- China

- /

- Electronic Equipment and Components

- /

- SZSE:002362

Hanwang Technology Co.,Ltd (SZSE:002362) Stocks Shoot Up 30% But Its P/S Still Looks Reasonable

Those holding Hanwang Technology Co.,Ltd (SZSE:002362) shares would be relieved that the share price has rebounded 30% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 40% in the last twelve months.

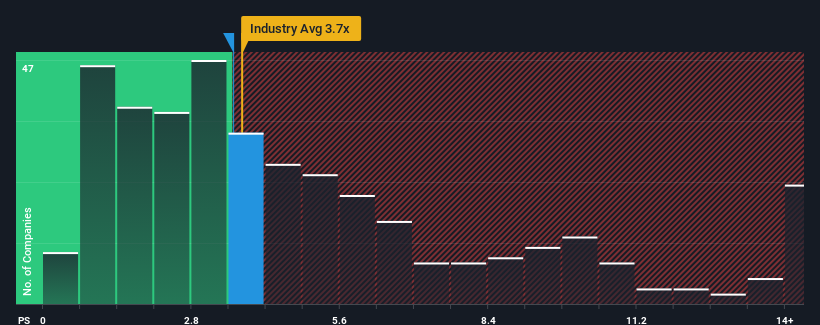

Although its price has surged higher, you could still be forgiven for feeling indifferent about Hanwang TechnologyLtd's P/S ratio of 3.6x, since the median price-to-sales (or "P/S") ratio for the Electronic industry in China is also close to 3.7x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

Check out our latest analysis for Hanwang TechnologyLtd

How Has Hanwang TechnologyLtd Performed Recently?

Hanwang TechnologyLtd's revenue growth of late has been pretty similar to most other companies. The P/S ratio is probably moderate because investors think this modest revenue performance will continue. Those who are bullish on Hanwang TechnologyLtd will be hoping that revenue performance can pick up, so that they can pick up the stock at a slightly lower valuation.

Want the full picture on analyst estimates for the company? Then our free report on Hanwang TechnologyLtd will help you uncover what's on the horizon.Do Revenue Forecasts Match The P/S Ratio?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Hanwang TechnologyLtd's to be considered reasonable.

Retrospectively, the last year delivered virtually the same number to the company's top line as the year before. The lack of growth did nothing to help the company's aggregate three-year performance, which is an unsavory 1.4% drop in revenue. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Turning to the outlook, the next year should generate growth of 26% as estimated by the sole analyst watching the company. Meanwhile, the rest of the industry is forecast to expand by 26%, which is not materially different.

With this information, we can see why Hanwang TechnologyLtd is trading at a fairly similar P/S to the industry. It seems most investors are expecting to see average future growth and are only willing to pay a moderate amount for the stock.

The Bottom Line On Hanwang TechnologyLtd's P/S

Hanwang TechnologyLtd appears to be back in favour with a solid price jump bringing its P/S back in line with other companies in the industry It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

A Hanwang TechnologyLtd's P/S seems about right to us given the knowledge that analysts are forecasting a revenue outlook that is similar to the Electronic industry. Right now shareholders are comfortable with the P/S as they are quite confident future revenue won't throw up any surprises. Unless these conditions change, they will continue to support the share price at these levels.

Before you take the next step, you should know about the 1 warning sign for Hanwang TechnologyLtd that we have uncovered.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if Hanwang TechnologyLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:002362

Hanwang TechnologyLtd

Provides handwriting recognition, optical character recognition, and handwriting input products in China and internationally.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success