- China

- /

- Electronic Equipment and Components

- /

- SZSE:002106

Shenzhen Laibao Hi-Tech Co., Ltd. (SZSE:002106) Stock Catapults 32% Though Its Price And Business Still Lag The Market

The Shenzhen Laibao Hi-Tech Co., Ltd. (SZSE:002106) share price has done very well over the last month, posting an excellent gain of 32%. Looking further back, the 12% rise over the last twelve months isn't too bad notwithstanding the strength over the last 30 days.

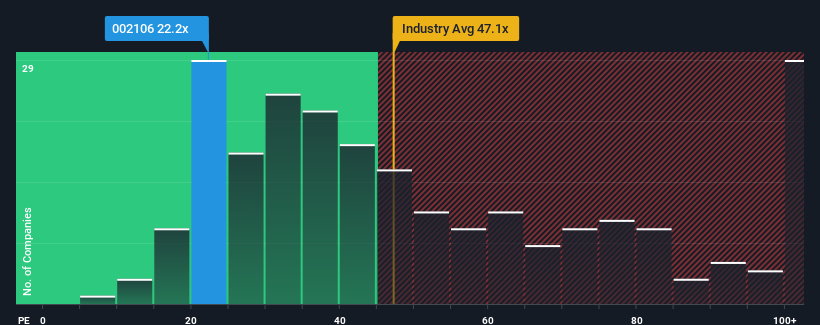

In spite of the firm bounce in price, given about half the companies in China have price-to-earnings ratios (or "P/E's") above 37x, you may still consider Shenzhen Laibao Hi-Tech as an attractive investment with its 22.2x P/E ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/E.

The earnings growth achieved at Shenzhen Laibao Hi-Tech over the last year would be more than acceptable for most companies. One possibility is that the P/E is low because investors think this respectable earnings growth might actually underperform the broader market in the near future. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

View our latest analysis for Shenzhen Laibao Hi-Tech

How Is Shenzhen Laibao Hi-Tech's Growth Trending?

The only time you'd be truly comfortable seeing a P/E as low as Shenzhen Laibao Hi-Tech's is when the company's growth is on track to lag the market.

If we review the last year of earnings growth, the company posted a terrific increase of 22%. Despite this strong recent growth, it's still struggling to catch up as its three-year EPS frustratingly shrank by 27% overall. Accordingly, shareholders would have felt downbeat about the medium-term rates of earnings growth.

Comparing that to the market, which is predicted to deliver 41% growth in the next 12 months, the company's downward momentum based on recent medium-term earnings results is a sobering picture.

With this information, we are not surprised that Shenzhen Laibao Hi-Tech is trading at a P/E lower than the market. However, we think shrinking earnings are unlikely to lead to a stable P/E over the longer term, which could set up shareholders for future disappointment. There's potential for the P/E to fall to even lower levels if the company doesn't improve its profitability.

The Key Takeaway

Despite Shenzhen Laibao Hi-Tech's shares building up a head of steam, its P/E still lags most other companies. We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

As we suspected, our examination of Shenzhen Laibao Hi-Tech revealed its shrinking earnings over the medium-term are contributing to its low P/E, given the market is set to grow. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. Unless the recent medium-term conditions improve, they will continue to form a barrier for the share price around these levels.

And what about other risks? Every company has them, and we've spotted 1 warning sign for Shenzhen Laibao Hi-Tech you should know about.

If these risks are making you reconsider your opinion on Shenzhen Laibao Hi-Tech, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:002106

Shenzhen Laibao Hi-Tech

Engages in the research and development, production, and sale of upstream materials and touch devices for flat panel displays in China.

Excellent balance sheet second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success