- China

- /

- Electronic Equipment and Components

- /

- SZSE:002388

Sunyes Manufacturing (Zhejiang) Holding Co., Ltd. (SZSE:002388) Looks Inexpensive After Falling 26% But Perhaps Not Attractive Enough

Unfortunately for some shareholders, the Sunyes Manufacturing (Zhejiang) Holding Co., Ltd. (SZSE:002388) share price has dived 26% in the last thirty days, prolonging recent pain. For any long-term shareholders, the last month ends a year to forget by locking in a 54% share price decline.

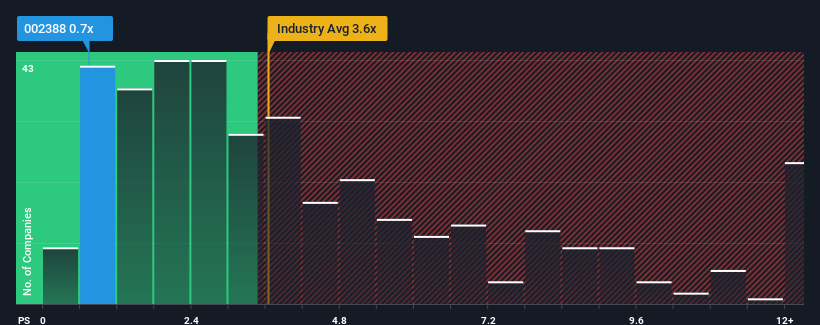

Since its price has dipped substantially, Sunyes Manufacturing (Zhejiang) Holding may look like a strong buying opportunity at present with its price-to-sales (or "P/S") ratio of 0.7x, considering almost half of all companies in the Electronic industry in China have P/S ratios greater than 3.6x and even P/S higher than 7x aren't out of the ordinary. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so limited.

Check out our latest analysis for Sunyes Manufacturing (Zhejiang) Holding

How Sunyes Manufacturing (Zhejiang) Holding Has Been Performing

Revenue has risen firmly for Sunyes Manufacturing (Zhejiang) Holding recently, which is pleasing to see. Perhaps the market is expecting this acceptable revenue performance to take a dive, which has kept the P/S suppressed. If that doesn't eventuate, then existing shareholders have reason to be optimistic about the future direction of the share price.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Sunyes Manufacturing (Zhejiang) Holding's earnings, revenue and cash flow.Is There Any Revenue Growth Forecasted For Sunyes Manufacturing (Zhejiang) Holding?

In order to justify its P/S ratio, Sunyes Manufacturing (Zhejiang) Holding would need to produce anemic growth that's substantially trailing the industry.

Retrospectively, the last year delivered an exceptional 19% gain to the company's top line. Despite this strong recent growth, it's still struggling to catch up as its three-year revenue frustratingly shrank by 2.5% overall. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

In contrast to the company, the rest of the industry is expected to grow by 26% over the next year, which really puts the company's recent medium-term revenue decline into perspective.

With this information, we are not surprised that Sunyes Manufacturing (Zhejiang) Holding is trading at a P/S lower than the industry. Nonetheless, there's no guarantee the P/S has reached a floor yet with revenue going in reverse. Even just maintaining these prices could be difficult to achieve as recent revenue trends are already weighing down the shares.

What Does Sunyes Manufacturing (Zhejiang) Holding's P/S Mean For Investors?

Shares in Sunyes Manufacturing (Zhejiang) Holding have plummeted and its P/S has followed suit. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

As we suspected, our examination of Sunyes Manufacturing (Zhejiang) Holding revealed its shrinking revenue over the medium-term is contributing to its low P/S, given the industry is set to grow. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. If recent medium-term revenue trends continue, it's hard to see the share price moving strongly in either direction in the near future under these circumstances.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with Sunyes Manufacturing (Zhejiang) Holding (at least 1 which is a bit unpleasant), and understanding them should be part of your investment process.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:002388

Sunyes Manufacturing (Zhejiang) Holding

Sunyes Manufacturing (Zhejiang) Holding Co., Ltd.

Slightly overvalued with imperfect balance sheet.

Market Insights

Community Narratives