- China

- /

- Electronic Equipment and Components

- /

- SZSE:000020

Shenzhen Zhongheng Huafa Co., Ltd. (SZSE:000020) May Have Run Too Fast Too Soon With Recent 25% Price Plummet

Shenzhen Zhongheng Huafa Co., Ltd. (SZSE:000020) shares have retraced a considerable 25% in the last month, reversing a fair amount of their solid recent performance. Still, a bad month hasn't completely ruined the past year with the stock gaining 57%, which is great even in a bull market.

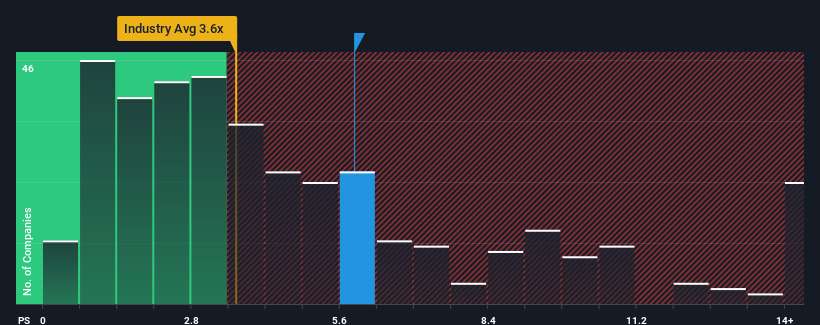

In spite of the heavy fall in price, when almost half of the companies in China's Electronic industry have price-to-sales ratios (or "P/S") below 3.6x, you may still consider Shenzhen Zhongheng Huafa as a stock not worth researching with its 5.9x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

See our latest analysis for Shenzhen Zhongheng Huafa

How Has Shenzhen Zhongheng Huafa Performed Recently?

Shenzhen Zhongheng Huafa has been doing a good job lately as it's been growing revenue at a solid pace. Perhaps the market is expecting this decent revenue performance to beat out the industry over the near term, which has kept the P/S propped up. If not, then existing shareholders may be a little nervous about the viability of the share price.

Although there are no analyst estimates available for Shenzhen Zhongheng Huafa, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.What Are Revenue Growth Metrics Telling Us About The High P/S?

There's an inherent assumption that a company should far outperform the industry for P/S ratios like Shenzhen Zhongheng Huafa's to be considered reasonable.

Taking a look back first, we see that the company managed to grow revenues by a handy 10% last year. Revenue has also lifted 11% in aggregate from three years ago, partly thanks to the last 12 months of growth. So we can start by confirming that the company has actually done a good job of growing revenue over that time.

Comparing the recent medium-term revenue trends against the industry's one-year growth forecast of 60% shows it's noticeably less attractive.

In light of this, it's alarming that Shenzhen Zhongheng Huafa's P/S sits above the majority of other companies. It seems most investors are ignoring the fairly limited recent growth rates and are hoping for a turnaround in the company's business prospects. Only the boldest would assume these prices are sustainable as a continuation of recent revenue trends is likely to weigh heavily on the share price eventually.

The Final Word

A significant share price dive has done very little to deflate Shenzhen Zhongheng Huafa's very lofty P/S. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Our examination of Shenzhen Zhongheng Huafa revealed its poor three-year revenue trends aren't detracting from the P/S as much as we though, given they look worse than current industry expectations. When we observe slower-than-industry revenue growth alongside a high P/S ratio, we assume there to be a significant risk of the share price decreasing, which would result in a lower P/S ratio. Unless the recent medium-term conditions improve markedly, it's very challenging to accept these the share price as being reasonable.

Having said that, be aware Shenzhen Zhongheng Huafa is showing 2 warning signs in our investment analysis, and 1 of those makes us a bit uncomfortable.

If these risks are making you reconsider your opinion on Shenzhen Zhongheng Huafa, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:000020

Shenzhen Zhongheng Huafa

Produces and sells injection molded parts, foam parts, and liquid crystal display monitors.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives