- China

- /

- Communications

- /

- SZSE:002446

3 Promising Growth Companies With Insider Ownership Up To 24%

Reviewed by Simply Wall St

As global markets navigate a complex landscape marked by interest rate adjustments and sector-specific movements, U.S. indices like the S&P 500 and Nasdaq Composite have shown resilience, buoyed by strong performance in utilities, real estate, and AI-related stocks. Amid these shifts, identifying growth companies with substantial insider ownership can be particularly appealing to investors seeking alignment of interests between management and shareholders.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 34% |

| Atlas Energy Solutions (NYSE:AESI) | 29.1% | 41.9% |

| Kirloskar Pneumatic (BSE:505283) | 30.3% | 30.1% |

| Clinuvel Pharmaceuticals (ASX:CUV) | 10.4% | 27.4% |

| Laopu Gold (SEHK:6181) | 36.4% | 33.2% |

| KebNi (OM:KEBNI B) | 36.3% | 86.1% |

| Findi (ASX:FND) | 35.8% | 64.8% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 13.9% | 95% |

| EHang Holdings (NasdaqGM:EH) | 32.8% | 81.4% |

| UTI (KOSDAQ:A179900) | 33.1% | 134.6% |

Let's uncover some gems from our specialized screener.

Bio-Thera Solutions (SHSE:688177)

Simply Wall St Growth Rating: ★★★★★★

Overview: Bio-Thera Solutions, Ltd. is a biopharmaceutical company focused on researching and developing novel therapeutics for cancer, autoimmune, cardiovascular, and other serious medical conditions in China and internationally, with a market cap of CN¥9.55 billion.

Operations: The company's revenue is primarily derived from its biopharmaceutical segment, totaling CN¥792.41 million.

Insider Ownership: 18.2%

Bio-Thera Solutions is positioned for growth with its substantial pipeline of biosimilars, including the recently EMA-approved BAT1706 and the filed BAT2206. The company reported a rise in half-year revenue to CNY 402.29 million, though it still posted a net loss of CNY 236.85 million. Analysts forecast significant revenue growth at 26.8% annually, outpacing the broader CN market, with profitability expected within three years despite current financial constraints like less than one year of cash runway.

- Click here and access our complete growth analysis report to understand the dynamics of Bio-Thera Solutions.

- Our valuation report here indicates Bio-Thera Solutions may be overvalued.

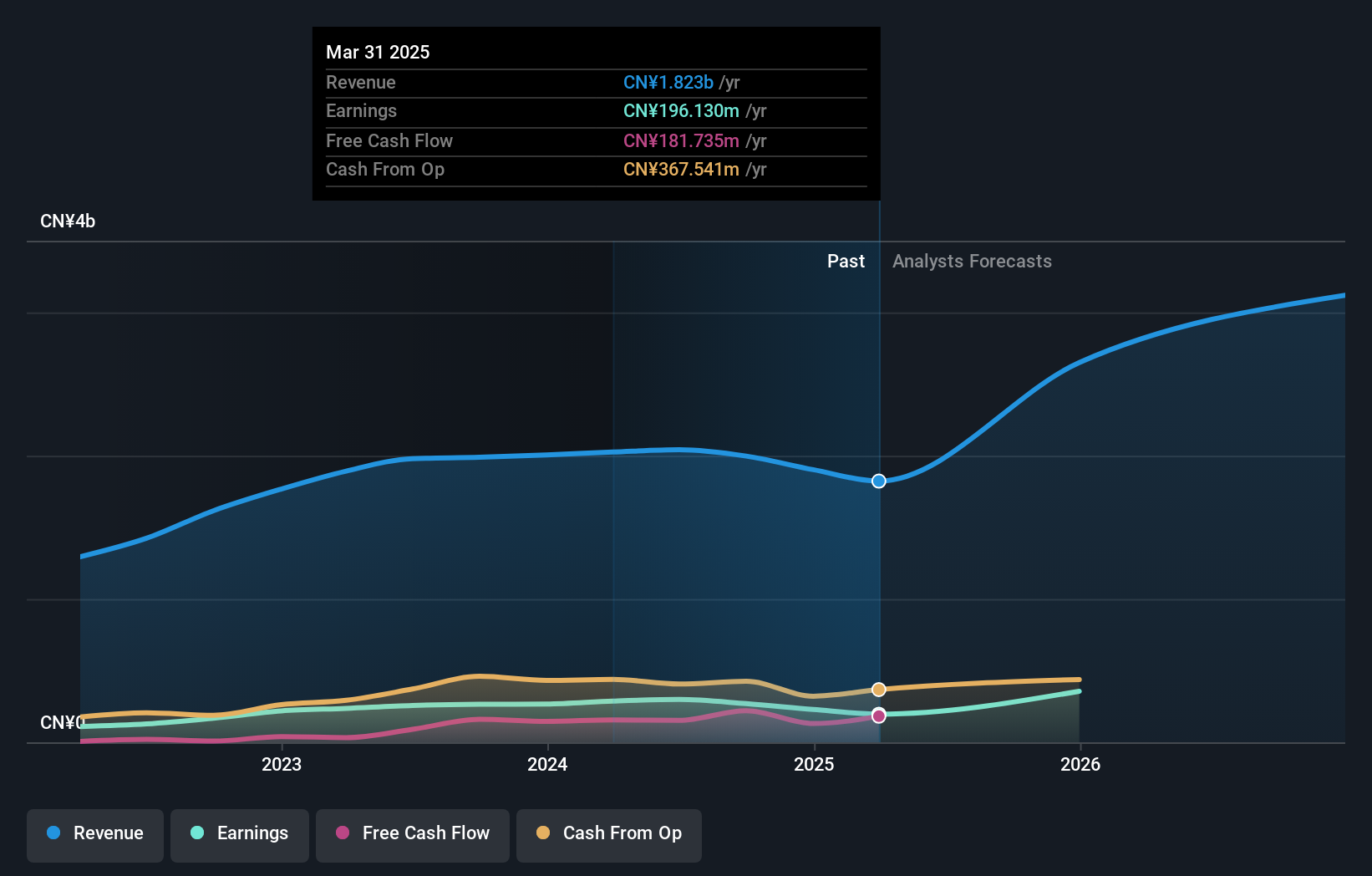

Guangdong Shenglu Telecommunication Tech (SZSE:002446)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Guangdong Shenglu Telecommunication Tech, with a market cap of CN¥6.11 billion, is engaged in the design and manufacture of telecommunication equipment.

Operations: The company's revenue is derived from two main segments: Microwave Electronics, contributing CN¥475.16 million, and Communication Equipment, generating CN¥536.63 million.

Insider Ownership: 16.2%

Guangdong Shenglu Telecommunication Tech. is set for substantial growth with revenue projected to increase by 36% annually, outpacing the broader CN market. Despite a decline in recent half-year earnings, with sales at CNY 559.16 million and net income dropping to CNY 49.6 million, analysts expect the company to become profitable within three years. Recent shareholder meetings approved changes in registered capital and company bylaws, potentially impacting future governance and operational strategies.

- Click here to discover the nuances of Guangdong Shenglu Telecommunication Tech with our detailed analytical future growth report.

- Upon reviewing our latest valuation report, Guangdong Shenglu Telecommunication Tech's share price might be too optimistic.

Ningbo Sunrise Elc TechnologyLtd (SZSE:002937)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Ningbo Sunrise Elc Technology Co., Ltd manufactures and sells precision components, with a market cap of CN¥5.23 billion.

Operations: The company generates revenue from several segments, including Mold (CN¥55.17 million), Smart Terminal (CN¥491.88 million), Vehicle Electronics (CN¥1.13 billion), and Consumer Electronics (CN¥125.34 million).

Insider Ownership: 24.3%

Ningbo Sunrise Elc Technology Ltd. is positioned for growth with earnings expected to rise 28.51% annually, surpassing the broader CN market's 23.8%. The company reported half-year sales of CNY 896.25 million, up from CNY 862.13 million, and net income increased to CNY 147.62 million from CNY 115.67 million year-on-year. Trading at a favorable price-to-earnings ratio of 18.6x compared to the CN market's average of 33.5x, it offers good relative value despite a dividend not well covered by free cash flows.

- Get an in-depth perspective on Ningbo Sunrise Elc TechnologyLtd's performance by reading our analyst estimates report here.

- In light of our recent valuation report, it seems possible that Ningbo Sunrise Elc TechnologyLtd is trading behind its estimated value.

Key Takeaways

- Click here to access our complete index of 1486 Fast Growing Companies With High Insider Ownership.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002446

Guangdong Shenglu Telecommunication Tech

Guangdong Shenglu Telecommunication Tech.

Flawless balance sheet with high growth potential.