- China

- /

- Electronic Equipment and Components

- /

- SZSE:002600

High Growth Tech Stocks to Watch in November 2024

Reviewed by Simply Wall St

As global markets adjust to the incoming Trump administration, uncertainty around policy implications has led to mixed performance across sectors, with notable impacts on key indices such as the S&P 500 and Nasdaq Composite. In this environment of fluctuating market sentiment and economic indicators, identifying high-growth tech stocks involves looking for companies that demonstrate resilience and adaptability in response to regulatory changes and evolving market dynamics.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Material Group | 20.45% | 24.01% | ★★★★★★ |

| Yggdrazil Group | 24.66% | 85.53% | ★★★★★★ |

| eWeLLLtd | 26.52% | 27.53% | ★★★★★★ |

| Seojin SystemLtd | 33.54% | 52.43% | ★★★★★★ |

| Pharma Mar | 26.94% | 56.39% | ★★★★★★ |

| Ascelia Pharma | 76.15% | 47.16% | ★★★★★★ |

| Medley | 25.59% | 31.50% | ★★★★★★ |

| Alkami Technology | 21.89% | 98.60% | ★★★★★★ |

| Mental Health TechnologiesLtd | 27.88% | 79.61% | ★★★★★★ |

| UTI | 114.97% | 134.60% | ★★★★★★ |

Click here to see the full list of 1301 stocks from our High Growth Tech and AI Stocks screener.

Let's dive into some prime choices out of from the screener.

Guangzhou Haige Communications Group (SZSE:002465)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Guangzhou Haige Communications Group Incorporated Company operates in the wireless communications, Beidou navigation, aerospace, and digital intelligence ecology sectors in China, with a market capitalization of approximately CN¥30.53 billion.

Operations: Haige Communications focuses on wireless communications, Beidou navigation, aerospace, and digital intelligence in China. It generates revenue from these sectors by leveraging its technological expertise and market presence.

Guangzhou Haige Communications Group, navigating through a challenging fiscal year, reported a noticeable dip in sales and net income for the nine months ending September 2024, with revenues sliding to CNY 3.77 billion from CNY 4.04 billion year-over-year. Despite this downturn, the company's projected revenue growth stands robust at an annual rate of 23.4%, outpacing the Chinese market forecast of 13.9%. Moreover, its earnings are expected to surge by an impressive 37.1% annually over the next three years, signaling potential resilience and adaptability in its operational strategy amidst fluctuating market conditions. This growth trajectory is particularly noteworthy given the broader industry's negative earnings trend over the past year, positioning Guangzhou Haige potentially as a dynamic player in its sector moving forward.

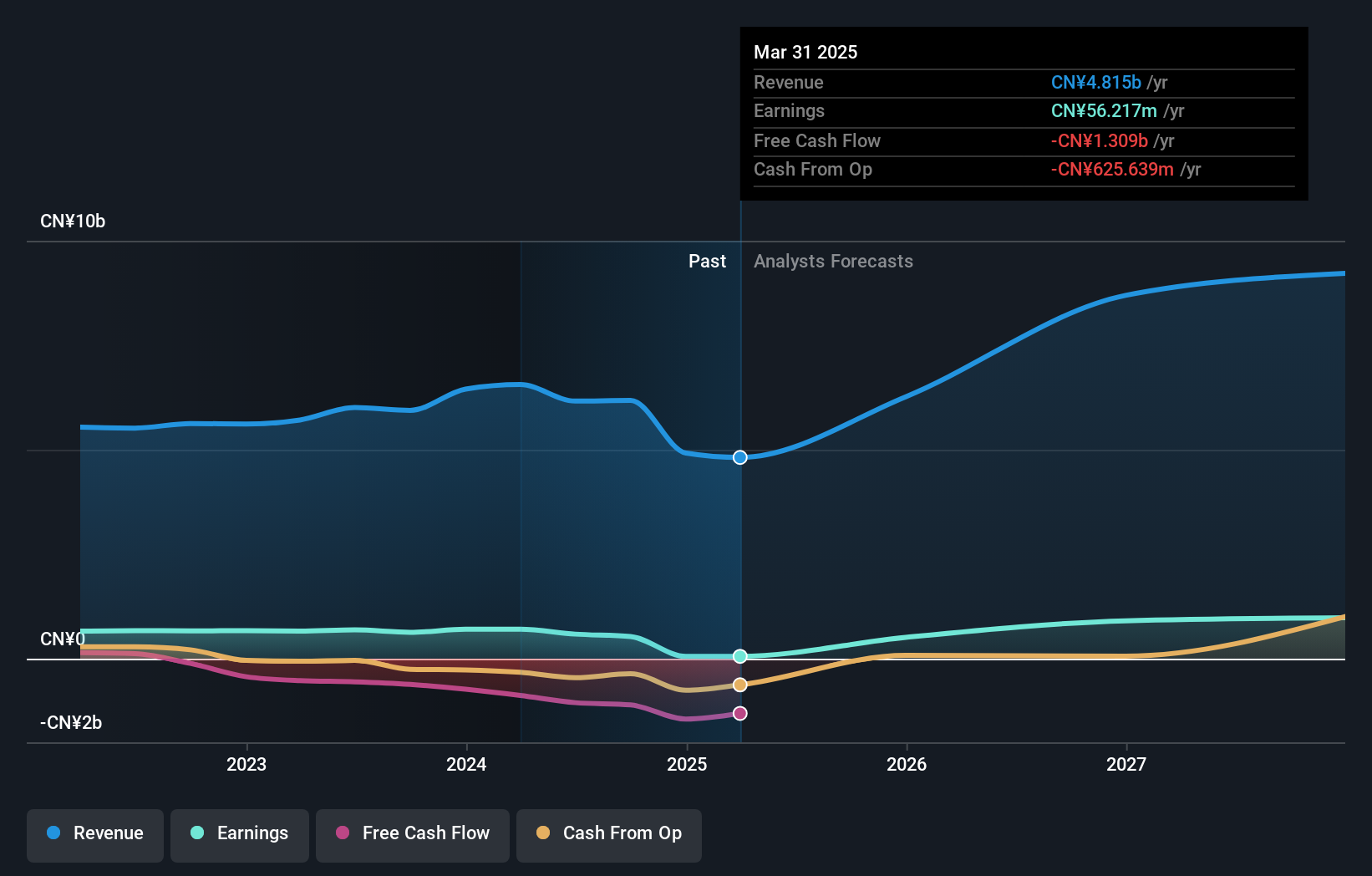

Lingyi iTech (Guangdong) (SZSE:002600)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Lingyi iTech (Guangdong) Company offers smart manufacturing services and solutions, with a market cap of CN¥56.87 billion.

Operations: Lingyi iTech specializes in smart manufacturing services, leveraging its expertise to drive revenue through innovative solutions. The company operates with a focus on optimizing production processes and delivering advanced technological products to various industries.

Lingyi iTech (Guangdong) has demonstrated a robust financial performance with a significant revenue jump to CNY 31.48 billion, up from CNY 24.65 billion year-over-year as of September 2024, underscoring a growth rate of 16% per year. Despite this, net income dipped to CNY 1.41 billion from CNY 1.87 billion, reflecting challenges in scaling profitably. The company's commitment to innovation is evident in its R&D spending which remains a critical focus, though specific figures are not disclosed; this investment in technology development may well dictate future competitiveness and market positioning within the tech sector.

- Get an in-depth perspective on Lingyi iTech (Guangdong)'s performance by reading our health report here.

Gain insights into Lingyi iTech (Guangdong)'s past trends and performance with our Past report.

Suzhou TFC Optical Communication (SZSE:300394)

Simply Wall St Growth Rating: ★★★★★★

Overview: Suzhou TFC Optical Communication Co., Ltd. is engaged in the design, manufacture, and sale of optical communication devices, with a market capitalization of CN¥62.43 billion.

Operations: TFC Optical Communication generates revenue primarily from the sale of optical communication devices, totaling CN¥3.12 billion. The company's market presence is bolstered by its focus on this core segment, which plays a crucial role in its financial performance.

Suzhou TFC Optical Communication has exhibited remarkable growth, with a revenue surge to CNY 2.39 billion in the first nine months of 2024, up from CNY 1.21 billion in the same period last year, marking an impressive increase of approximately 98%. This growth trajectory is underpinned by robust earnings expansion; net income nearly doubled to CNY 976.45 million from CNY 439.08 million year-over-year. The firm's strategic focus on R&D is pivotal, dedicating substantial resources to innovation—evident from its significant financial commitment—ensuring it stays at the forefront of optical communication technology and potentially outpaces broader market and industry growth rates forecasted at 35.3% and 33.9% respectively per annum.

- Navigate through the intricacies of Suzhou TFC Optical Communication with our comprehensive health report here.

Learn about Suzhou TFC Optical Communication's historical performance.

Seize The Opportunity

- Unlock our comprehensive list of 1301 High Growth Tech and AI Stocks by clicking here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002600

Lingyi iTech (Guangdong)

Provides smart manufacturing services and solutions.

Flawless balance sheet with reasonable growth potential.