- China

- /

- Electronic Equipment and Components

- /

- SZSE:002139

Shenzhen Topband Co., Ltd.'s (SZSE:002139) Shares Not Telling The Full Story

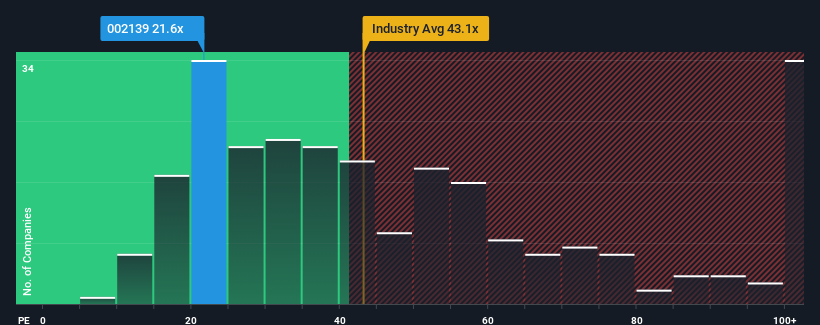

Shenzhen Topband Co., Ltd.'s (SZSE:002139) price-to-earnings (or "P/E") ratio of 21.6x might make it look like a buy right now compared to the market in China, where around half of the companies have P/E ratios above 34x and even P/E's above 65x are quite common. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's limited.

With its earnings growth in positive territory compared to the declining earnings of most other companies, Shenzhen Topband has been doing quite well of late. One possibility is that the P/E is low because investors think the company's earnings are going to fall away like everyone else's soon. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

View our latest analysis for Shenzhen Topband

Does Growth Match The Low P/E?

The only time you'd be truly comfortable seeing a P/E as low as Shenzhen Topband's is when the company's growth is on track to lag the market.

Retrospectively, the last year delivered a decent 14% gain to the company's bottom line. Still, lamentably EPS has fallen 25% in aggregate from three years ago, which is disappointing. So unfortunately, we have to acknowledge that the company has not done a great job of growing earnings over that time.

Looking ahead now, EPS is anticipated to climb by 18% each year during the coming three years according to the eight analysts following the company. That's shaping up to be similar to the 19% per year growth forecast for the broader market.

With this information, we find it odd that Shenzhen Topband is trading at a P/E lower than the market. It may be that most investors are not convinced the company can achieve future growth expectations.

The Bottom Line On Shenzhen Topband's P/E

Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our examination of Shenzhen Topband's analyst forecasts revealed that its market-matching earnings outlook isn't contributing to its P/E as much as we would have predicted. When we see an average earnings outlook with market-like growth, we assume potential risks are what might be placing pressure on the P/E ratio. It appears some are indeed anticipating earnings instability, because these conditions should normally provide more support to the share price.

Many other vital risk factors can be found on the company's balance sheet. You can assess many of the main risks through our free balance sheet analysis for Shenzhen Topband with six simple checks.

If these risks are making you reconsider your opinion on Shenzhen Topband, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:002139

Shenzhen Topband

Engages in the research and development, production, and sale of intelligent control system solutions in China and internationally.

Flawless balance sheet with reasonable growth potential and pays a dividend.

Market Insights

Community Narratives