- China

- /

- Communications

- /

- SZSE:002188

The Price Is Right For Zhongtian Service Co., Ltd. (SZSE:002188) Even After Diving 27%

Unfortunately for some shareholders, the Zhongtian Service Co., Ltd. (SZSE:002188) share price has dived 27% in the last thirty days, prolonging recent pain. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 39% share price drop.

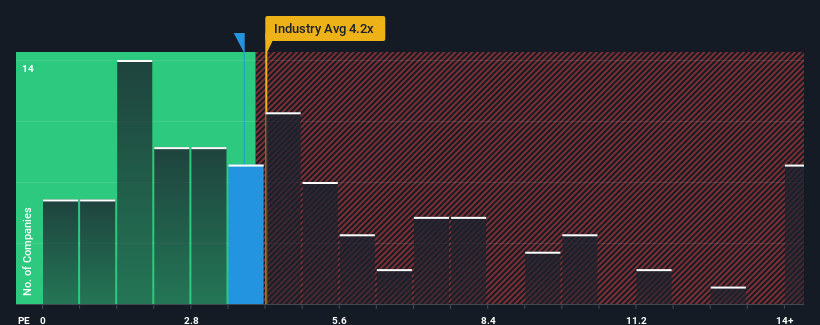

In spite of the heavy fall in price, it's still not a stretch to say that Zhongtian Service's price-to-sales (or "P/S") ratio of 3.8x right now seems quite "middle-of-the-road" compared to the Communications industry in China, where the median P/S ratio is around 4.2x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

View our latest analysis for Zhongtian Service

How Has Zhongtian Service Performed Recently?

Revenue has risen at a steady rate over the last year for Zhongtian Service, which is generally not a bad outcome. Perhaps the expectation moving forward is that the revenue growth will track in line with the wider industry for the near term, which has kept the P/S subdued. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

Although there are no analyst estimates available for Zhongtian Service, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.How Is Zhongtian Service's Revenue Growth Trending?

Zhongtian Service's P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

Taking a look back first, we see that the company managed to grow revenues by a handy 5.2% last year. Pleasingly, revenue has also lifted 207% in aggregate from three years ago, partly thanks to the last 12 months of growth. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Weighing that recent medium-term revenue trajectory against the broader industry's one-year forecast for expansion of 48% shows it's about the same on an annualised basis.

With this in consideration, it's clear to see why Zhongtian Service's P/S matches up closely to its industry peers. It seems most investors are expecting to see average growth rates continue into the future and are only willing to pay a moderate amount for the stock.

What We Can Learn From Zhongtian Service's P/S?

Zhongtian Service's plummeting stock price has brought its P/S back to a similar region as the rest of the industry. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

It appears to us that Zhongtian Service maintains its moderate P/S off the back of its recent three-year growth being in line with the wider industry forecast. Right now shareholders are comfortable with the P/S as they are quite confident future revenue won't throw up any surprises. If recent medium-term revenue trends continue, it's hard to see the share price moving strongly in either direction in the near future under these circumstances.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with Zhongtian Service, and understanding them should be part of your investment process.

If you're unsure about the strength of Zhongtian Service's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if Zhongtian Service might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:002188

Flawless balance sheet with proven track record.

Market Insights

Community Narratives