- China

- /

- Tech Hardware

- /

- SZSE:000727

Optimistic Investors Push TPV Technology Co., Ltd. (SZSE:000727) Shares Up 30% But Growth Is Lacking

TPV Technology Co., Ltd. (SZSE:000727) shares have continued their recent momentum with a 30% gain in the last month alone. Taking a wider view, although not as strong as the last month, the full year gain of 13% is also fairly reasonable.

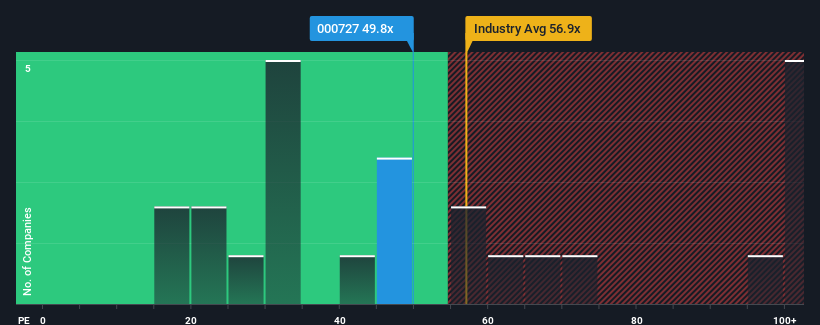

After such a large jump in price, TPV Technology's price-to-earnings (or "P/E") ratio of 49.8x might make it look like a sell right now compared to the market in China, where around half of the companies have P/E ratios below 35x and even P/E's below 20x are quite common. However, the P/E might be high for a reason and it requires further investigation to determine if it's justified.

We'd have to say that with no tangible growth over the last year, TPV Technology's earnings have been unimpressive. One possibility is that the P/E is high because investors think the benign earnings growth will improve to outperform the broader market in the near future. If not, then existing shareholders may be a little nervous about the viability of the share price.

Check out our latest analysis for TPV Technology

Is There Enough Growth For TPV Technology?

There's an inherent assumption that a company should outperform the market for P/E ratios like TPV Technology's to be considered reasonable.

Taking a look back first, we see that there was hardly any earnings per share growth to speak of for the company over the past year. The lack of growth did nothing to help the company's aggregate three-year performance, which is an unsavory 84% drop in EPS. Accordingly, shareholders would have felt downbeat about the medium-term rates of earnings growth.

In contrast to the company, the rest of the market is expected to grow by 39% over the next year, which really puts the company's recent medium-term earnings decline into perspective.

With this information, we find it concerning that TPV Technology is trading at a P/E higher than the market. It seems most investors are ignoring the recent poor growth rate and are hoping for a turnaround in the company's business prospects. Only the boldest would assume these prices are sustainable as a continuation of recent earnings trends is likely to weigh heavily on the share price eventually.

The Final Word

TPV Technology shares have received a push in the right direction, but its P/E is elevated too. It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that TPV Technology currently trades on a much higher than expected P/E since its recent earnings have been in decline over the medium-term. When we see earnings heading backwards and underperforming the market forecasts, we suspect the share price is at risk of declining, sending the high P/E lower. If recent medium-term earnings trends continue, it will place shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

You always need to take note of risks, for example - TPV Technology has 1 warning sign we think you should be aware of.

You might be able to find a better investment than TPV Technology. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're here to simplify it.

Discover if TPV Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:000727

TPV Technology

Manufactures and distributes display products in China and internationally.

Mediocre balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives