- China

- /

- Electronic Equipment and Components

- /

- SZSE:300679

Exploring High Growth Tech Stocks in Asia November 2025

Reviewed by Simply Wall St

As global markets grapple with concerns over AI valuations and economic uncertainties, the Asian tech sector continues to capture investor interest, particularly in the high-growth segment. In this environment, identifying promising stocks often involves looking for companies that demonstrate strong innovation capabilities and resilience amidst fluctuating market sentiments.

Top 10 High Growth Tech Companies In Asia

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Giant Network Group | 33.47% | 39.54% | ★★★★★★ |

| Suzhou TFC Optical Communication | 34.61% | 35.52% | ★★★★★★ |

| Shengyi TechnologyLtd | 21.50% | 32.87% | ★★★★★★ |

| Fositek | 37.43% | 49.42% | ★★★★★★ |

| Shengyi Electronics | 24.67% | 33.32% | ★★★★★★ |

| Knowmerce | 42.51% | 33.23% | ★★★★★★ |

| Gold Circuit Electronics | 25.79% | 31.13% | ★★★★★★ |

| eWeLLLtd | 25.07% | 25.13% | ★★★★★★ |

| Co-Tech Development | 35.68% | 75.80% | ★★★★★★ |

| CARsgen Therapeutics Holdings | 100.40% | 118.16% | ★★★★★★ |

Let's dive into some prime choices out of from the screener.

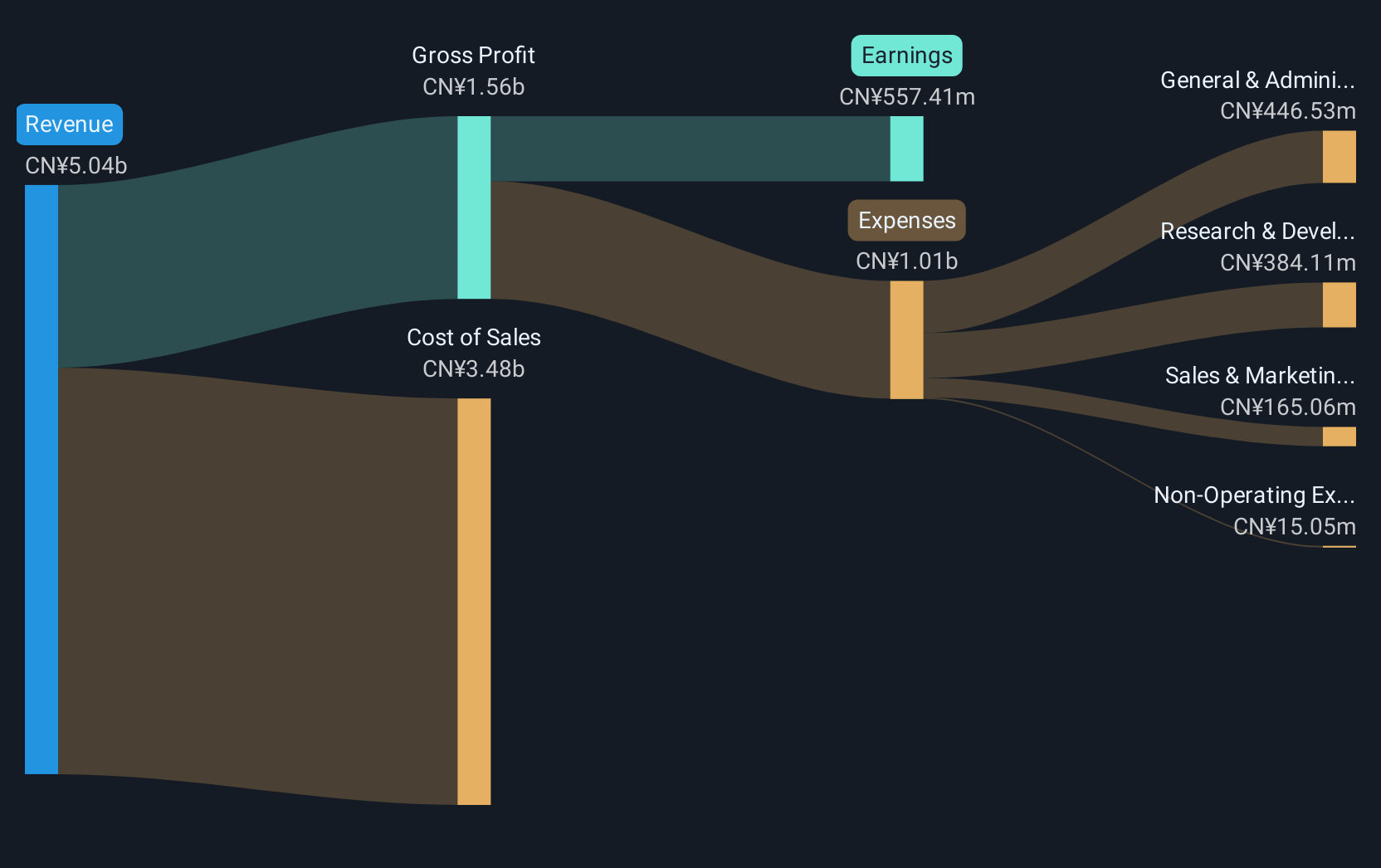

QuantumCTek (SHSE:688027)

Simply Wall St Growth Rating: ★★★★★☆

Overview: QuantumCTek Co., Ltd. is involved in the research, development, production, and sale of quantum communication, computing, and precision measurement products in China with a market cap of CN¥44.85 billion.

Operations: QuantumCTek focuses on quantum communication, computing, and precision measurement products. The company operates in China and is engaged in research, development, production, and sales within these specialized technology sectors.

QuantumCTek, amidst a dynamic tech landscape in Asia, is showing promising signs with a robust annual revenue growth rate of 32.7%. This growth trajectory is notably higher than the broader Chinese market's 14.4%, underscoring its potential in the high-tech sector despite current unprofitability. Recent financials reveal significant improvements, with revenue nearly doubling to CNY 189.73 million from last year and net losses more than halving to CNY 26.47 million, indicating effective cost management and scalability potential. With earnings expected to surge by approximately 134.7% annually, QuantumCTek's aggressive investment in R&D could be a pivotal factor for future profitability and market competitiveness.

- Click here and access our complete health analysis report to understand the dynamics of QuantumCTek.

Assess QuantumCTek's past performance with our detailed historical performance reports.

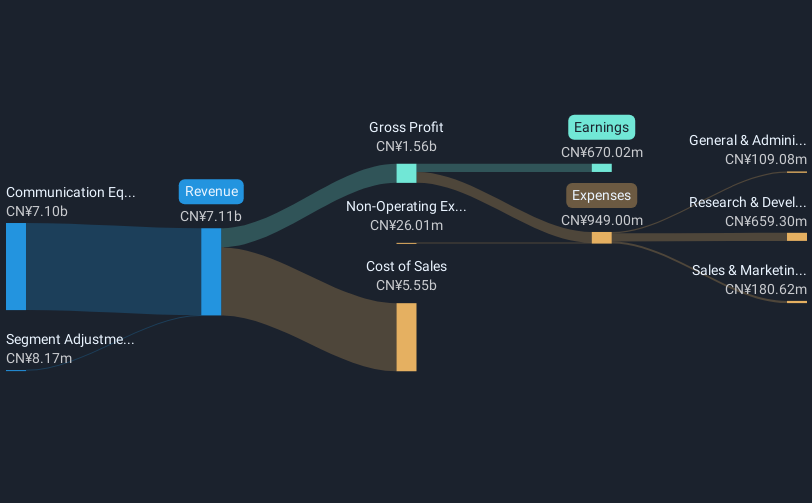

Accelink Technologies CoLtd (SZSE:002281)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Accelink Technologies Co., Ltd. engages in the research, development, manufacturing, sales, and provision of technical services for optoelectronic chips, devices, modules, and subsystem products primarily in China with a market cap of CN¥43.89 billion.

Operations: Accelink Technologies Co., Ltd. primarily generates revenue from its communication equipment manufacturing segment, which accounts for CN¥11.38 billion.

Accelink Technologies CoLtd, navigating through a competitive tech landscape in Asia, has demonstrated robust financial performance with a notable 18.6% annual revenue growth and an impressive 29.7% surge in earnings. The company's commitment to innovation is evident from its R&D investments which have strategically aligned with its growth trajectory, contributing significantly to its market position. Recent corporate actions, including leadership changes and amendments to bylaws, signal strategic shifts possibly aimed at bolstering future growth prospects amidst the evolving tech industry dynamics in Asia.

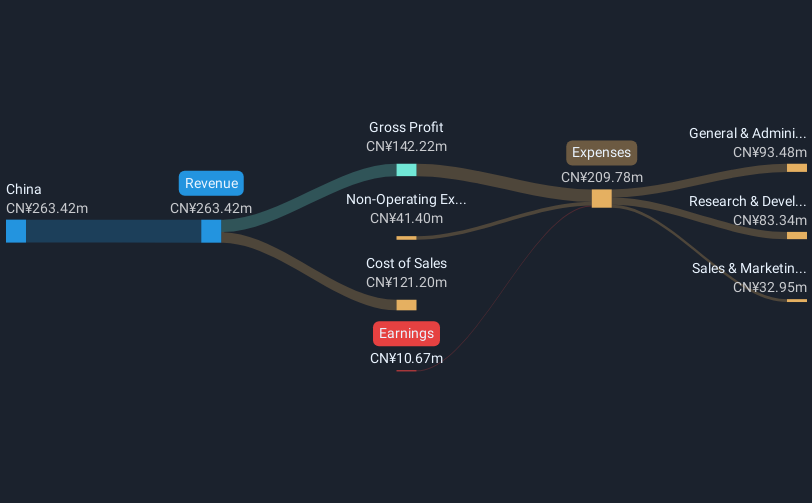

Electric Connector Technology (SZSE:300679)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Electric Connector Technology Co., Ltd. specializes in the research, design, development, manufacture, and sale of micro electronic connectors and interconnection system products across various global markets with a market cap of CN¥18.85 billion.

Operations: The company operates in the micro electronic connectors and interconnection systems sector, serving markets in China, North America, Europe, Japan, and the Asia Pacific. It focuses on research, design, development, manufacturing, and sales activities globally.

Electric Connector Technology Co., Ltd. has shown a promising trajectory with a 22.1% annual revenue growth, outpacing the Chinese market's average of 14.4%. Despite a recent dip in net income from CNY 458.59 million to CNY 372.78 million, the company maintains robust earnings projections, expected to surge by approximately 30.9% annually. This growth is underpinned by strategic amendments in corporate governance and audit processes which could enhance operational efficiencies moving forward, positioning it well within Asia’s competitive tech landscape.

Key Takeaways

- Embark on your investment journey to our 189 Asian High Growth Tech and AI Stocks selection here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Electric Connector Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300679

Electric Connector Technology

Engages in the research, design, development, manufacture, and sale of micro electronic connectors and interconnection system related products in China, North America, Europe, Japan, the Asia Pacific, and internationally.

Flawless balance sheet and undervalued.

Market Insights

Community Narratives