- China

- /

- Tech Hardware

- /

- SZSE:002180

Ninestar Corporation (SZSE:002180) Stock Rockets 35% But Many Are Still Ignoring The Company

Ninestar Corporation (SZSE:002180) shareholders have had their patience rewarded with a 35% share price jump in the last month. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 29% in the last twelve months.

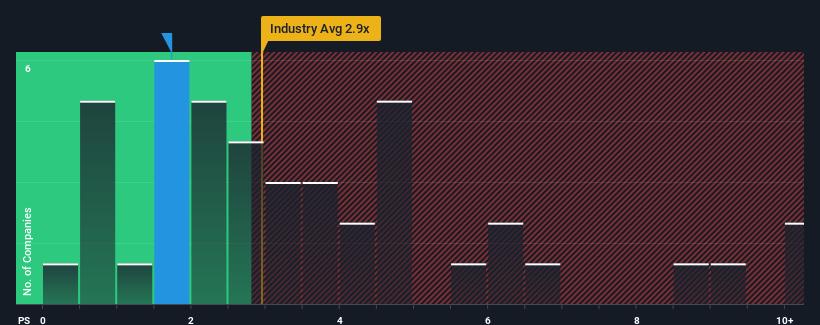

In spite of the firm bounce in price, Ninestar may still be sending bullish signals at the moment with its price-to-sales (or "P/S") ratio of 1.7x, since almost half of all companies in the Tech industry in China have P/S ratios greater than 2.9x and even P/S higher than 5x are not unusual. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

See our latest analysis for Ninestar

How Ninestar Has Been Performing

While the industry has experienced revenue growth lately, Ninestar's revenue has gone into reverse gear, which is not great. The P/S ratio is probably low because investors think this poor revenue performance isn't going to get any better. So while you could say the stock is cheap, investors will be looking for improvement before they see it as good value.

Keen to find out how analysts think Ninestar's future stacks up against the industry? In that case, our free report is a great place to start.How Is Ninestar's Revenue Growth Trending?

In order to justify its P/S ratio, Ninestar would need to produce sluggish growth that's trailing the industry.

Retrospectively, the last year delivered a frustrating 10% decrease to the company's top line. This has soured the latest three-year period, which nevertheless managed to deliver a decent 12% overall rise in revenue. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been mostly respectable for the company.

Looking ahead now, revenue is anticipated to climb by 19% during the coming year according to the two analysts following the company. Meanwhile, the rest of the industry is forecast to expand by 18%, which is not materially different.

With this in consideration, we find it intriguing that Ninestar's P/S is lagging behind its industry peers. It may be that most investors are not convinced the company can achieve future growth expectations.

What Does Ninestar's P/S Mean For Investors?

The latest share price surge wasn't enough to lift Ninestar's P/S close to the industry median. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've seen that Ninestar currently trades on a lower than expected P/S since its forecast growth is in line with the wider industry. Despite average revenue growth estimates, there could be some unobserved threats keeping the P/S low. Perhaps investors are concerned that the company could underperform against the forecasts over the near term.

Before you take the next step, you should know about the 1 warning sign for Ninestar that we have uncovered.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if Ninestar might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:002180

Ninestar

Engages in the research and development, production, processing, and sales of self-produced printers, and printer consumables and accessories.

High growth potential with excellent balance sheet.

Market Insights

Community Narratives