- China

- /

- Communications

- /

- SZSE:002313

There's No Escaping Sunsea AIoT Technology Co., Ltd.'s (SZSE:002313) Muted Revenues Despite A 32% Share Price Rise

Despite an already strong run, Sunsea AIoT Technology Co., Ltd. (SZSE:002313) shares have been powering on, with a gain of 32% in the last thirty days. The annual gain comes to 142% following the latest surge, making investors sit up and take notice.

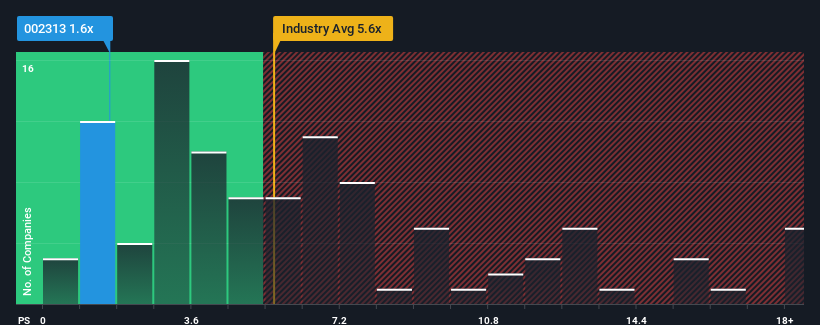

In spite of the firm bounce in price, Sunsea AIoT Technology's price-to-sales (or "P/S") ratio of 1.6x might still make it look like a strong buy right now compared to the wider Communications industry in China, where around half of the companies have P/S ratios above 5.6x and even P/S above 10x are quite common. However, the P/S might be quite low for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for Sunsea AIoT Technology

What Does Sunsea AIoT Technology's Recent Performance Look Like?

Revenue has risen at a steady rate over the last year for Sunsea AIoT Technology, which is generally not a bad outcome. Perhaps the market believes the recent revenue performance might fall short of industry figures in the near future, leading to a reduced P/S. Those who are bullish on Sunsea AIoT Technology will be hoping that this isn't the case, so that they can pick up the stock at a lower valuation.

Although there are no analyst estimates available for Sunsea AIoT Technology, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.Is There Any Revenue Growth Forecasted For Sunsea AIoT Technology?

There's an inherent assumption that a company should far underperform the industry for P/S ratios like Sunsea AIoT Technology's to be considered reasonable.

If we review the last year of revenue growth, the company posted a worthy increase of 4.0%. Still, lamentably revenue has fallen 24% in aggregate from three years ago, which is disappointing. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

In contrast to the company, the rest of the industry is expected to grow by 34% over the next year, which really puts the company's recent medium-term revenue decline into perspective.

With this information, we are not surprised that Sunsea AIoT Technology is trading at a P/S lower than the industry. Nonetheless, there's no guarantee the P/S has reached a floor yet with revenue going in reverse. There's potential for the P/S to fall to even lower levels if the company doesn't improve its top-line growth.

What We Can Learn From Sunsea AIoT Technology's P/S?

Shares in Sunsea AIoT Technology have risen appreciably however, its P/S is still subdued. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

As we suspected, our examination of Sunsea AIoT Technology revealed its shrinking revenue over the medium-term is contributing to its low P/S, given the industry is set to grow. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises either. Unless the recent medium-term conditions improve, they will continue to form a barrier for the share price around these levels.

Plus, you should also learn about these 3 warning signs we've spotted with Sunsea AIoT Technology.

If these risks are making you reconsider your opinion on Sunsea AIoT Technology, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:002313

Sunsea AIoT Technology

Provides Internet of Things products and services to telecom operators, ICT equipment vendors, system integrators, and enterprise customers in China and internationally.

Mediocre balance sheet and slightly overvalued.

Market Insights

Community Narratives