- China

- /

- Electronic Equipment and Components

- /

- SZSE:000636

The past three years for Guangdong Fenghua Advanced Technology (Holding) (SZSE:000636) investors has not been profitable

While it may not be enough for some shareholders, we think it is good to see the Guangdong Fenghua Advanced Technology (Holding) Co., Ltd. (SZSE:000636) share price up 21% in a single quarter. But that doesn't help the fact that the three year return is less impressive. After all, the share price is down 45% in the last three years, significantly under-performing the market.

Now let's have a look at the company's fundamentals, and see if the long term shareholder return has matched the performance of the underlying business.

Check out our latest analysis for Guangdong Fenghua Advanced Technology (Holding)

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

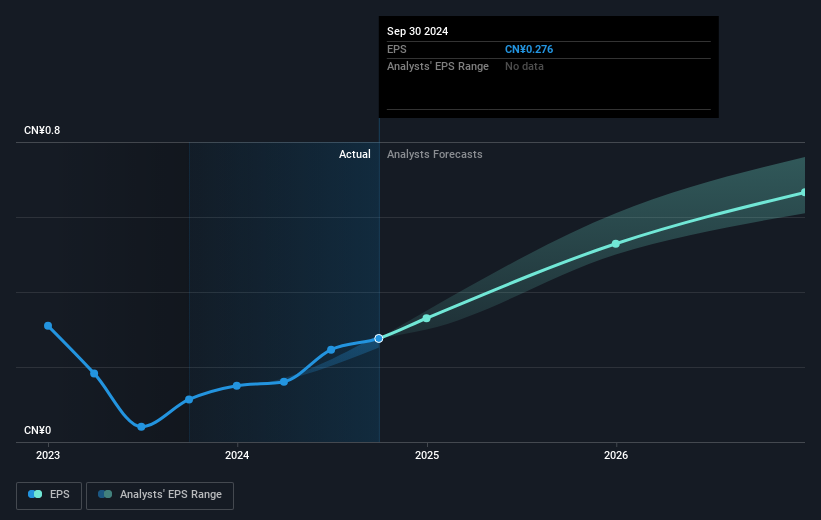

During the three years that the share price fell, Guangdong Fenghua Advanced Technology (Holding)'s earnings per share (EPS) dropped by 34% each year. In comparison the 18% compound annual share price decline isn't as bad as the EPS drop-off. This suggests that the market retains some optimism around long term earnings stability, despite past EPS declines. This positive sentiment is also reflected in the generous P/E ratio of 54.34.

The graphic below depicts how EPS has changed over time (unveil the exact values by clicking on the image).

We know that Guangdong Fenghua Advanced Technology (Holding) has improved its bottom line lately, but is it going to grow revenue? This free report showing analyst revenue forecasts should help you figure out if the EPS growth can be sustained.

A Different Perspective

We're pleased to report that Guangdong Fenghua Advanced Technology (Holding) shareholders have received a total shareholder return of 16% over one year. And that does include the dividend. That gain is better than the annual TSR over five years, which is 1.6%. Therefore it seems like sentiment around the company has been positive lately. Given the share price momentum remains strong, it might be worth taking a closer look at the stock, lest you miss an opportunity. Is Guangdong Fenghua Advanced Technology (Holding) cheap compared to other companies? These 3 valuation measures might help you decide.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:000636

Guangdong Fenghua Advanced Technology (Holding)

Guangdong Fenghua Advanced Technology (Holding) Co., Ltd.

Flawless balance sheet with reasonable growth potential.

Market Insights

Community Narratives