- China

- /

- Communications

- /

- SZSE:300548

High Growth Tech Stocks To Watch In October 2024

Reviewed by Simply Wall St

As global markets navigate the impact of rising U.S. Treasury yields, small-cap stocks have faced challenges with large-cap and growth stocks showing relative resilience, highlighted by the Nasdaq Composite Index's slight gains. In this climate, identifying high-growth tech stocks that can thrive despite economic headwinds requires a focus on companies with strong innovation potential and adaptability to shifting market dynamics.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Material Group | 20.45% | 24.01% | ★★★★★★ |

| Yggdrazil Group | 24.66% | 85.53% | ★★★★★★ |

| eWeLLLtd | 26.52% | 27.53% | ★★★★★★ |

| Medley | 24.98% | 30.36% | ★★★★★★ |

| Scandion Oncology | 40.71% | 75.34% | ★★★★★★ |

| Seojin SystemLtd | 33.39% | 49.13% | ★★★★★★ |

| Mental Health TechnologiesLtd | 27.88% | 79.61% | ★★★★★★ |

| Adveritas | 57.98% | 144.21% | ★★★★★★ |

| Travere Therapeutics | 29.19% | 70.82% | ★★★★★★ |

| UTI | 114.97% | 134.60% | ★★★★★★ |

Click here to see the full list of 1281 stocks from our High Growth Tech and AI Stocks screener.

Let's dive into some prime choices out of from the screener.

Shenzhen JPT Opto-Electronics (SHSE:688025)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Shenzhen JPT Opto-Electronics Co., Ltd. focuses on the R&D, production, sale, and technical services of laser technology, intelligent equipment, and optical devices with a market cap of CN¥4.90 billion.

Operations: JPT Opto-Electronics specializes in laser technology, intelligent equipment, and optical devices. The company generates revenue primarily through the sale of these products and related technical services.

Shenzhen JPT Opto-Electronics has demonstrated robust financial performance with a significant 22% increase in sales to CNY 1.07 billion and a net income rise to CNY 103.29 million, reflecting strong operational execution. This growth outpaces the broader Chinese market's average, with revenue and earnings forecasted to surge by 22% and 35.2% respectively each year, overshadowing the sector's norms. The firm's commitment to innovation is evident from its R&D investments, crucial for sustaining its competitive edge in the high-tech industry. Despite challenges like a highly volatile share price, JPT’s strategic focus on expanding its technological capabilities could enhance its market position and appeal to clients seeking advanced opto-electronic solutions.

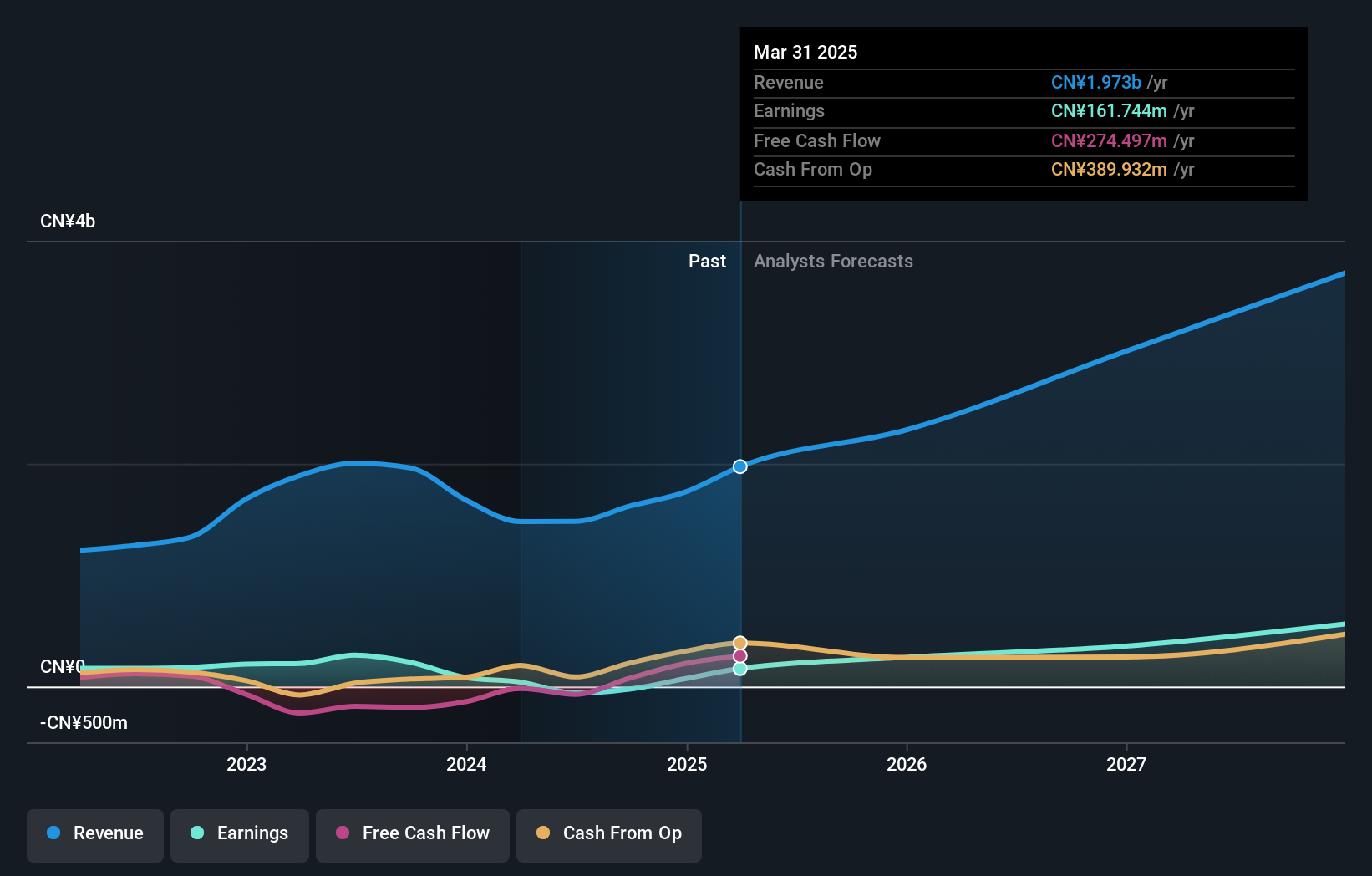

AVIC Jonhon Optronic TechnologyLtd (SZSE:002179)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: AVIC Jonhon Optronic Technology Co., Ltd. focuses on the research and development of optical, electrical, and fluid connection technologies and equipment in China, with a market cap of CN¥94.87 billion.

Operations: The company generates revenue primarily through the development and sale of optical, electrical, and fluid connection technologies. It operates within China and has a market capitalization of CN¥94.87 billion.

AVIC Jonhon Optronic TechnologyLtd, amid a challenging market, reported a decline in sales to CNY 14.1 billion from CNY 15.36 billion year-over-year and a net income drop to CNY 2.51 billion from CNY 2.89 billion, reflecting tighter operational conditions. Despite these headwinds, the company is poised for recovery with projected revenue and earnings growth rates of 21.3% and 23.6% per year respectively, outpacing the broader Chinese market forecasts of 13.7% and 24.6%. This resilience is underpinned by significant R&D investments aimed at enhancing technological capabilities in optronic technologies—a crucial factor for maintaining competitive advantage in this high-stakes sector.

- Click here and access our complete health analysis report to understand the dynamics of AVIC Jonhon Optronic TechnologyLtd.

Understand AVIC Jonhon Optronic TechnologyLtd's track record by examining our Past report.

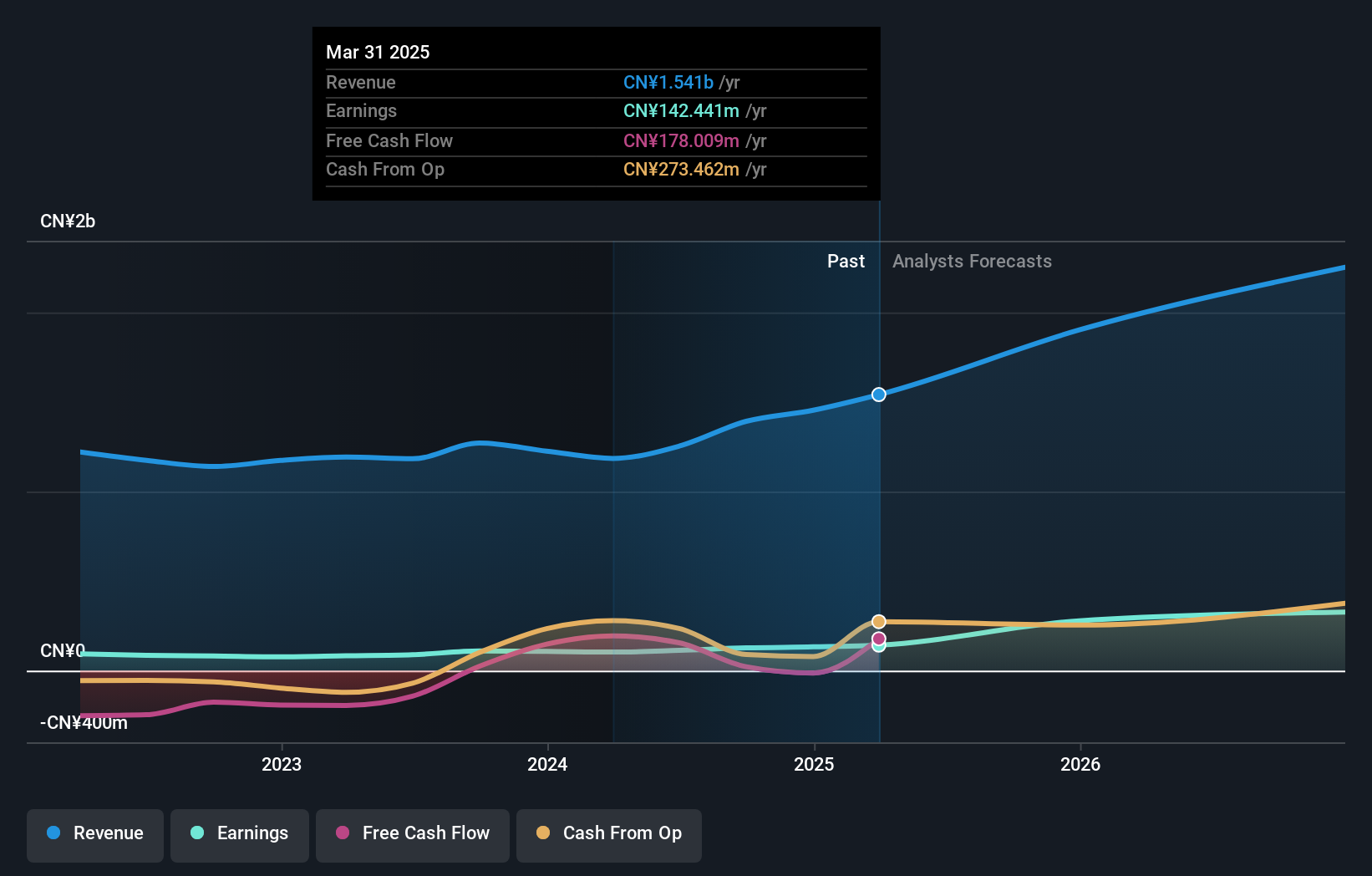

Broadex Technologies (SZSE:300548)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Broadex Technologies Co., Ltd. engages in the research, development, production, and sale of integrated optoelectronic devices for optical communications both in China and internationally, with a market cap of CN¥7.70 billion.

Operations: Broadex Technologies focuses on the optical communications sector, offering integrated optoelectronic devices. The company's revenue model is centered around the production and sale of these devices, catering to both domestic and international markets.

Amid recent challenges, Broadex Technologies has demonstrated resilience with a projected annual revenue growth rate of 21.6%, outstripping the broader Chinese market forecast of 13.7%. This growth is underpinned by substantial R&D investments, which have consistently represented a significant portion of their expenditures, aligning with their strategic focus on innovation in communications technology. Moreover, the company's recent M&A activities underscore its strategic initiatives to bolster market position and enhance shareholder value through tactical acquisitions. With earnings expected to surge by 63.4% annually, Broadex is positioning itself as a future profit generator in an increasingly competitive sector.

- Dive into the specifics of Broadex Technologies here with our thorough health report.

Evaluate Broadex Technologies' historical performance by accessing our past performance report.

Summing It All Up

- Click through to start exploring the rest of the 1278 High Growth Tech and AI Stocks now.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Broadex Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300548

Broadex Technologies

Researches and develops, produces, and sells integrated optoelectronic devices in the field of optical communications in China and internationally.

High growth potential with excellent balance sheet.