- China

- /

- Electronic Equipment and Components

- /

- SZSE:000532

Some Zhuhai Huajin Capital Co., Ltd. (SZSE:000532) Shareholders Look For Exit As Shares Take 26% Pounding

Zhuhai Huajin Capital Co., Ltd. (SZSE:000532) shareholders won't be pleased to see that the share price has had a very rough month, dropping 26% and undoing the prior period's positive performance. The recent drop has obliterated the annual return, with the share price now down 7.1% over that longer period.

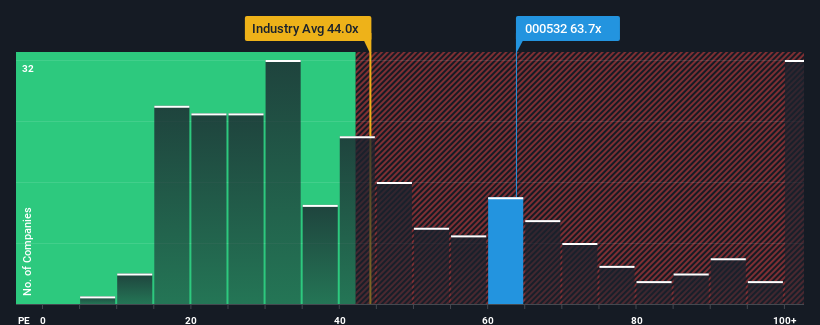

In spite of the heavy fall in price, given close to half the companies in China have price-to-earnings ratios (or "P/E's") below 32x, you may still consider Zhuhai Huajin Capital as a stock to avoid entirely with its 63.7x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so lofty.

It looks like earnings growth has deserted Zhuhai Huajin Capital recently, which is not something to boast about. One possibility is that the P/E is high because investors think the benign earnings growth will improve to outperform the broader market in the near future. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

See our latest analysis for Zhuhai Huajin Capital

How Is Zhuhai Huajin Capital's Growth Trending?

In order to justify its P/E ratio, Zhuhai Huajin Capital would need to produce outstanding growth well in excess of the market.

Retrospectively, the last year delivered virtually the same number to the company's bottom line as the year before. The lack of growth did nothing to help the company's aggregate three-year performance, which is an unsavory 44% drop in EPS. Accordingly, shareholders would have felt downbeat about the medium-term rates of earnings growth.

Comparing that to the market, which is predicted to deliver 38% growth in the next 12 months, the company's downward momentum based on recent medium-term earnings results is a sobering picture.

With this information, we find it concerning that Zhuhai Huajin Capital is trading at a P/E higher than the market. It seems most investors are ignoring the recent poor growth rate and are hoping for a turnaround in the company's business prospects. Only the boldest would assume these prices are sustainable as a continuation of recent earnings trends is likely to weigh heavily on the share price eventually.

The Bottom Line On Zhuhai Huajin Capital's P/E

Zhuhai Huajin Capital's shares may have retreated, but its P/E is still flying high. Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that Zhuhai Huajin Capital currently trades on a much higher than expected P/E since its recent earnings have been in decline over the medium-term. When we see earnings heading backwards and underperforming the market forecasts, we suspect the share price is at risk of declining, sending the high P/E lower. Unless the recent medium-term conditions improve markedly, it's very challenging to accept these prices as being reasonable.

You always need to take note of risks, for example - Zhuhai Huajin Capital has 1 warning sign we think you should be aware of.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're here to simplify it.

Discover if Zhuhai Huajin Capital might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:000532

Zhuhai Huajin Capital

Engages in the investment and management, electronic device manufacturing, sewage treatment, and science and technology parks businesses in China and internationally.

Flawless balance sheet with acceptable track record.

Market Insights

Community Narratives