- China

- /

- Electronic Equipment and Components

- /

- SZSE:300657

Exploring High Growth Tech Stocks This November 2024

Reviewed by Simply Wall St

As global markets navigate a landscape marked by U.S. indexes approaching record highs and smaller-cap indexes outperforming their larger counterparts, investors are keenly observing the tech sector's potential for high growth amidst broad-based gains and economic optimism driven by strong labor market reports. In this dynamic environment, identifying promising tech stocks involves assessing companies with robust innovation pipelines and adaptability to evolving market demands, especially as geopolitical tensions and economic indicators continue to shape investment strategies.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Material Group | 20.45% | 24.01% | ★★★★★★ |

| Seojin SystemLtd | 32.56% | 43.21% | ★★★★★★ |

| Yggdrazil Group | 24.66% | 85.53% | ★★★★★★ |

| eWeLLLtd | 27.24% | 28.74% | ★★★★★★ |

| Ascelia Pharma | 76.15% | 47.16% | ★★★★★★ |

| Mental Health TechnologiesLtd | 24.68% | 97.53% | ★★★★★★ |

| Pharma Mar | 25.97% | 56.89% | ★★★★★★ |

| Medley | 25.57% | 31.67% | ★★★★★★ |

| JNTC | 20.52% | 57.26% | ★★★★★★ |

| Elliptic Laboratories | 65.73% | 103.55% | ★★★★★★ |

Click here to see the full list of 1288 stocks from our High Growth Tech and AI Stocks screener.

Here's a peek at a few of the choices from the screener.

Neusoft (SHSE:600718)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Neusoft Corporation offers software and IT solutions globally and has a market cap of CN¥12.41 billion.

Operations: Neusoft Corporation generates revenue primarily through its software and IT solutions services offered worldwide. The company focuses on delivering a range of technology-driven products and services tailored to various industries, contributing to its financial performance.

Neusoft has demonstrated a robust growth trajectory with an 18.3% annual revenue increase, outpacing the Chinese market's average of 13.8%. This performance is bolstered by significant R&D investments, aligning with its strategic focus on innovation to stay competitive in the software industry. Furthermore, Neusoft's earnings are projected to surge by 58.2% annually, reflecting strong operational efficiency and market demand for its technologies. Recent financial results underscore this momentum, with a reported net income rise from CNY 134.76 million to CNY 152.36 million in the latest nine-month period compared to the previous year. These figures not only highlight Neusoft’s financial health but also its potential for sustained growth amidst evolving technological landscapes.

Fujian Star-net Communication (SZSE:002396)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Fujian Star-net Communication Co., LTD. offers ICT infrastructure and AI application solutions in China, with a market cap of approximately CN¥10.22 billion.

Operations: The company generates revenue primarily through its communication equipment manufacturing segment, which amounts to CN¥16.74 billion.

Fujian Star-net Communication has navigated a challenging landscape with a notable 7.6% increase in sales to CNY 11.89 billion, despite a dip in net income to CNY 262.78 million from the previous year's CNY 302.81 million. This performance is underscored by an aggressive R&D strategy, where expenses are strategically allocated to foster innovation and maintain competitive advantage in the communications sector. With earnings forecasted to grow by an impressive 35.5% annually, surpassing the Chinese market average of 26.1%, the company is poised for significant advancements, especially considering its recent executive reshuffling aimed at bolstering strategic direction and governance.

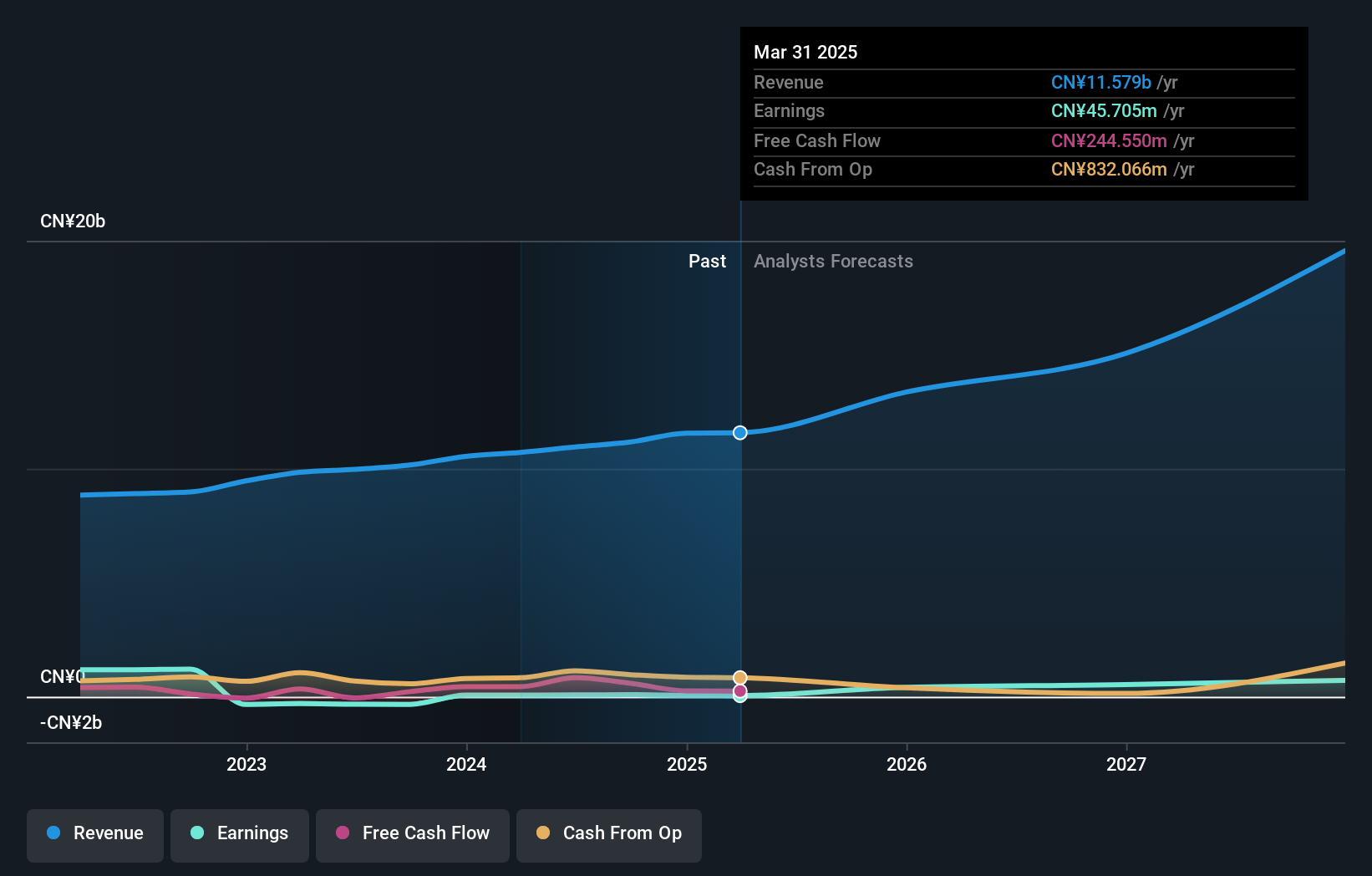

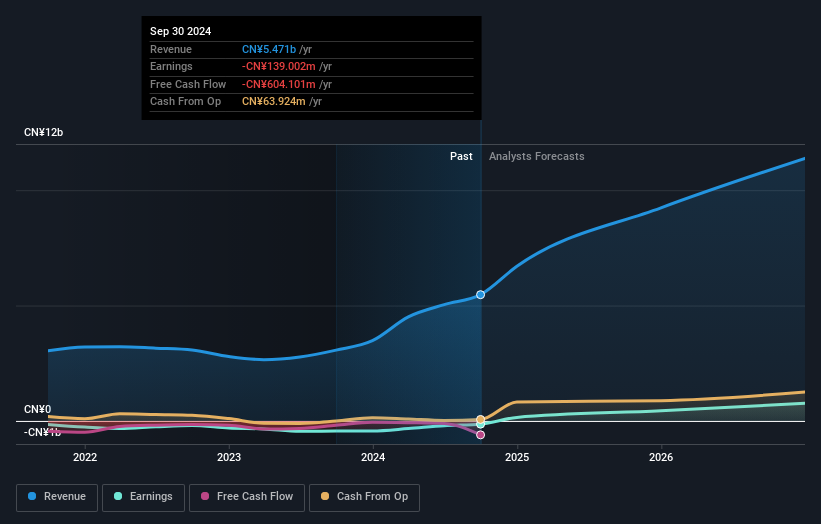

XiaMen HongXin Electron-tech GroupLtd (SZSE:300657)

Simply Wall St Growth Rating: ★★★★★★

Overview: XiaMen HongXin Electron-tech Group Co.,Ltd focuses on the research, development, design, manufacture, and sale of flexible printed circuit boards (FPCs) in China with a market capitalization of CN¥9.98 billion.

Operations: XiaMen HongXin Electron-tech Group Co.,Ltd generates its revenue primarily from the electronics manufacturing industry, amounting to CN¥5.40 billion. The company is involved in the research, development, design, manufacture, and sale of flexible printed circuit boards (FPCs) in China.

XiaMen HongXin Electron-tech GroupLtd has demonstrated a robust growth trajectory, with its revenue surging by 31.1% annually, outpacing the Chinese market's average of 13.8%. This surge is underpinned by a significant turnaround in net income—from a substantial loss to CNY 54.7 million within just nine months. Notably, the firm's commitment to innovation is evident from its R&D investments which are poised to fuel future technologies, aligning with earnings forecasts projecting an annual increase of 99.4%. These financial dynamics are complemented by strategic initiatives like the recent private placement aimed at bolstering capital for further expansion and development projects, showcasing a proactive approach in securing its growth trajectory amidst volatile market conditions.

Next Steps

- Get an in-depth perspective on all 1288 High Growth Tech and AI Stocks by using our screener here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300657

XiaMen HongXin Electron-tech GroupLtd

Engages in the research and development, design, manufacture, and sale of flexible printed circuit boards (FPCs) in China.

Exceptional growth potential and fair value.