- China

- /

- Electronic Equipment and Components

- /

- SZSE:002056

Hengdian Group DMEGC Magnetics Ltd (SZSE:002056) jumps 16% this week, though earnings growth is still tracking behind five-year shareholder returns

Generally speaking the aim of active stock picking is to find companies that provide returns that are superior to the market average. And the truth is, you can make significant gains if you buy good quality businesses at the right price. To wit, the Hengdian Group DMEGC Magnetics Ltd share price has climbed 90% in five years, easily topping the market return of 7.8% (ignoring dividends).

Since the stock has added CN¥2.8b to its market cap in the past week alone, let's see if underlying performance has been driving long-term returns.

See our latest analysis for Hengdian Group DMEGC Magnetics Ltd

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

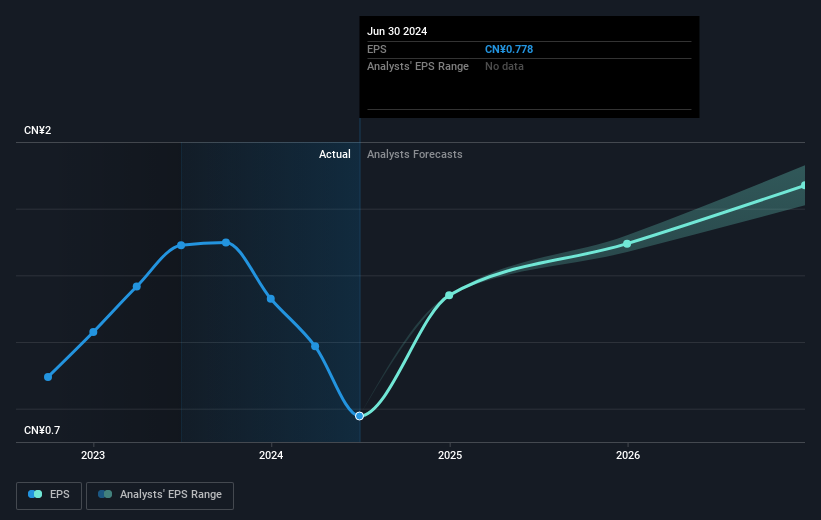

Over half a decade, Hengdian Group DMEGC Magnetics Ltd managed to grow its earnings per share at 13% a year. This EPS growth is reasonably close to the 14% average annual increase in the share price. That suggests that the market sentiment around the company hasn't changed much over that time. Rather, the share price has approximately tracked EPS growth.

The company's earnings per share (over time) is depicted in the image below (click to see the exact numbers).

It might be well worthwhile taking a look at our free report on Hengdian Group DMEGC Magnetics Ltd's earnings, revenue and cash flow.

What About Dividends?

When looking at investment returns, it is important to consider the difference between total shareholder return (TSR) and share price return. The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. Arguably, the TSR gives a more comprehensive picture of the return generated by a stock. In the case of Hengdian Group DMEGC Magnetics Ltd, it has a TSR of 108% for the last 5 years. That exceeds its share price return that we previously mentioned. And there's no prize for guessing that the dividend payments largely explain the divergence!

A Different Perspective

We regret to report that Hengdian Group DMEGC Magnetics Ltd shareholders are down 18% for the year (even including dividends). Unfortunately, that's worse than the broader market decline of 6.0%. Having said that, it's inevitable that some stocks will be oversold in a falling market. The key is to keep your eyes on the fundamental developments. Longer term investors wouldn't be so upset, since they would have made 16%, each year, over five years. If the fundamental data continues to indicate long term sustainable growth, the current sell-off could be an opportunity worth considering. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Even so, be aware that Hengdian Group DMEGC Magnetics Ltd is showing 2 warning signs in our investment analysis , you should know about...

We will like Hengdian Group DMEGC Magnetics Ltd better if we see some big insider buys. While we wait, check out this free list of undervalued stocks (mostly small caps) with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Hengdian Group DMEGC Magnetics Ltd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:002056

Hengdian Group DMEGC Magnetics Ltd

Provides magnetic materials, components, PV solar products, and lithium-ion batteries in China and internationally.

Excellent balance sheet established dividend payer.