recently repurchased 13,200 shares for CNY 0.21 million as part of its buyback strategy announced in May 2024.

- Dive into the specifics of Shenzhen Rapoo Technology here with our thorough health report.

Learn about Shenzhen Rapoo Technology's historical performance.

Hengong Precision Equipment (SZSE:301261)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Hengong Precision Equipment Co., Ltd. focuses on the R&D, production, processing, and sales of new fluid technology materials both in China and internationally with a market cap of CN¥5.28 billion.

Operations: Hengong Precision Equipment generates revenue primarily from the sales of new fluid technology materials. The company's financial performance is influenced by its ability to manage production and processing costs effectively, which impacts its net profit margin.

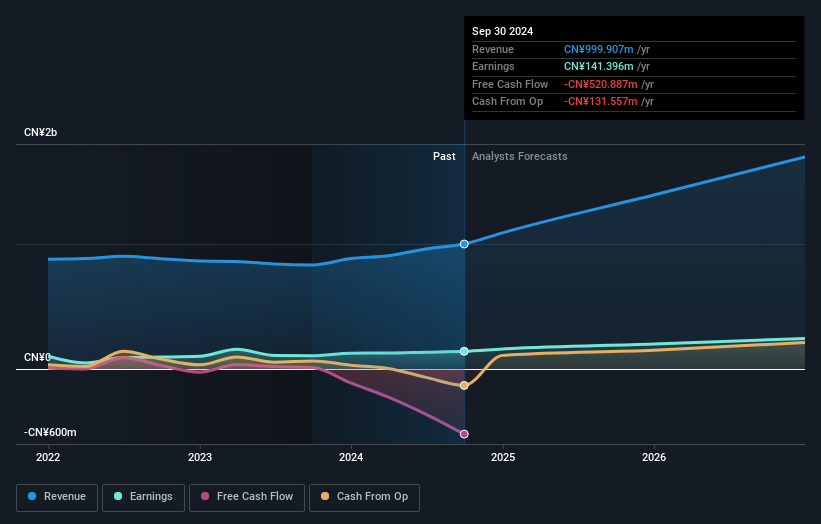

Hengong Precision Equipment, a smaller player in the industry, has shown impressive earnings growth of 32.3% over the past year, outpacing the broader Metals and Mining sector's -2.3%. Despite its high level of non-cash earnings, Hengong's debt to equity ratio has risen from 30.5% to 70.5% in five years, indicating increased leverage. The company's net debt to equity ratio is a satisfactory 11.6%, suggesting manageable debt levels relative to equity. However, with volatile share prices recently observed and no positive free cash flow reported, investors should weigh these factors carefully when considering potential growth prospects.

Zhejiang Sling Automobile Bearing (SZSE:301550)

Simply Wall St Value Rating: ★★★★★★

Overview: Zhejiang Sling Automobile Bearing Co., Ltd. specializes in the production and distribution of automotive bearings, with a market cap of CN¥10.20 billion.

Operations: Zhejiang Sling generates revenue primarily from its Auto Parts & Accessories segment, totaling CN¥764.93 million.

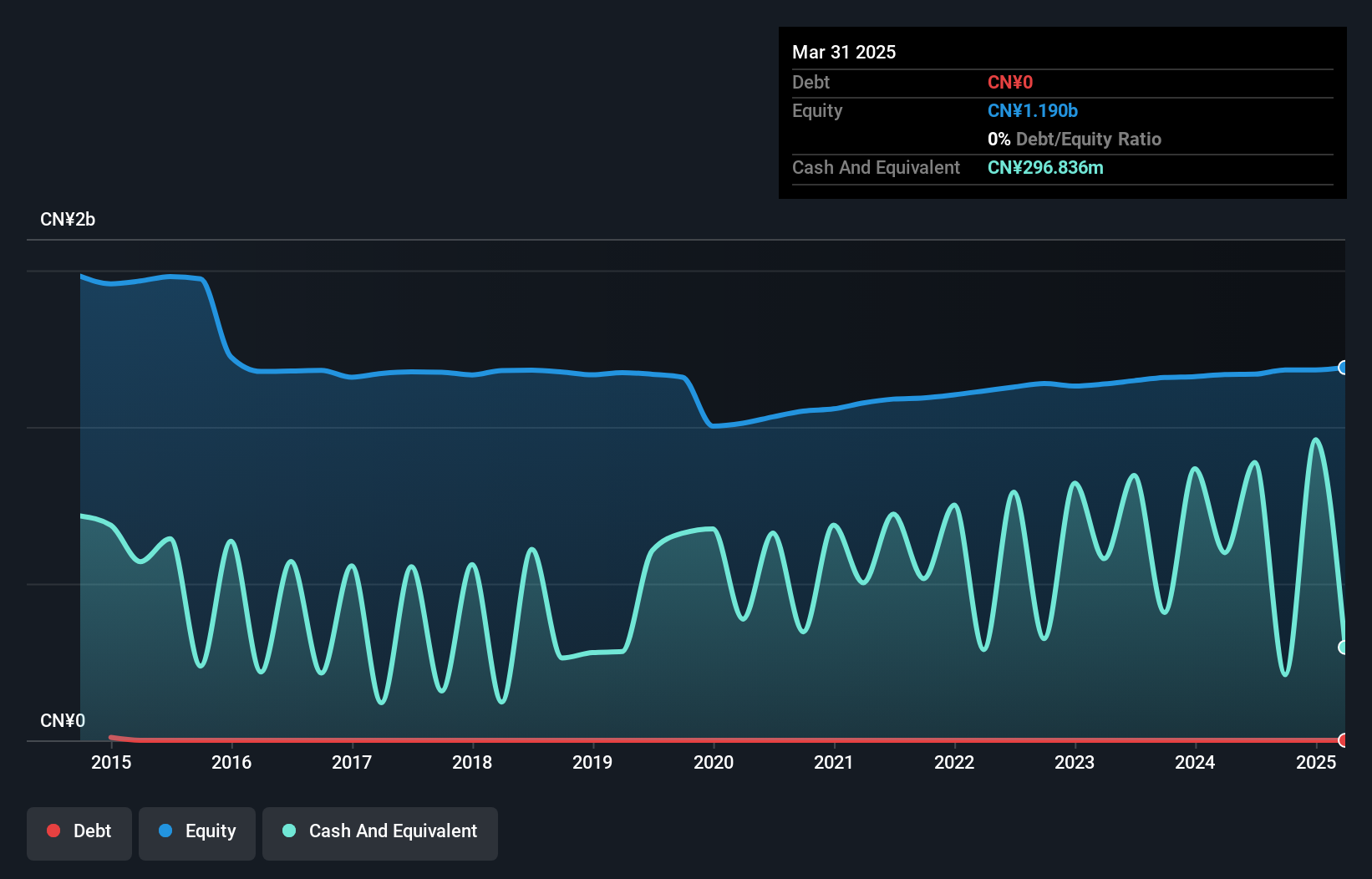

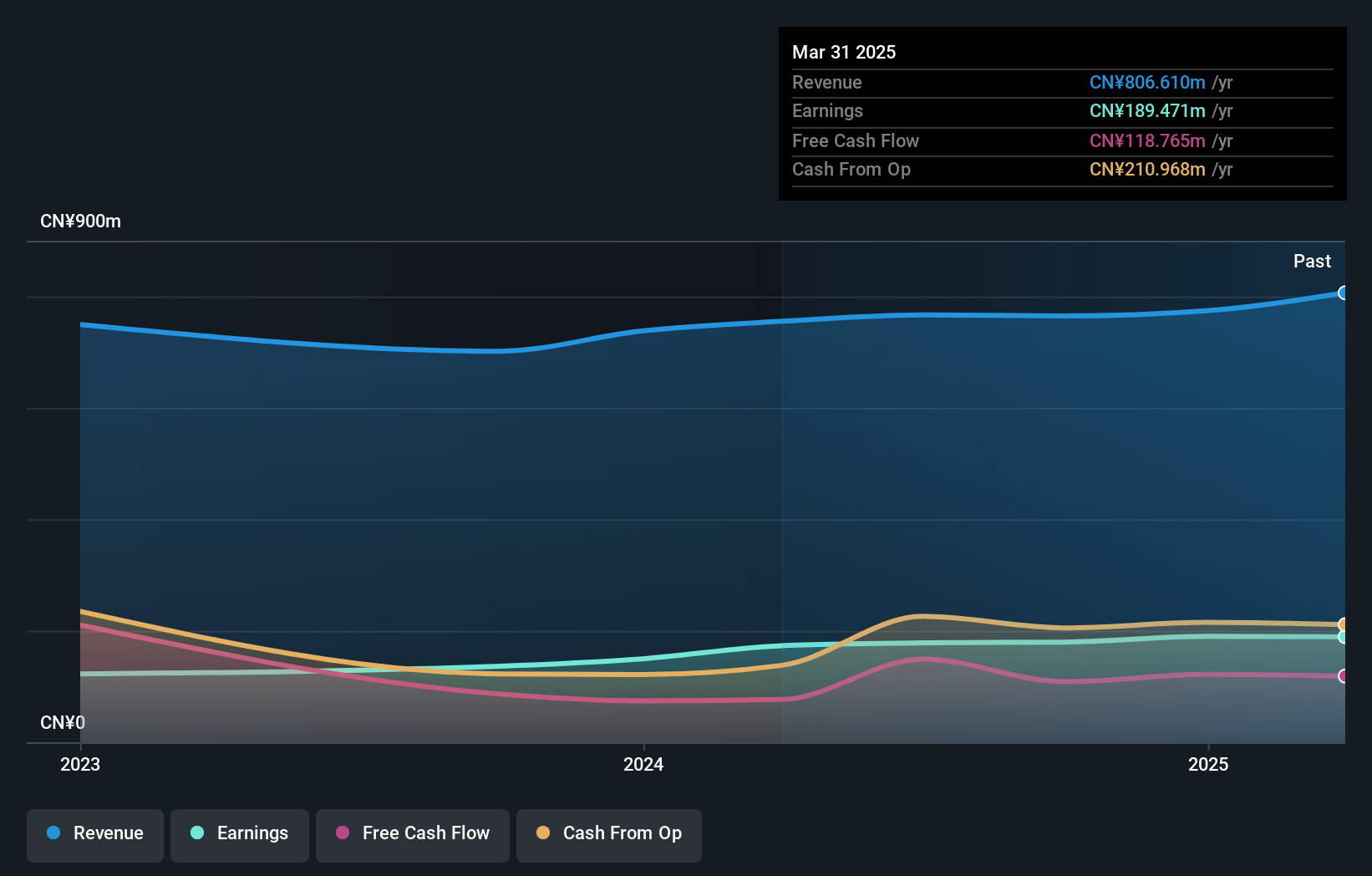

Zhejiang Sling Automobile Bearing, a nimble player in the auto components sector, has demonstrated impressive financial health with its earnings surging by 31.7% over the past year, outpacing the industry average of 10.5%. The company operates debt-free now, a significant improvement from five years ago when its debt-to-equity ratio stood at 47.7%. Despite recent share price volatility, Zhejiang Sling's robust free cash flow position of US$108.69 million as of September 2024 suggests strong operational efficiency and potential for sustained growth. With earnings projected to grow annually by 21.85%, it seems well-positioned for future expansion in this competitive market landscape.

- Click here and access our complete health analysis report to understand the dynamics of Zhejiang Sling Automobile Bearing.

Understand Zhejiang Sling Automobile Bearing's track record by examining our Past report.

Where To Now?

- Click through to start exploring the rest of the 4721 Undiscovered Gems With Strong Fundamentals now.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hengong Precision Equipment might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:301261

Hengong Precision Equipment

Engages in the research and development, production and processing, and sales services of new fluid technology materials in China and internationally.

High growth potential with adequate balance sheet.

Market Insights

Community Narratives