- China

- /

- Auto Components

- /

- SHSE:605333

3 Stocks Estimated To Be Trading Up To 42.5% Below Intrinsic Value

Reviewed by Simply Wall St

In recent weeks, global markets have been influenced by rising U.S. Treasury yields, which have put pressure on equities and led to a mixed performance across major indices. As investors navigate these volatile conditions, identifying stocks that are trading below their intrinsic value can offer potential opportunities for those looking to capitalize on market inefficiencies. In this context, understanding the fundamentals of a stock and its valuation relative to its intrinsic worth becomes crucial in making informed investment decisions.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Lindab International (OM:LIAB) | SEK227.40 | SEK453.69 | 49.9% |

| California Resources (NYSE:CRC) | US$52.09 | US$104.09 | 50% |

| Geovis TechnologyLtd (SHSE:688568) | CN¥40.77 | CN¥81.12 | 49.7% |

| Grupo Traxión. de (BMV:TRAXION A) | MX$21.46 | MX$42.66 | 49.7% |

| Super Group (JSE:SPG) | ZAR23.21 | ZAR46.16 | 49.7% |

| WEX (NYSE:WEX) | US$173.16 | US$346.09 | 50% |

| Foxtons Group (LSE:FOXT) | £0.594 | £1.19 | 49.9% |

| SBI Sumishin Net Bank (TSE:7163) | ¥2725.00 | ¥5408.67 | 49.6% |

| DPC Dash (SEHK:1405) | HK$65.00 | HK$129.82 | 49.9% |

| Sinch (OM:SINCH) | SEK31.33 | SEK62.49 | 49.9% |

Here's a peek at a few of the choices from the screener.

Kunshan Huguang Auto HarnessLtd (SHSE:605333)

Overview: Kunshan Huguang Auto Harness Co., Ltd. specializes in the research, development, production, and sales of automotive high and low voltage wiring harness assembly products both in China and internationally, with a market cap of CN¥14.61 billion.

Operations: Kunshan Huguang Auto Harness Co., Ltd. generates revenue from the development, production, and sales of automotive wiring harness assembly products across both domestic and international markets.

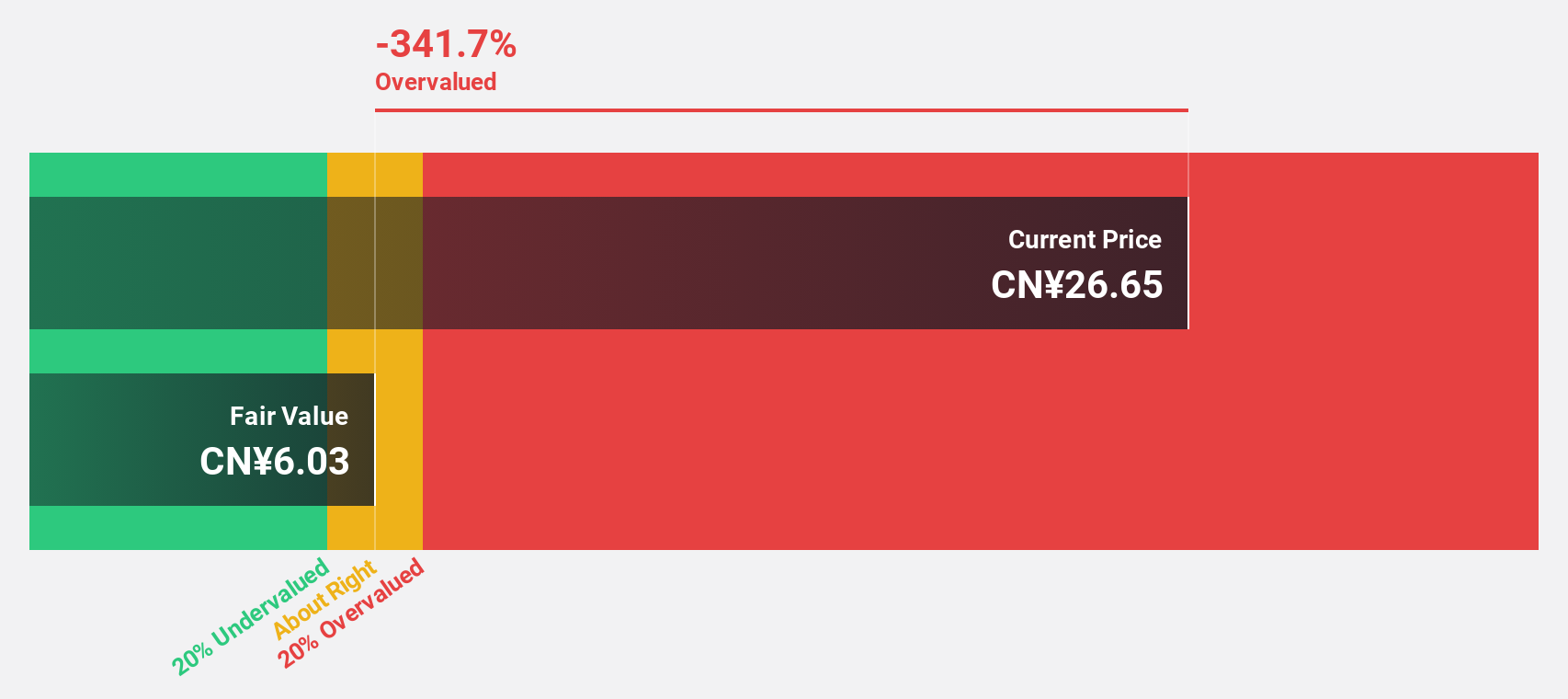

Estimated Discount To Fair Value: 16.3%

Kunshan Huguang Auto Harness Ltd. reported robust earnings growth, with sales reaching CNY 5.53 billion for the nine months ended September 2024, up from CNY 2.37 billion a year ago, and net income at CNY 438.42 million compared to a prior loss. The stock trades at approximately 16% below its estimated fair value of CNY 41.46, suggesting undervaluation based on cash flows despite high debt levels and strong forecasted revenue growth of over 23% annually.

- The analysis detailed in our Kunshan Huguang Auto HarnessLtd growth report hints at robust future financial performance.

- Take a closer look at Kunshan Huguang Auto HarnessLtd's balance sheet health here in our report.

Accelink Technologies CoLtd (SZSE:002281)

Overview: Accelink Technologies Co., Ltd. engages in the research, development, manufacturing, sales, and technical services of optoelectronic chips, devices, modules, and subsystem products primarily in China with a market cap of CN¥29.89 billion.

Operations: Accelink Technologies Co., Ltd. generates revenue through its activities in optoelectronic chips, devices, modules, and subsystem products primarily within the Chinese market.

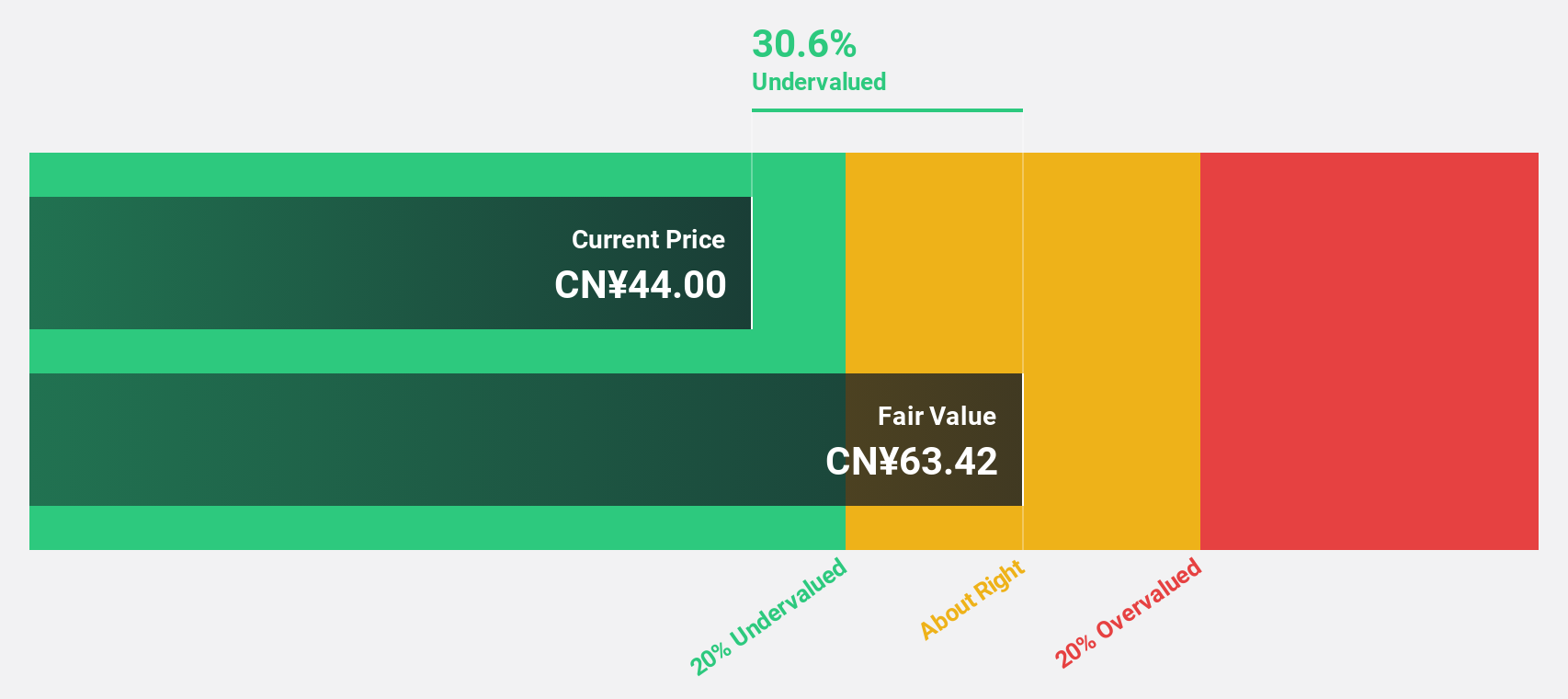

Estimated Discount To Fair Value: 36.7%

Accelink Technologies Co., Ltd. is trading at CNY 41.39, significantly below its estimated fair value of CNY 65.36, indicating potential undervaluation based on cash flows. The company reported sales of CNY 5.38 billion for the nine months ended September 2024, with net income rising to CNY 464 million from a year ago. Although earnings are expected to grow significantly over the next three years, dividends remain inadequately covered by free cash flows.

- Our growth report here indicates Accelink Technologies CoLtd may be poised for an improving outlook.

- Unlock comprehensive insights into our analysis of Accelink Technologies CoLtd stock in this financial health report.

Kokusai Electric (TSE:6525)

Overview: Kokusai Electric Corporation develops, manufactures, sells, repairs, and maintains semiconductor manufacturing equipment globally and has a market cap of ¥675.10 billion.

Operations: The company's revenue segment is derived entirely from the Semiconductor Manufacturing Equipment Business, totaling ¥213.35 billion.

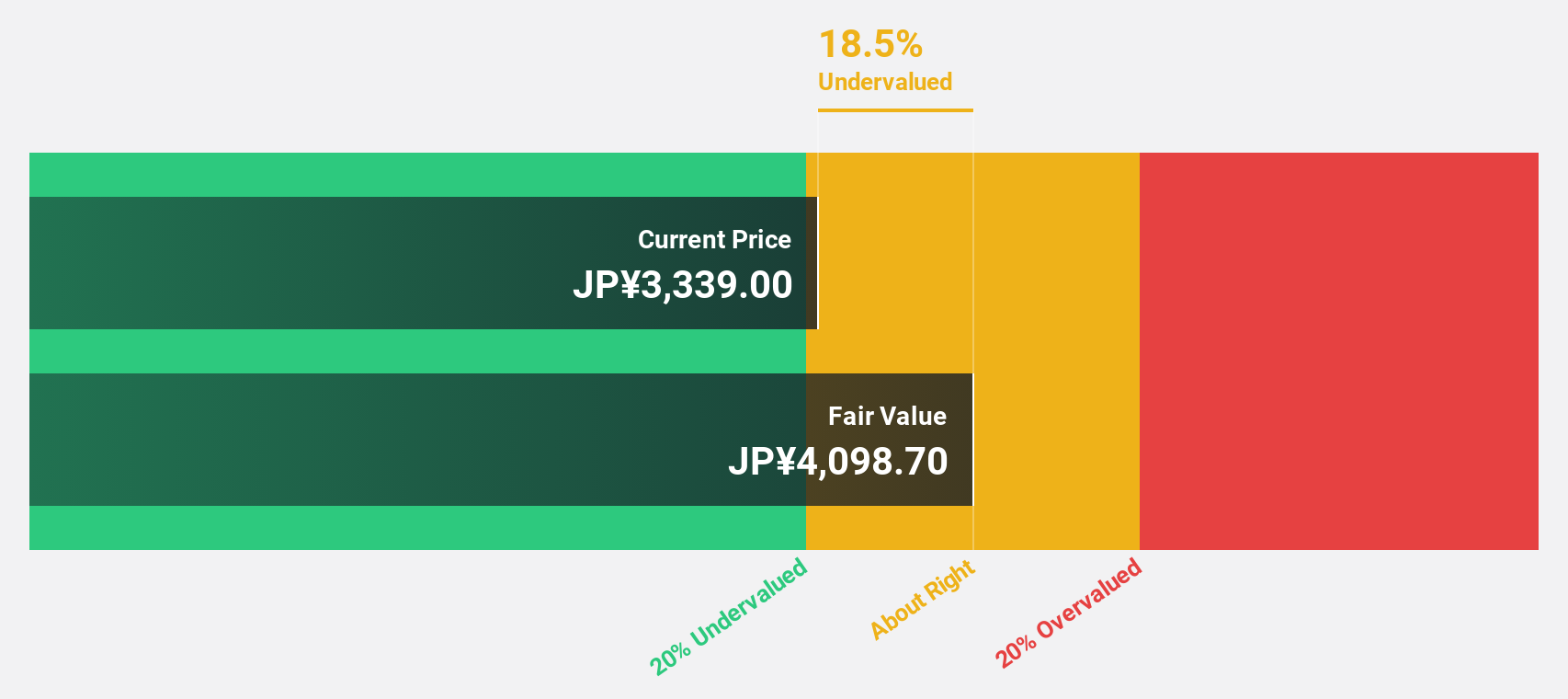

Estimated Discount To Fair Value: 42.5%

Kokusai Electric, trading at ¥2,947, is significantly undervalued with an estimated fair value of ¥5,120.88. Despite recent shareholder dilution and high share price volatility, its earnings are expected to grow 16.93% annually—outpacing the Japanese market average. The company completed a share buyback worth ¥17.99 billion and has increased dividends to ¥16 per share for 2025. It was recently added to the S&P Japan 500 index, enhancing its market visibility.

- The growth report we've compiled suggests that Kokusai Electric's future prospects could be on the up.

- Delve into the full analysis health report here for a deeper understanding of Kokusai Electric.

Seize The Opportunity

- Embark on your investment journey to our 939 Undervalued Stocks Based On Cash Flows selection here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kunshan Huguang Auto HarnessLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:605333

Kunshan Huguang Auto HarnessLtd

Engages in the research and development, production, and sales of automotive high and low voltage wiring harness assembly products in China and internationally.

Exceptional growth potential with solid track record.