- China

- /

- Tech Hardware

- /

- SZSE:002017

Investors Holding Back On Eastcompeace Technology Co.Ltd (SZSE:002017)

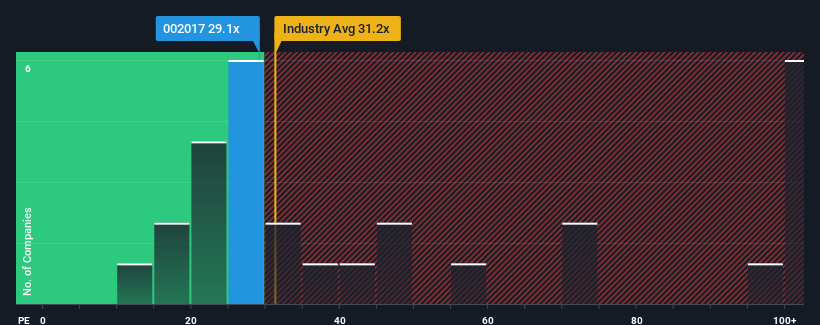

With a median price-to-earnings (or "P/E") ratio of close to 27x in China, you could be forgiven for feeling indifferent about Eastcompeace Technology Co.Ltd's (SZSE:002017) P/E ratio of 29.1x. Although, it's not wise to simply ignore the P/E without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

With earnings growth that's exceedingly strong of late, Eastcompeace TechnologyLtd has been doing very well. It might be that many expect the strong earnings performance to wane, which has kept the P/E from rising. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

View our latest analysis for Eastcompeace TechnologyLtd

Does Growth Match The P/E?

There's an inherent assumption that a company should be matching the market for P/E ratios like Eastcompeace TechnologyLtd's to be considered reasonable.

If we review the last year of earnings growth, the company posted a terrific increase of 43%. The latest three year period has also seen an excellent 287% overall rise in EPS, aided by its short-term performance. So we can start by confirming that the company has done a great job of growing earnings over that time.

Weighing that recent medium-term earnings trajectory against the broader market's one-year forecast for expansion of 36% shows it's noticeably more attractive on an annualised basis.

In light of this, it's curious that Eastcompeace TechnologyLtd's P/E sits in line with the majority of other companies. It may be that most investors are not convinced the company can maintain its recent growth rates.

The Final Word

While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

We've established that Eastcompeace TechnologyLtd currently trades on a lower than expected P/E since its recent three-year growth is higher than the wider market forecast. When we see strong earnings with faster-than-market growth, we assume potential risks are what might be placing pressure on the P/E ratio. It appears some are indeed anticipating earnings instability, because the persistence of these recent medium-term conditions would normally provide a boost to the share price.

We don't want to rain on the parade too much, but we did also find 1 warning sign for Eastcompeace TechnologyLtd that you need to be mindful of.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're here to simplify it.

Discover if Eastcompeace TechnologyLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:002017

Eastcompeace TechnologyLtd

Eastcompeace Technology Co.Ltd is involved in the research and development, production, sales, and service of smart card products, digital identity security products, and industry applications in China and internationally.

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

The "Rate Cut" Supercycle Winner – Profitable & Accelerating

The Industrialist of the Skies – Scaling with "Automotive DNA

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026